Leisure Stocks' Q2 Earnings Roster for Aug 2: MGM, RCL & ERI

The Q2 earnings season is gathering pace, with multiple reports lined up for release this week. Per the latest Earnings Preview, 80.8% of the 265 S&P 500 companies delivered positive earnings surprises while 72.1% surpassed top-line expectations.

According to the report, total earnings for S&P 500 companies are expected to increase 23.6% on a year-over-year basis, with revenues likely to improve 8.8%. This projection compares with year-over-year bottom- and top-line growth of 24.6% and 8.6%, respectively, in the last reported quarter.

What’s in Store for Consumer Discretionary Sector?

Like some other sectors, the widely diversified Consumer Discretionary sector (among 12 of the 16 Zacks categorized sectors) is likely to put up a decent show in Q2. In fact, we believe that increased consumer spending have positioned the industry on a growth trajectory. The industry is expected to gain in the near term, especially on a steady rise in wages, lower unemployment and upbeat consumer confidence.

Total earnings for the sector are expected to increase 11.5% in the current reporting cycle, slightly lower than 14.7% growth in the first quarter. Revenues are projected to grow 5.7%, higher than 3.6% growth recorded in the preceding quarter. Even though margins are not expected to outpace the first quarter’s increase of 1.1%, it is anticipated to rise 0.6% Q2. Notably, leisure stocks form a part of the Consumer Discretionary sector.

Among the leisure stocks lined up to release their quarterly numbers on Aug 2, let’s take a look at three important companies from this sector.

MGM Resorts International MGM is scheduled to report second-quarter 2018 results before market open. In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 9.7%.

MGM Resorts’ top line in Q2 is likely to be driven by an increase in revenues from both domestic and China operations. The Zacks Consensus Estimate for revenues from domestic resorts stands at $2,120 million, indicating 2.4% year-over-year increase. The same for revenues from China operations is currently pegged at $700 million, reflecting 55.9% rise on a year-over-year basis.

Meanwhile, the company’s strong business model and extensive non-gaming revenue opportunities will continue boosting its performance in the to-be-reported quarter. MGM Resorts’ maximization of digital technology is an added positive. In fact, over the past few years, it has taken various initiatives to align every recognized brand into one global entertainment brand. This, in turn, resulted in a disciplined business model with a unified view of strategy.

MGM Resorts has an Earnings ESP of -23.91% and a Zacks Rank #4 (Sell), a combination that decreases the odds of an earnings beat. (Read more: Factors Setting the Tone for MGM Resorts Q2 Earnings)

MGM Resorts International Price, Consensus and EPS Surprise

MGM Resorts International Price, Consensus and EPS Surprise | MGM Resorts International Quote

Royal Caribbean Cruises Ltd. RCL is scheduled to report second-quarter 2018 financial numbers before the opening bell.

In the last reported quarter, the company pulled off a positive earnings surprise of 13.5%. Also, Royal Caribbean’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average beat of 7.3%.

Higher passenger ticket revenues as well as onboard and other revenues, which drove Royal Caribbean’s first-quarter 2018 results, are likely to be major growth drivers in the soon-to-be-reported quarter too. The Zacks Consensus Estimate for passenger ticket revenues indicates 5.7% year-over-year increase to $1,671 million. Moreover, the consensus mark for the onboard and other revenues is pegged at $661 million, reflecting 7.7% increase on a year-over-year basis. In the last reported quarter, passenger ticket revenues inched up 0.5% to $1,425.6 million, and onboard and other revenues increased 2% to $602.1 million.

Meanwhile, the company’s sailings in the United States, Europe, Alaska, Baltic and Asia are likely to continue performing well. While, its capacity growth should aid in meeting the increased demand, ship innovation and technology investments may lead to higher yields. Asia-Pacific itineraries accounting for 17% of 2018 capacity had a particularly strong first quarter, with robust yield growth in Australia, China and Southeast Asia. Notably, these itineraries are in a good book position for the current year. (Read more: Royal Caribbean Q2 Earnings: Ticket Revenues Hold Key)

Royal Caribbean Cruises has an Earnings ESP of +4.67% and a Zacks Rank #3 (Hold), a combination that increases the odds of an earnings beat.

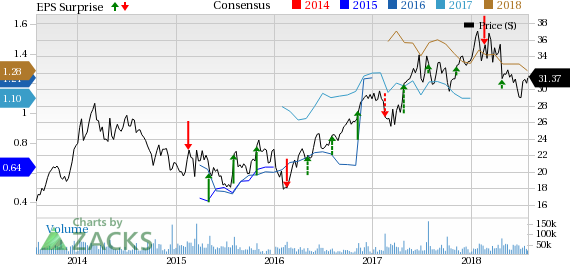

Royal Caribbean Cruises Ltd. Price, Consensus and EPS Surprise

Royal Caribbean Cruises Ltd. Price, Consensus and EPS Surprise | Royal Caribbean Cruises Ltd. Quote

Eldorado Resorts, Inc. ERI will report second-quarter 2018 results after the market close. In first-quarter 2018, the company’s earnings missed the Zacks Consensus Estimate by 14%. Notably, in three of the trailing four quarters, the company’s earnings missed the consensus estimate by an average of 99.5%.

The chances of Eldorado Resorts beating the Zacks Consensus Estimate in Q2 are dim, even though it carries a Zacks Rank #3. This is because the company has an Earnings ESP of 0.00% as the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 52 cents. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Eldorado Resorts, Inc. Price, Consensus and EPS Surprise

Eldorado Resorts, Inc. Price, Consensus and EPS Surprise | Eldorado Resorts, Inc. Quote

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Eldorado Resorts, Inc. (ERI) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research