Lincoln Educational Services (NASDAQ:LINC) Shareholders Have Enjoyed A 62% Share Price Gain

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Lincoln Educational Services Corporation (NASDAQ:LINC) share price is 62% higher than it was a year ago, much better than the market return of around 9.6% (not including dividends) in the same period. That's a solid performance by our standards! However, the longer term returns haven't been so impressive, with the stock up just 29% in the last three years.

View our latest analysis for Lincoln Educational Services

Given that Lincoln Educational Services didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Lincoln Educational Services saw its revenue grow by 0.5%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 62%. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

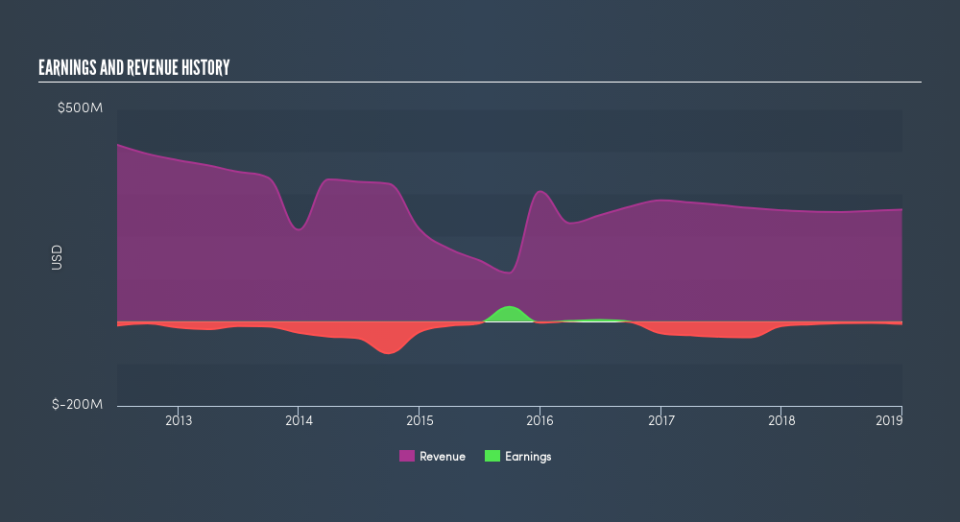

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Lincoln Educational Services's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Lincoln Educational Services shareholders, and that cash payout contributed to why its TSR of 62%, over the last year, is better than the share price return.

A Different Perspective

It's good to see that Lincoln Educational Services has rewarded shareholders with a total shareholder return of 62% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 2.5% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You could get a better understanding of Lincoln Educational Services's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Lincoln Educational Services may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.