Do Lindblad Expeditions Holdings's (NASDAQ:LIND) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Lindblad Expeditions Holdings (NASDAQ:LIND). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Lindblad Expeditions Holdings

How Fast Is Lindblad Expeditions Holdings Growing?

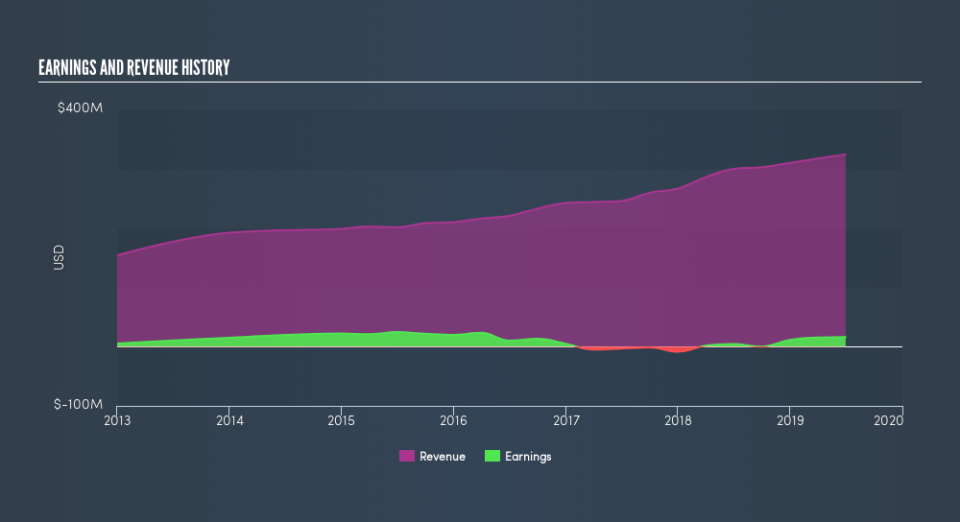

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Lindblad Expeditions Holdings grew its EPS by 17% per year. That's a good rate of growth, if it can be sustained.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While Lindblad Expeditions Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Lindblad Expeditions Holdings EPS 100% free.

Are Lindblad Expeditions Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Lindblad Expeditions Holdings insiders own a meaningful share of the business. In fact, they own 39% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling US$363m. That means they have plenty of their own capital riding on the performance of the business!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Lindblad Expeditions Holdings with market caps between US$400m and US$1.6b is about US$2.8m.

The Lindblad Expeditions Holdings CEO received US$1.7m in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Lindblad Expeditions Holdings Deserve A Spot On Your Watchlist?

One important encouraging feature of Lindblad Expeditions Holdings is that it is growing profits. Earnings growth might be the main game for Lindblad Expeditions Holdings, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Of course, profit growth is one thing but it's even better if Lindblad Expeditions Holdings is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.