LYFT's Q2 Loss Narrower Than Expected, Revenues Surge Y/Y

Lyft, Inc. LYFT incurred a loss (excluding 70 cents from non-recurring items) of 6 cents per share in the second quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of 23 cents. The amount of loss narrowed significantly from the year-ago period when coronavirus-led restrictions caused a dramatic drop in ride volumes.

Total revenues of $765 million also outperformed the Zacks Consensus Estimate of $701.2 million. The top line surged more than 100% year over year due to 97.3% rise in Active Riders (riders who take at least one ride during a quarter on Lyft’s multimodal platform through its app). Active Riders totaled 17.14 million in the quarter under review. This San Francisco-based company’s Revenue per Active Rider increased 14.3% year over year to $44.63.

Lyft’s second-quarter performance improved sequentially as well, reflecting continued recovery in rideshare rides. Total revenues increased 26% from the first quarter of 2021 with 27% rise in Active Riders.

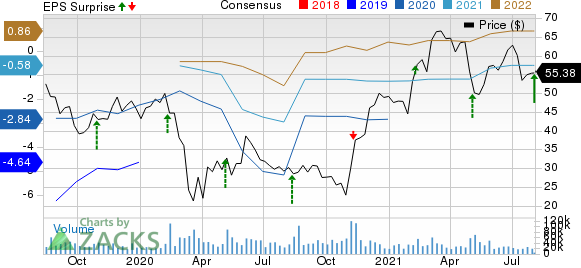

Lyft, Inc. Price, Consensus and EPS Surprise

Lyft, Inc. price-consensus-eps-surprise-chart | Lyft, Inc. Quote

During the second quarter, Lyft generated adjusted EBITDA profits for the first time, thus achieving its goal of adjusted EBITDA profitability earlier by a quarter. Second-quarter adjusted EBITDA of $23.8 million improved $304.1 million year over year and by $96.8 million sequentially. Adjusted EBITDA margin for the second quarter was 3.1% against adjusted EBITDA loss margin of 82.6% in the year-ago period. In the first quarter of 2021, adjusted EBITDA loss margin was 12%.

Total costs and expenses climbed 21.6% year over year to $1 billion in the quarter. Contribution improved more than 200% year over year to $452 million. Contribution margin increased to 59.1% from 34.6% in the year-ago period. Lyft, carrying a Zacks Rank #3 (Hold), exited the second quarter with unrestricted cash, cash equivalents and short-term investments of $2.2 billion compared with $2.25 billion at the end of 2020.

Q3 Outlook

Lyft expects revenues of $850-$860 million for the third quarter of 2021, implying a surge of 70-72% year over year and an 11-12% rise sequentially. The Zacks Consensus Estimate for the same is pegged at $912.40 million. The company’s guidance includes an estimated impact of $30-$40 million from low prices for rides and costs associated with driver bonuses and incentives. Lyft stated that if rise in demand is strong enough, it will continue to make investments in drivers.

The company anticipates contribution margin of 58.5-59% in the third quarter. Adjusted EBITDA is predicted in the band of $25-$35 million while adjusted EBITDA margin is estimated to be 3-4% in the current quarter.

With continued improvement in its operations and an expected recovery in the second half of 2021, the company hopes to achieve adjusted EBITDA profitability on a full-year basis in 2021.

Performance of Other Computer & Technology Stocks

Within the broader Computer and Technology sector, AMETEK, Inc. AME, T-Mobile US, Inc. TMUS and Carrier Global Corporation CARR recently reported earnings numbers.

AMETEK’s second-quarter 2021 adjusted earnings of $1.15 per share beat the Zacks Consensus Estimate by 3.6%. Net sales of $1.39 billion surpassed the Zacks Consensus Estimate of $1.33 billion. The stock carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

T-Mobile, carrying a Zacks Rank #3, reported second-quarter 2021 earnings of 78 cents per share, surpassing the Zacks Consensus Estimate by 26 cents. Quarterly total revenues of $19,950 million surpassed the consensus estimate of $19,391 million.

Carrier Global, carrying a Zacks Rank #2, reported second-quarter 2021 adjusted earnings of 64 cents per share, outperforming the Zacks Consensus Estimate by 14.3%. Net sales of $5.44 billion also beat the Zacks Consensus Estimate of $4.95 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMETEK, Inc. (AME) : Free Stock Analysis Report

TMobile US, Inc. (TMUS) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research