Leisure Stocks to Watch for Earnings on Feb 3: ONEW, VSTO & MCFT

Despite being severely impacted by the coronavirus pandemic, the leisure industry is gradually coming out of the woods, courtesy of economy reopening and ramped-up vaccinations.

New boat sales have increased sharply amid the coronavirus pandemic. In fact, boat sales have been going through the roof since April-end last year and some dealers are hard-pressed to supply. The boat industry continues to focus on consumer experience, digital marketing, operational excellence and human capital development to drive growth. Although pandemic-induced lockdowns and restricted movement were a roadblock, the ship, boat building and repairing market displayed enough resilience to overcome the same. Per ResearchAndMarkets report, the boat repairing market is likely to reach $8.75 billion in 2025 with a CAGR of 6.5%.

Of late, the golf industry is gaining from high participation by millennials. Technology has also been playing a vital role in reshaping the sport. India and China have popped up as two of the largest emerging golf markets. However, golf equipment sales have slowed in recent months. We believe that macroeconomic hurdles like supply chain constraints, freight cost, staffing challenges and inflationary pressure are likely to have influenced the pace of growth in the upcoming period.

Traffic has been a major concern for the gaming industry since the pandemic. However, the industry is gradually recovering. The companies have been increasing emphasis on levels of services and staffing with selective amenities and enhanced safety and social distancing protocols in the gaming floor to welcome gamers. The gaming industry might have benefited from robust demand for sports betting.

Sneak Peek into Upcoming Earnings Releases

Let’s focus on a few Consumer Discretionary companies that are scheduled to release earnings on Nov 4.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

OneWater Marine Inc. ONEW is scheduled to report first-quarter fiscal 2022 results before the opening bell. In the last reported quarter, the company registered a negative earnings surprise of 14.4%.

The company’s fiscal first-quarter results are likely to reflect an increase in the average unit price of new and pre-owned boats. An increase in service, parts and other sales and acquisitions might have driven the company’s performance. Emphasis on technological investments and inventory planning tools and good retail demand also bode well. For fiscal 2022, the company expects same-store sales to be up high-single digits.

However, pandemic-induced supply and carrier constraints are likely to have weighed on the to-be-reported quarter's performance. Inability to manage inventory and anticipate changing consumer preferences and buying trends are likely to have affected the company’s operations in the fiscal first quarter.

The company has a Zacks Rank #1 and an Earnings ESP of +4.94%. You can see the complete list of today’s Zacks #1 Rank stocks here.

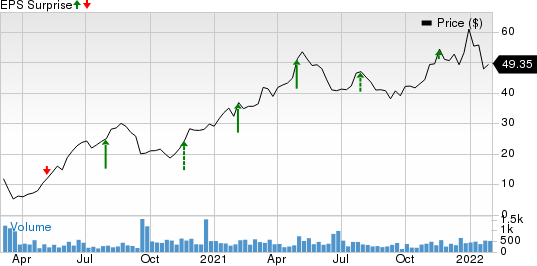

OneWater Marine Inc. Price and EPS Surprise

OneWater Marine Inc. price-eps-surprise | OneWater Marine Inc. Quote

Vista Outdoor Inc. VSTO is scheduled to report third-quarter fiscal 2022 results on Feb 3, before the opening bell. In the last reported quarter, the company delivered an earnings surprise of 36.2%.

Vista Outdoor’s fiscal third-quarter performance is likely to have benefited from increased demand in commercial ammunitions, cycling, outdoor cooking categories and firearms. The company has been gaining from rise in outdoor activity and shooting sports participation. More emphasis on product innovation and digital marketing and e-commerce are likely to get reflected in the fiscal third-quarter top line.

The Zacks Consensus Estimate for total Shooting Sports revenues is pegged at $546 million, indicating growth of 35.8% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for total Outdoor Products revenues is pegged at $204 million, indicating growth of 17.9% from the year-ago quarter’s levels.

The company has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Vista Outdoor Inc. Price and EPS Surprise

Vista Outdoor Inc. price-eps-surprise | Vista Outdoor Inc. Quote

MasterCraft Boat Holdings, Inc. MCFT is scheduled to report second-quarter fiscal 2022 results before the opening bell. In the last reported quarter, the company posted an earnings miss of 17.5%. The company has an Earnings ESP of -1.59% and a Zacks Rank #4. The company’s earnings and revenues are likely to witness growth of 5.3% and 29.4% year over year, respectively.

MASTERCRAFT BOAT HOLDINGS, INC. Price and EPS Surprise

MASTERCRAFT BOAT HOLDINGS, INC. price-eps-surprise | MASTERCRAFT BOAT HOLDINGS, INC. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vista Outdoor Inc. (VSTO) : Free Stock Analysis Report

MASTERCRAFT BOAT HOLDINGS, INC. (MCFT) : Free Stock Analysis Report

OneWater Marine Inc. (ONEW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research