Larry Robbins' Firm Sells More Tenet Healthcare Shares

- By Graham Griffin

Larry Robbins (Trades, Portfolio)'s firm has revealed a reduction in its largest position, Tenet Healthcare Corp. (NYSE:THC), according to GuruFocus' Real-Time Picks.

Founded in 2000, Glenview Capital Management operates as a privately held investment firm. It is focused on delivering attractive absolute returns through an intense focus on deep fundamental research and individual security selection. The firm's investments are primarily focused on the U.S., with a smaller amount of exposure in western Europe.

On Feb. 2, the firm sold 2.03 million shares to reduce the holding by 11.14%. On the day of the transaction, the shares traded at an average price of $49.57. Overall, the sale had an impact on the portfolio of -3.16% and GuruFocus estimates the firm has gained a total of 65.70% on the holding.

Tenet Healthcare is a Dallas-based health care provider operating a collection of 65 hospitals and many outpatient facilities. These facilities include ambulatory surgery centers, urgent care centers, freestanding imaging centers, freestanding emergency rooms and micro-hospitals and physician practices across the United States. Tenet enjoys the number-one ambulatory surgical center position nationwide through its nearly full stake in United Surgical Partners International.

As of Feb. 5, the stock was trading at $49.86 per share with a market cap of $5.27 billion. According to the GF Value Line, the stock is trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 6 out of 10. There are currently three severe warning signs issued for declining revenue per share, poor financial strength and an Altman Z-Score of 0.9 placing the company in the distress column. The company has maintained high levels of debt for several years and 2020 saw net income drop into negative values.

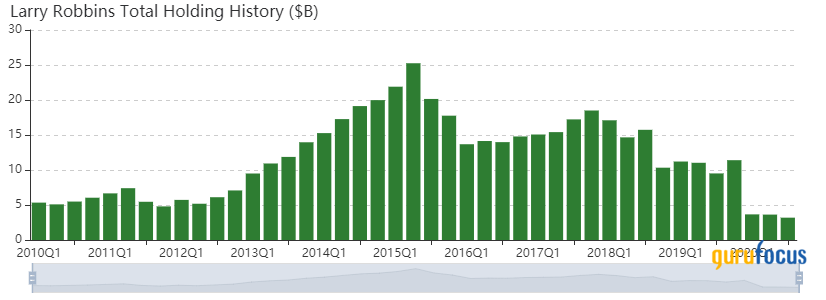

At the end of the third quarter, Glenview's portfolio contained 45 stocks, with seven new holdings. It was valued at $3.19 billion and has seen a turnover rate of 4%. Tenet Healthcare is the firm's largest holding, followed by Takeda Pharmaceutical Co. Ltd. (NYSE:TAK), Bausch Health Companies Inc. (NYSE:BHC), Cigna Corp. (NYSE:CI), HCA Healthcare Inc. (NYSE:HCA) and McKesson Corp. (NYSE:MCK).

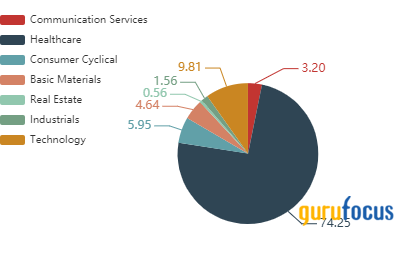

By weight, the top three sectors represented are health care (74.25%), technology (9.81%) and consumer cyclical (5.95%).

Disclosure: Author owns no stocks mentioned.

Read more here:

Yum Brands Tops Esimates With Taco Bell Same-Store Sales Growth

February Members Engagement Meeting Recap

Pfizer Posts Strong Revenue and Big Expectations for 2021

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.