Leon Cooperman's Top 5 Buys in 1st Quarter

- By James Li

Leon Cooperman (Trades, Portfolio), founder and chairman of Omega Advisors family office, disclosed this week his top five buys during the first quarter included major Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) airline holding Delta Air Lines Inc. (DAL).

Warning! GuruFocus has detected 4 Warning Signs with GRBK. Click here to check it out.

The intrinsic value of DAL

Cooperman turned his Omega hedge fund into a family office at the end of 2018, citing in a client letter he "does not wish to spend the rest of his life chasing the Standard & Poor's 500 index and generating returns on invested capital."

Omega combines macroeconomic views and fundamental valuation in its investing strategy. Cooperman and fellow billionaire investor Mario Gabelli (Trades, Portfolio) discussed in a CNBC "Halftime Report" interview on May 9 the ongoing trade war between the U.S. and China.

Although Cooperman does not believe the markets have the ingredients normally associated with a recession, the Omega chairman did warn a trade war can have negative consequences to the economy.

Cooperman's $1.64 billion equity portfolio contains 56 stocks, of which 20 represent new holdings. The top five buys in terms of portfolio weight were Twin River Worldwide Holdings Inc. (TRWH), Centene Corp. (CNC), Adobe Inc. (ADBE), New Residential Investment Corp. (NRZ) and Delta.

Twin River Worldwide Holdings

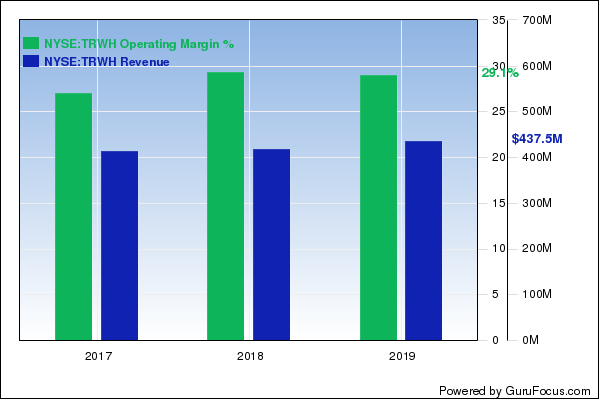

Cooperman purchased 1.2 million shares of Twin River Worldwide Holdings, giving the stake 2.20% weight in the equity portfolio.

The Lincoln, Rhode Island-based casino operator said this week that during the first quarter, it completed its acquisition of Dover Downs and commenced trading on the New York Stock Exchange. Revenues for the quarter were $120.6 million, up 15.1% from the prior-year quarter. Over the past three years, the company reported revenue of at least $400 million. Operating margins were at least 26% over the same period.

Centene

Cooperman purchased 275,000 shares of Centene, giving the position 0.89% equity portfolio space. Shares averaged $60.76 during the quarter.

The St. Louis-based company offers health care plans to U.S. government-sponsored health care programs, with a focus on uninsured individuals. Centene announced on March 27 it entered a definitive merger agreement in which it will acquire WellCare Health Plans Inc. (WCG). The cash and stock transaction of $305.39 per share is based on WellCare's closing price on March 26.

GuruFocus ranks Centene's financial strength 6 out of 10: Although the company has a moderately strong Altman Z-score of 2.94, its interest coverage of 4.29 is below Benjamin Graham's safe threshold of 5 and underperforms 88% of global competitors.

Other gurus with positions in Centene include Andreas Halvorsen (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and the Vanguard Health Care Fund (Trades, Portfolio).

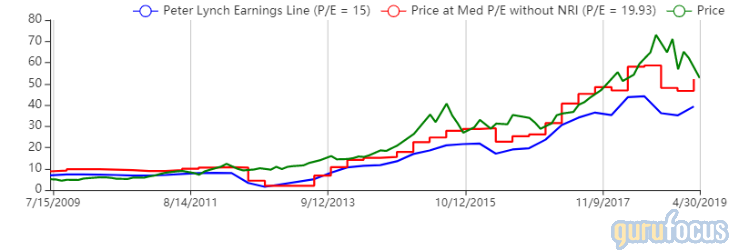

Adobe

Cooperman purchased 38,000 shares of Adobe, giving the position 0.62% equity portfolio space. Shares averaged $251.74 during the quarter.

