Logitech (LOGI) Reports Record Sales in Q2, Misses on Earnings

Logitech LOGI on Monday reported record quarterly sales reaching second-quarter fiscal 2022 revenues at $1.31 billion, up 4% from the year-ago quarter (2% on constant currency). However, the top-line results missed the Zacks Consensus Estimate of $1.33 billion.

Logitech has been benefiting from the elevated demand for its Video Collaboration tools, mainly driven by the heightening work-from-home and learn-from-home trends. Also, the PC peripheral market is witnessing a strong traction, which is aiding top-line growth.

Additionally, the demand for gaming products shot up on the growing popularity of online video games and eSports amid the stay-at-home scenario.

However, the bottom line registered a year-over-year decline as well as missed the consensus mark. The company’s non-GAAP earnings plunged 44% to $1.05 per share and fell short of the Zacks Consensus Estimate of $1.22.

The dismal bottom-line performance reflects the company’s planned increased promotional spending, higher investment in retail point of sale marketing and industry-wide elevated component costs.

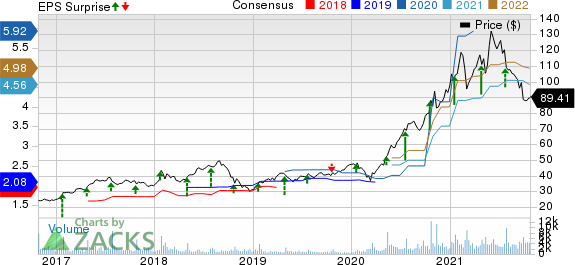

Logitech International S.A. Price, Consensus and EPS Surprise

Logitech International S.A. price-consensus-eps-surprise-chart | Logitech International S.A. Quote

Segmental Details

Logitech’s Gaming segment sales climbed 9% year over year to $331 million. Revenues from Pointing Devices increased 10% year over year to $189 million. Keyboards & Combos sales grew 15% to $236 million.

Video Collaboration sales declined 4% year on year to $232 million. Revenues from PC Webcams were down 9% to $94 million, while the Tablet and Other Accessories sales dipped 3% to $81 million.

The Audio & Wearables segment sales declined 15% year over year to $98 million. Mobile Speakers’ sales decreased 11% to $39 million. The Smart Home segment sales plunged 35% year over year to $6 million.

Margins & Operating Metrics

Non-GAAP gross profit decreased 4.5% to $548 million from the year-ago quarter’s $574 million. Non-GAAP gross margin contracted 370 basis points (bps) from the prior-year quarter to 42%.

Non-GAAP operating expenses flared up 52.5% to $337 million. As a percentage of revenues, non-GAAP operating expenses shot up to 25.8% from the year-earlier quarter’s figure of 17.6%.

Non-GAAP operating income plummeted 40.4% to $211 million from the $354 million reported in the year-ago quarter. Operating margin declined 11.9% to 16.2% from the year-ago quarter’s 28.1%.

Liquidity and Shareholders’ Return

As of Sep 30, 2021, Logitech’s cash and cash equivalents were $1.14 billion compared with the $1.50 billion recorded in the previous quarter. Additionally, the company used cash flow of $62.9 million during the fiscal second quarter for operational activities and $177.8 million in the first-half of fiscal 2022.

During the second quarter of fiscal 2022, the company paid a dividend of $159.4 million and repurchased shares worth $119.5 million. In the first-half of fiscal 2022, it bought back shares worth $174.4 million and paid $159.4 million in dividend.

Fiscal 2022 Outlook Reiterated

The company reiterated its projections for revenues and operating income. It still estimates sales to remain flat (+/- 5%) year over year in constant currency. Management also kept the non-GAAP operating income guidance range unchanged at $800-$850 million.

Zacks Rank and Stocks to Consider

Logitech currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Applied Materials AMAT, Advanced Micro Devices AMD and CACI International CACI, all carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for Digital Turbine, Intuit and Zoom is currently pegged at 19.4%, 44.6% and 5.5%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research