Lone Pine Capital Sells Alibaba, Fleetcor, Exits Symantec

- By Tiziano Frateschi

Lone Pine Capital was founded in 1997 and is managed by Stephen Mandel. The fund reported solid returns in the last year. The performance from March 2016 to March 2017 was a 29% gain. In a recent letter to investors, Mandel announced that he will leave the day-to-day portfolio management in January 2019, when Mala Gaonkar and Kelly Granat will succeed him. The following stocks were sold during the third quarter.

Warning! GuruFocus has detected 4 Warning Signs with FLT. Click here to check it out.

The intrinsic value of FLT

The guru trimmed his Fleetcor Technologies Inc. (FLT) holding by 87.77%, impacting the portfolio by -4.22%.

The provider of fuel cards has a market cap of $16.14 billion and enterprise value of $19.04 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity (ROE) of 16.82% and return on assets (ROA) of 5.42% are outperforming 61% of the companies in the Global Business Services industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.36 is below the industry median of 1.37.

Chase Coleman (Trades, Portfolio) is the largest shareholder of the company among the gurus, with 3.12% of outstanding shares followed by Spiros Segalas (Trades, Portfolio) with 2.14% and Andreas Halvorsen (Trades, Portfolio) with 1.13%.

The investor closed his position in O"Reilly Automotive Inc. (ORLY). The trade had an impact of -3.16% on the portfolio.

The retail company has a market cap of $18.39 billion and enterprise value of $21.25 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The ROE of 83.74% and ROA of 14.66% are outperforming 92% of the companies in the Global Specialty Retail industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.99.

The largest shareholder of the company among the gurus is Chuck Akre (Trades, Portfolio) with 2.23% of outstanding shares followed by Ruane Cunniff (Trades, Portfolio) with 1.56%, David Abrams (Trades, Portfolio) with 1% and Pioneer Investments (Trades, Portfolio) with 1%.

The Symantec Corp. (SYMC) position was closed. The transaction had an impact of -3.03% on the portfolio.

The provider of software application has a market cap of $17.71 billion and enterprise value of $21.89 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of -6.64% and ROA of -1.45% are outperforming 75% of the companies in the Global Software - Application industry. Financial strength has a rating of 4 out of 10. The cash-debt ratio of 0.33 is below the industry median of 6.56.

Jim Simons (Trades, Portfolio) is the largest shareholder of the company among the gurus with 0.39% of outstanding shares followed by John Buckingham (Trades, Portfolio) with 0.04%, Pioneer Investments (Trades, Portfolio) with 0.03%, Jeremy Grantham (Trades, Portfolio) with 0.02% and Dodge & Cox with 0.02%.

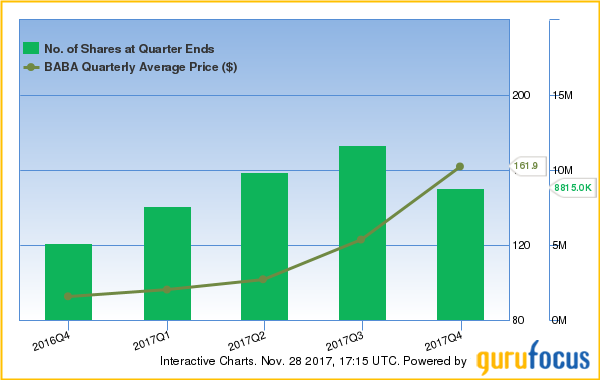

The guru"s holding of CSX Corp. (CSX) was closed, impacting the portfolio by -2.86%.

The railroad operating company has a market cap of $45.49 billion and enterprise value of $56.61 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The ROE of 15.57% and ROA of 5.05% are outperforming 71% of the companies in the Global Railroads industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.06 is below the industry median of 0.34.

The largest shareholder of the company among the gurus is PRIMECAP Management (Trades, Portfolio) with 0.44% of outstanding shares followed by John Griffin (Trades, Portfolio) with 0.41%, Steven Cohen (Trades, Portfolio) with 0.1% and Grantham with 0.05%.

Mandel exited his Ulta Beauty Inc. (ULTA)"s position. The trade had an impact of -2.1% on the portfolio.

The beauty retailer has a market cap of $12.92 billion and enterprise value of $12.65 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The ROE of 30.65% and ROA of 18.34% are outperforming 93% of the companies in the Global Specialty Retail industry. Financial strength has a rating of 8 out of 10 with no cash to debt.

Griffin is the largest shareholder of the company among the gurus with 1.76% of outstanding shares followed by Segalas with 0.91%, Simons with 0.55% and Columbia Wanger (Trades, Portfolio) with 0.12%.

