Update: LiveRamp Holdings (NYSE:RAMP) Stock Gained 87% In The Last Five Years

While LiveRamp Holdings, Inc. (NYSE:RAMP) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 21% in the last quarter. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 87%, less than the market return of 123%.

View our latest analysis for LiveRamp Holdings

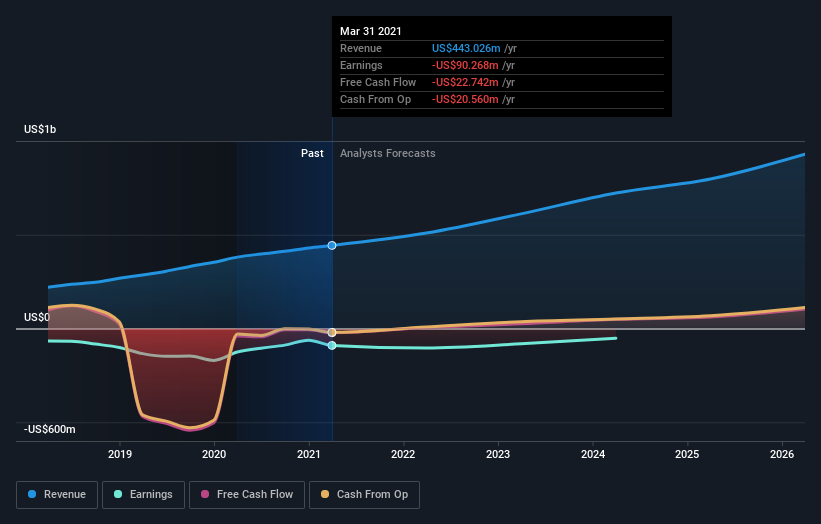

Because LiveRamp Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years LiveRamp Holdings saw its revenue shrink by 19% per year. The stock is only up 13% for each year during the period. That's pretty decent given the top line decline, and lack of profits. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

LiveRamp Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think LiveRamp Holdings will earn in the future (free analyst consensus estimates)

A Different Perspective

LiveRamp Holdings shareholders are up 1.2% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 13% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for LiveRamp Holdings you should know about.

But note: LiveRamp Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.