Lincoln National (LNC) Earnings Miss in Q4, Decrease Y/Y

Lincoln National Corp.’s LNC fourth-quarter 2020 earnings of $1.78 per share missed the Zacks Consensus Estimate by 10.1% and also declined 26.1% year over year.

Results were affected by an increase in benefit expense, which was more than revenue growth.

Adjusted operating revenues of $4.66 billion, however, increased 3.1% year over year and also surpassed the Zacks Consensus Estimate by 0.9%, driven by highest contribution from its Life insurance segment.

Total expenses were up 4.7% year over year to $4.1 billion, primarily due to higher benefits and a strategic digitization expense.

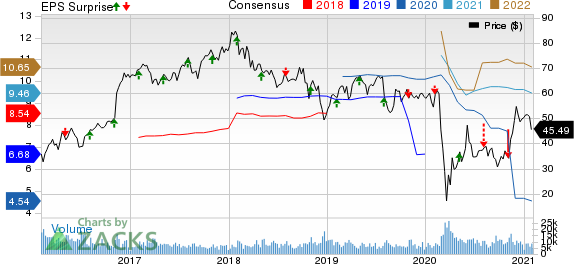

Lincoln National Corporation Price, Consensus and EPS Surprise

Lincoln National Corporation price-consensus-eps-surprise-chart | Lincoln National Corporation Quote

Segmental Performance

Operating income in the Annuities segment was up 7.4% year over year to $289 million. Revenues of $1.16 billion inched up 0.9% year over year. Total annuity sales plunged 35.7% to $2.5 billion from the year-ago quarter, induced by the respective 93% and 11% declines in fixed and variable annuity sales.

Operating income in Retirement Plan Services rose 4.3% year over year to $49 million. Revenues of $323 million climbed 4.2% year over year. Total deposits declined 4% year over year to $2.6 billion due to lower first-year sales, partly offset by slight growth in recurring deposits.

Life Insurance segment’s income of $144 million dropped 19.6% year over year. Moreover, operating revenues increased 4.9% year over year to $1.9 billion. Total life insurance sales slumped 74% year over year to $115 million, caused by a 70% and 92% decline each in individual life and executive benefits.

The company’s Group Protection reported an operating loss of $42 million against the year-ago quarter’s operating income of $54 million. Operating revenues inched up 2.2% year over year to $1.19 billion, courtesy of a 51.5% surge in sales.

Share Repurchase Update

The company resumed its share buyback activity with $50 million already completed in the December quarter.Financial Update (as of Dec 31, 2020)

Lincoln National’s book value per share excluding accumulated other comprehensive income inched up 0.4% year over year to $71.59. Adjusted operating return on equity (ROE) excluding accumulated other comprehensive income and goodwill stands at 10.1%, down 380 basis points year over year.

The company ended the fourth quarter with long-term debt of $6.7 billion, up 4.9% year over year. Its assets were worth $365.9 billion, up 9.3% from the year-ago quarter’s number. Shareholders’ equity increased 15.3% year over year to $22.7 billion.

Our Take

The company continues to be impacted by higher claims from the pandemic. However, the economic environment is gradually improving. Such a bettering macro environment along with the company’s strategy to build sales, execute its expense initiatives as well as accelerate digital capabilities bode well.

Resumption of share buybacks restores investors’ confidence in the company.

Other stocks in the insurance space including Aflac Inc. AFL, Principal Financial Group, Inc. PFG and MetLife Inc. MET surpassed on fourth-quarter earnings by 2.88%, 3.5% and 32.68%, respectively.

Lincoln National carries a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research