Looks Like Consumers Are Retreating To Their Bad Credit Habits

CardHub

Consumers are on track to rack up $47 billion in credit card debt in 2013, according to the latest estimates from CardHub.com.

That's good news and bad news.

On the positive side, we're carrying less debt now than during the thick of the recession and fewer consumers are defaulting on payments. But it's also slightly troubling, considering Americans just managed to pay down $32.5 billion worth of debt in the first quarter of 2013.

Compared to the last four years, workers paid less debt down in the first quarter of 2013 than the same time period a year ago –– a decrease of 7%. It's the first time in a while that we've actually gotten worse at managing our debt.

In fact, the 2013 debt picture is shaping up to mirror 2011's, when Americans paid down $32.7 billion in debt only to turn around and rack up $46.71 billion.

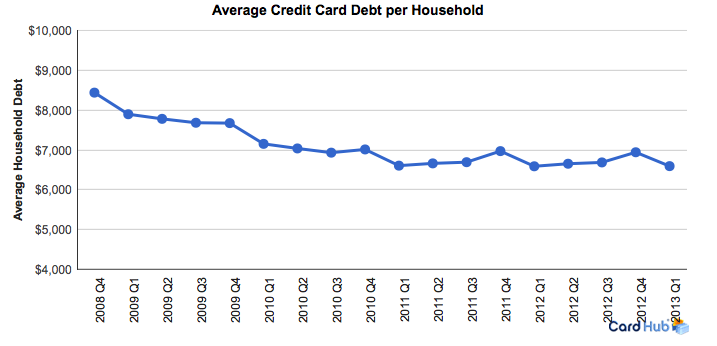

If you're planning on rejiggering your budget to clamp down on credit debt, now is the time to do it. The average American household has more than $6,500 in credit card debt, despite a steady decrease since the recession.

If you're looking for a strategy, simplicity works best: Focus on the debt with the highest interest rates first, then work your way down from there.

More From Business Insider