Lumentum (LITE) Q3 Earnings Beat Estimates, Revenues Up Y/Y

Lumentum Holdings LITE reported third-quarter fiscal 2019 earnings of 91 cents per share, which beat the Zacks Consensus Estimate by 6 cents. The figure increased 16.7% year over year.

Net revenues of $432.9 million also beat the Zacks Consensus Estimate of $430 million and jumped 44.9% from the year-ago quarter.

Top-Line Details

Optical Communications (87.3% of net revenues) revenues surged 53.4% year over year to $377.9 million. Lasers (12.7%) revenues increased 4.8% to $55 million. Revenues from kilowatt class fiber lasers soared 135% year over year.

Lumentum benefited from strong demand for its new products in ROADMs and fiber lasers. The company stated that Chinese customers are gradually stepping up their contribution to ROADM revenues.

Although the company has expanded its production capacity related to the ROADM product line, demand remained much higher compared to supply in the reported quarter. This is expected to continue in the fourth quarter as well.

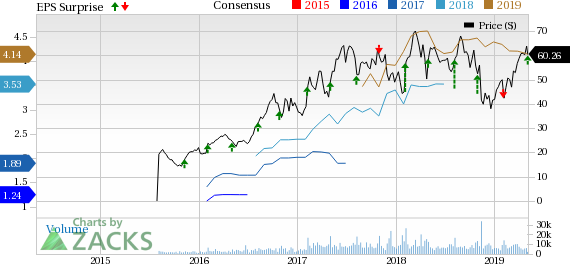

Lumentum Holdings Inc. Price, Consensus and EPS Surprise

Lumentum Holdings Inc. Price, Consensus and EPS Surprise | Lumentum Holdings Inc. Quote

Moreover, the third-quarter results included full-quarter contribution from the Oclaro acquisition. The acquisition has helped Lumentum achieve a better telecom revenue mix. While transport contributed 60% of telecom revenues, 40% came from transmission. Notably, Lumentum’s telecom revenue mix was heavily dominated by transport, historically.

The company believes that launch of higher speed transmission products, including DCO modules, later in 2019 will further improve telecom revenue mix.

In terms of 3D sensing product line, Lumentum continued to win contracts from Android customers. Notably, for the first time in the company’s history, a single Android customer drove more than $10 million in revenues in the reported quarter.

Operating Details

Non-GAAP gross margin expanded 270 basis points (bps) from the year-ago quarter to 40.1%.

The Lasers segment gross margin improved due to lower product costs. Lumentum shifted its pump laser production to a new facility in Thailand, which is achieving lower costs than the previous manufacturing location.

The company is making healthy investments in new laser product development that is targeting high-growth material processing applications.

Non-GAAP research and development (R&D) expenses soared 50.9% year over year to $52.8 million. Non-GAAP selling, general and administrative expenses (SG&A) surged 61.8% year over year to $39 million.

Lumentum’s operating margin expanded 130 bps from the year-ago quarter to 17.8%.

Notably, Lumentum achieved more than $20 million in annual expense synergies from the Oclaro acquisition in the third quarter.

Guidance

For fourth-quarter fiscal 2019, the company expects 3D sensing revenues to be flat to slightly down, owing to seasonality on existing products. Moreover, Lasers revenues are expected to decline sequentially in the to-be-reported quarter.

Lumentum now expects net revenues between $405 million and $425 million for the fourth quarter. Non-GAAP operating margin is anticipated to be 18-20%.

Non-GAAP earnings are expected between 85 cents and $1 per share.

Lumentum expects telecom market to remain strong on the back of continued growth in global network bandwidth requirements and solid demand for building infrastructure related to 5G.

Moreover, the company is restructuring its product suite for telecom customers. Reduction in overlapping products is expected to have minimal negative impact on revenues but anticipated to improve gross margin. Lumentum expects to complete the restructuring process over the next few quarters.

Further, the company is discontinuing some legacy telecom product lines that do not support its long-term goals in terms of growth and profitability. Revenues from these products are roughly $15 million per quarter currently and projected to decline to zero over the coming three to four quarters.

Regarding datacom products, Lumentum is now focusing on datacom chip sales and will stop selling datacom transceivers over time. On Apr 18, 2019, the company completed the divestiture of certain datacom product lines to Cambridge Industries Group (CIG). This is expected to hurt revenues for the fiscal year (revenues down by $20-$25 million).

Lumentum expects revenues from datacom transceiver product lines to decline to zero over the next four to five quarters. Currently, datacom chip revenues are roughly $20 million per quarter.

Lumentum has witnessed increased interest from new customers for its datacom chips. The company is investing in the development of new datacom chip. It expects sales of chips to customers serving the datacom and 5G markets to grow in the long haul.

Lumentum also foresees robust growth opportunity for its 3D sensing business.

Further, the company expects synergies from Oclaro acquisition to be more than $60 million per year within 12 to 24 months from the close of the transaction.

Zacks Rank & Stocks to Consider

Lumentum currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader computer & technology industry include MongoDB MDB, Kingdee International Software Group KGDEY and Upland Software UPLD. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for MongoDB, Kingdee and Upland is 8%, 28% and 20%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Upland Software, Inc. (UPLD) : Free Stock Analysis Report

Lumentum Holdings Inc. (LITE) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Kingdee International Software Group Co., Ltd. Unsponsored ADR (KGDEY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research