LPL Financial (LPLA) Q2 Earnings Beat, Revenues Decline Y/Y

LPL Financial’s LPLA second-quarter 2020 adjusted earnings of $1.42 per share surpassed the Zacks Consensus Estimate of $1.31. The figure reflected a decline of 23% from the prior-year quarter.

In the quarter, the company recorded growth in total brokerage and advisory assets. Moreover, the balance sheet position remained strong. However, a decline in revenues and higher expenses hurt results to some extent.

After taking into consideration non-recurring items, net income was $101.7 million or $1.27 per share, down from $146.1 million or $1.71 per share recorded in the year-ago quarter.

Revenues Decline, Expenses Rise

Total net revenues were $1.37 billion, down 2% year over year. The fall was due to a decline in commissions, asset-based revenues, and interest income, net of interest expenses. The reported figure lagged the Zacks Consensus Estimate of $1.38 billion.

Total operating expenses increased 4% year over year to $1.20 billion. All expense components increased, except for professional services costs and other costs.

At the end of the second quarter, LPL Financial’s total brokerage and advisory assets were $761.7 billion, up 8% year over year.

Total net new assets were $13 billion at the end of the quarter, up from $6.2 billion recorded at the end of the prior-year quarter. Total client cash balances increased 50% year over year to $45.3 billion.

Balance Sheet Position Strong

As of Jun 30, 2020, the company had total assets of $5.91 billion, down 3.4% from the Mar 31, 2020 level. As of the same date, cash and cash equivalents totaled $845.2 million, up from $418.2 million as of Mar 31, 2020.

Also, total stockholders’ equity was $1.11 billion as of Jun 30, 2020, up from $1.01 billion recorded at the end of the prior quarter.

Guidance

For 2020, management expects core G&A expenses in the lower half of $915-$940 million.

Our Viewpoint

LPL Financial’s recruiting efforts and solid advisor productivity will likely aid advisory revenues amid the coronavirus outbreak-induced economic uncertainty. However, persistently mounting expenses mainly due to higher compensation and benefits costs are expected to hurt the bottom line to an extent in the near term.

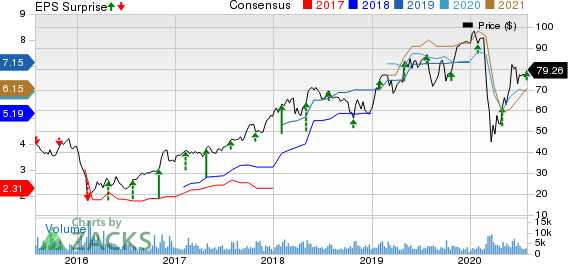

LPL Financial Holdings Inc. Price, Consensus and EPS Surprise

LPL Financial Holdings Inc. price-consensus-eps-surprise-chart | LPL Financial Holdings Inc. Quote

Currently, LPL Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Companies

BlackRock, Inc.’s BLK second-quarter 2020 adjusted earnings of $7.85 per share comfortably surpassed the Zacks Consensus Estimate of $6.90. The figure reflects a rise of 22.5% from the year-ago number.

Cohen & Steers’ CNS second-quarter 2020 adjusted earnings of 54 cents per share missed the Zacks Consensus Estimate of 55 cents. Moreover, the bottom line was 12.9% lower than the year-ago reported figure.

Affiliated Managers Group, Inc.’s AMG second-quarter 2020 economic earnings of $2.74 per share surpassed the Zacks Consensus Estimate of $2.70. However, the bottom line declined 17.7% year over year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report

Cohen Steers Inc (CNS) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.