San Jose, California-based Adobe develops and sells software like Photoshop and the "portable document format" processor, which is also known as the PDF. GuruFocus ranks the company's financial strength 7 out of 10: Although it has a robust Altman Z-score of 10.29, Adobe's debt-to-equity ratio of 0.42 underperforms 63.61% of global competitors. Despite this, Adobe's profitability ranks 9 out of 10 on positive indicators like strong operating margin growth and returns that are near 10-year highs.

Ken Fisher (Trades, Portfolio) and Philippe Laffont (Trades, Portfolio) also purchased shares of Adobe during the quarter.

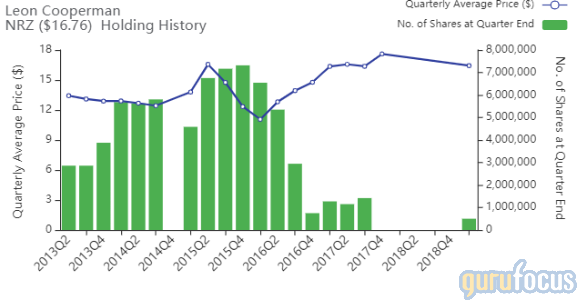

New Residential Investment

Cooperman purchased 500,000 shares of New Residential Investment, giving the holding 0.52% equity portfolio space. Shares averaged $16.44 during the first quarter.

The New York-based real estate investment trust's asset portfolio is mainly comprised of servicing-related assets, residential securities and loans. GuruFocus ranks the REIT's financial strength 3 out of 10 on several weak signs, which include an equity-to-asset ratio that underperforms 89.72% of global competitors and a cash-debt ratio that underperforms 66.56% of global competitors.

Delta

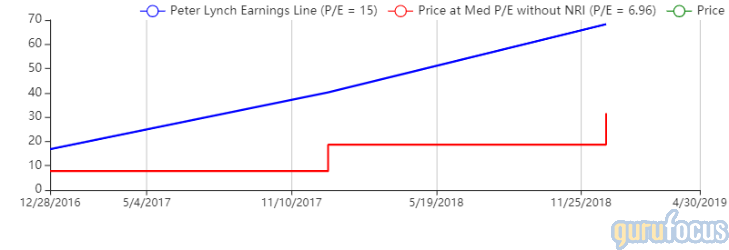

Cooperman purchased 125,000 shares of Delta, giving the position 0.39% equity portfolio weight. Shares averaged $49.61 during the first quarter.

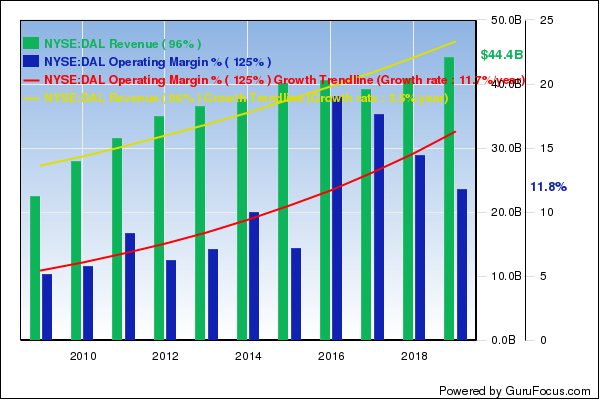

The Atlanta-based airline operates a hub-and-spoke system, flying to more than 325 destinations across 60 countries. GuruFocus ranks the company's profitability 7 out of 10: Even though Delta's three-year revenue growth rate of 3% outperforms just 55% of global competitors, the operating margin of 12.12% outperforms 81.33% of global airlines.

Warren Buffett (Trades, Portfolio)'s Berkshire added 5,375,456 shares of Delta, increasing the holding 8.2% and the conglomerate's equity portfolio 0.14%.

Disclosure: No positions.

Read more here:

6 Stocks Leon Cooperman and Mario Gabelli Agree On

David Tepper Buys Berkshire Hathaway Holding Amazon

Philippe Laffont's Top 5 Buys of the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with GRBK. Click here to check it out.

The intrinsic value of DAL