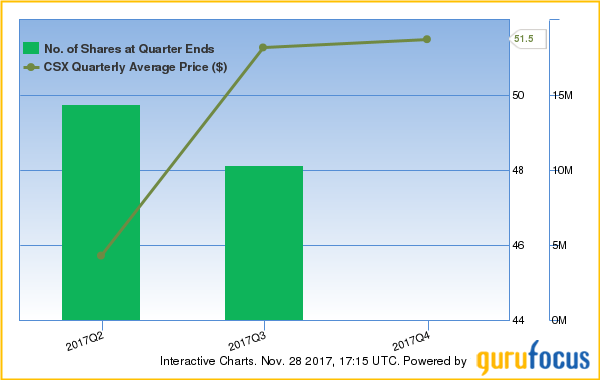

Alibaba Group Holding Ltd ADR (BABA)"s stake was reduced by 24.44%, impacting the portfolio by -2.04%.

The online commerce company has a market cap of $483.59 billion and enterprise value of $479.27 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The ROE of 21.52% and ROA of 11.78% are underperforming 83% of the companies in the Global Specialty Retail industry. Financial strength has a rating of 7 out of 10. The cash-debt ratio of 1.80 is below the industry median of 0.99.

The largest shareholder of the company among the gurus is PRIMECAP Management (Trades, Portfolio) with 0.61% of outstanding shares followed by Frank Sands (Trades, Portfolio) with 0.59%, Ken Fisher (Trades, Portfolio) with 0.41% and Mandel with 0.35%.

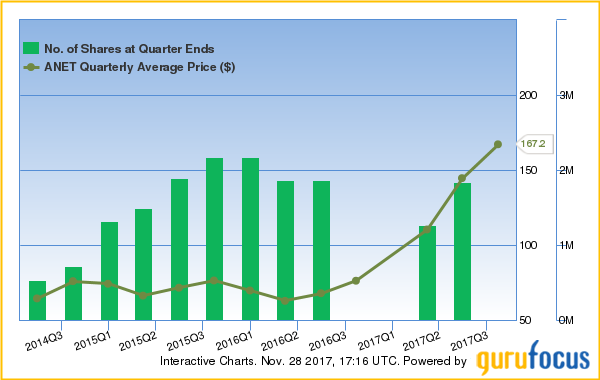

The Arista Networks Inc. (ANET)"s position was closed. The trade had an impact of -1.41% on the portfolio.

The supplier of cloud networking solutions has a market cap of $17.69 billion and enterprise value of $16.39 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The ROE of 30.27% and ROA of 19.59% are outperforming 96% of the companies in the Global Computer Systems industry. Financial strength has a rating of 8 out of 10. The cash-debt ratio of 35.16 is above the industry median of 1.44.

Simons is the largest shareholder of the company among the gurus with 0.93% of outstanding shares followed by Joel Greenblatt (Trades, Portfolio) with 0.01%.

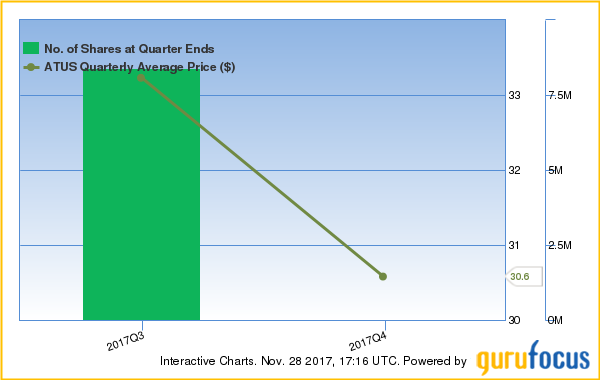

Mandel also exited his holding of Altice USA Inc Class A(ATUS), impacting the portfolio by -1.38%.

The company operates in the telecommunications sector and has a market cap of $14.15 billion and enterprise value of $36.24 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The ROE of -42.58% and ROA of -3.37% are underperforming 92% of the companies in the Global Telecom Services industry. Financial strength has a rating of 3 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.37.

The largest shareholder of the company among the gurus is Coleman with 0.16% of outstanding shares followed by Louis Moore Bacon (Trades, Portfolio) with 0.02%.

The 9th largest sales was Cheniere Energy Inc. (LNG). Mandel closed the position impacting the portfolio by -1.28%.

The energy company has a market cap of $11.4 billion and enterprise value of $38.42 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROA of -1.62% and ROC of 5.03% are underperforming 82% of the companies in the Global Oil & Gas Midstream industry. Financial strength has a rating of 3 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.05.

Carl Icahn (Trades, Portfolio) is the largest shareholder of the company among the gurus with 13.75% of outstanding shares followed by Seth Klarman (Trades, Portfolio) with 8.72% and NWQ Managers (Trades, Portfolio) with 0.8%.

Disclosure: I do not own any shares of any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with FLT. Click here to check it out.

The intrinsic value of FLT