Lockheed Martin (LMT) Q4 Earnings & Sales Beat Estimates

Lockheed Martin Corp. LMT reported fourth-quarter 2020 earnings from continuing operations of $6.38 per share, which came in line with the Zacks Consensus Estimate. The bottom line, however, improved 20.6% from the year-ago quarter’s $5.29 per share.

This year-over-year upside can be attributed to higher sales and operating profit.

For 2020, earnings were $24.30 per share, which rose 10.7% from $21.95 in the year-ago quarter. However, the full-year earnings figure missed the Zacks Consensus Estimate of $24.48 by 0.7%.

Operational Highlights

In the reported quarter, net sales amounted to $17,032 million, which outshined the Zacks Consensus Estimate of $16,972 million by 0.4%. The reported figure also increased 7.3% from $15,878 million reported a year ago, driven by growth in all segments.

In 2020, total revenues grew 9.3% year over year to $65.40 billion. Full-year revenues surpassed the Zacks Consensus Estimate of $65.32 billion by a mere 0.1%.

Backlog

Lockheed Martin ended the fourth quarter (on Dec 31, 2020) with $147.1 billion in backlog, up 2.2% from $144 billion at the end of 2019. Of this, the Aeronautics segment accounted for $56.6 billion, Rotary and Mission Systems contributed $36.2 billion, Space Systems contributed $25.1 billion and $29.2 billion came from the Missiles and Fire Control segment.

Segmental Performance

Aeronautics: Sales increased 5% year over year to $6.71 billion, primarily driven by higher net sales from F-35 programs. Also, higher volumes of classified development contracts contributed to sales growth in this unit.

The segment’s operating profit increased 7% year over year to $727 million, whereas operating margin improved 20 basis points (bps) to 10.8%.

Missiles and Fire Control: Quarterly sales improved 4% year over year to $2.87 billion owing to higher sales for integrated air and missile defense programs stemming from increased volumes from Terminal High Altitude Area Defense (THAAD) and Patriot Advanced Capability-3 (PAC-3).

The segment’s operating profit increased 7% year over year to $374 million and operating margin improved 40 bps to 13%.

Rotary and Mission Systems: Sales of $4.2 billion improved 8% from the prior-year quarter on account of higher sales in Sikorsky helicopter programs and integrated warfare systems and sensors (IWSS) programs.

The segment’s operating profit improved 15% year over year to $406 million. Operating margin expanded 50 bps to 9.6%.

Space Systems: Sales rose 14% year over year to about $3.24 billion in the fourth quarter. The uptick was driven by government satellite programs as well as strategic and missile defense programs.

The segment’s operating profit soared 42% to $368 million. Operating margin improved 220 bps to 11.4% in the reported quarter.

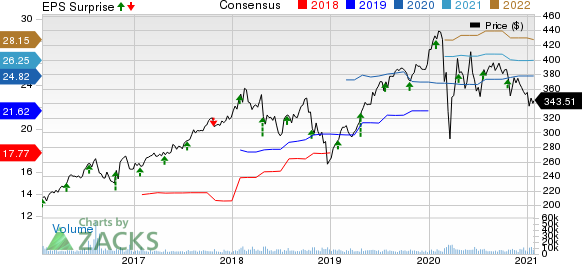

Lockheed Martin Corporation Price, Consensus and EPS Surprise

Lockheed Martin Corporation price-consensus-eps-surprise-chart | Lockheed Martin Corporation Quote

Financial Condition

Lockheed Martin’s cash and cash equivalents totaled $3.16 billion as of Dec 31, 2020, compared with $1.51 billion at the end of 2019. Long-term debt was $11.67 billion, higher than $11.40 billion reported at 2019-end.

Cash from operations at the end of fourth-quarter 2020 amounted to $8.18 billion compared with $7.31 billion a year ago.

Lockheed Martin paid out dividends worth $728 million to shareholders in the fourth quarter compared with the year-ago quarter’s $675 million.

Guidance 2021

Lockheed Martin issued its financial guidance for 2021. The company expects to generate revenues of $67.10-$68.50 billion. Additionally, it expects to deliver earnings per share of $26-$26.30.

The company also expects to generate cash from operations of more than $8.3 billion during the year.

Zacks Rank

Lockheed Martin currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Recent Defense Release

Hexcel Corporation HXL reported a fourth-quarter 2020 loss of 18 cents per share, in line with the Zacks Consensus Estimate.

Upcoming Defense Releases

Boeing BA a Zacks Rank #3 company, will release results on Jan 27.

Northrop Grumman NOC, a Zacks Rank #3 company, is set to release results on Jan 28.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research