A Look Behind Costco's (NASDAQ:COST) High Valuation

This article first appeared on Simply Wall St News.

After a slump in the first quarter, Costco Wholesale (NASDAQ: COST) rallied to make new highs. While the company has many positives going on, with growing revenues and consumer loyalty, there are challenges on the horizon.

In this article, we will examine its profitability to check how it compares to the current valuation.

View our latest analysis for Costco Wholesale

Earnings Results

Non-GAAP EPS: US$3.90 (beat by US$0.36)

GAAP EPS: US$3.76 (beat by US$0.18)

Revenue: US$62.68b (beat by US$1.23b)

By the results, it looks like Costco is winning on all fronts. Besides the revenue rising 17% y/y, the company is also doing well on the e-commerce sales (11% up q/q) and comparable sales up 15%.

While the market notes the 41.5 price-to-earnings ratio, Wall Street is predominantly bullish on the stock. Morgan Stanley lifted its price target from US$500 to US$510, quoting the optimism on comparable sales in FY22.

Meanwhile, the CFO Richard Galanti pointed out the inflationary pressures, as the company's outlook tripled during this year – rising from 1%-1.5% to 3.5%-4.5%. The company sees the most notable inflation in plastics, paper goods, and fresh food.

Furthermore, to combat the logistics costs, the company is chartering ocean vessels. This doesn't come as a surprise as shipping costs are climbing to new highs.

A Look at the Profitability

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Costco Wholesale is:

28% = US$5.1b ÷ US$18b (Based on the trailing twelve months to August 2021).

The 'return' refers to a company's earnings over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.28.

What Has ROE Got To Do With Earnings Growth?

By evaluating how much profit the company reinvests or "retains" for future growth, we will get an idea about the company's growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention have a higher growth rate than firms that don't share these attributes.

Costco Wholesale's Earnings Growth And 28% ROE

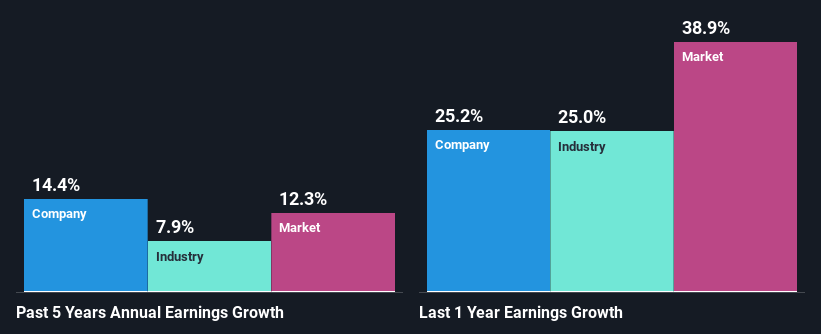

First thing first, we like that Costco Wholesale has an impressive ROE. Additionally, the company's ROE is higher than the industry average of 12%, which is remarkable. This probably laid the groundwork for Costco Wholesale's moderate 14% net income growth seen over the past five years.

Next, comparing with the industry net income growth, we found that Costco Wholesale's growth is relatively high compared to the industry average growth of 7.9% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them show if the stock's future looks promising or ominous.

What is COST worth today? The intrinsic value infographic in our free research report helps visualize whether the market currently misprices COST.

Is Costco Wholesale Using Its Retained Earnings Effectively?

With a 3-year median payout ratio of 30% (implying that the company retains 70% of its profits), it seems that Costco Wholesale is reinvesting efficiently in a way that it sees a respectable amount of growth in its earnings and pays a dividend that's well covered.

Besides, Costco Wholesale has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 25%.

Accordingly, forecasts suggest that Costco Wholesale's future ROE will be 23%, which is similar to the current ROE.

Conclusion

Despite its rich valuation, we can conclude that Costco Wholesale is doing the right things. The company is taking precautionary measures to stay ahead of the ongoing problems like shipping and inflation while leading the way in other areas like they did with the minimum wage increase back in February. Furthermore, the company retains strong brand loyalty with over 100m loyalty club members.

In particular, it's great to see that the company is investing heavily into its business, and along with a high rate of return that has resulted in a sizeable growth in its earnings.

Having said that, the company's earnings growth is expected to slow down, as forecast in the current analyst estimates. Are these analysts' expectations based on the general expectations for the industry or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com