What You Can Learn From Collectors Universe, Inc.'s (NASDAQ:CLCT) P/E

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

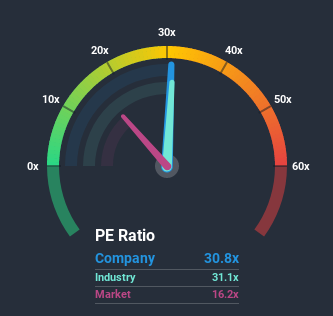

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Collectors Universe, Inc. (NASDAQ:CLCT) as a stock to avoid entirely with its 30.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Collectors Universe as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Collectors Universe

Where Does Collectors Universe's P/E Sit Within Its Industry?

We'd like to see if P/E's within Collectors Universe's industry might provide some colour around the company's particularly high P/E ratio. You'll notice in the figure below that P/E ratios in the Consumer Services industry are also significantly higher than the market. So we'd say there is merit in the premise that the company's ratio being shaped by its industry at this time. Some industry P/E's don't move around a lot and right now most companies within the Consumer Services industry should be getting a strong boost. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Collectors Universe will help you shine a light on its historical performance.

Is There Enough Growth For Collectors Universe?

Collectors Universe's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. As a result, it also grew EPS by 9.9% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to shrink 12% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we can see why Collectors Universe is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From Collectors Universe's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Collectors Universe revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Collectors Universe that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.