LyondellBasell (LYB) PE Technology Picked by PetroChina Again

LyondellBasell Industries N.V.’s LYB Polyethylene (PE) technology has again been licensed by PetroChina Jilin Petrochemical Company at its facility located in Jilin city of China. This new license will include LYB’s high-pressure Lupotech process technology, which will be used for a 100 kiloton per year (KTA) Autoclave and a 300 KTA Tubular line by PetroChina. Additionally, a 400 KTA Hostalen “Advanced Cascade Process” (ACP) line will be built for the production of High-Density Polyethylene (HDPE).

LYB’s vast experience in high-pressure application design makes its Lupotech process a preferred technology for EVA/LDPE plant operators. The Lupotech process’s high reliability, unmatched conversion rates and effective process of heat integration enable it to provide ongoing energy efficiency. LyondellBasell has licensed more than 15000 KTA of high-pressure LDPE technology in over 80 lines around the world.

LYB’s Hostalen ACP process is used in the pressure pipe, film and blow molding process as it provides high performance, multi-modal HDPE resins with an industry-leading stiffness/toughness balance, impact resistance and high stress cracking resistance. The PetroChina HDPE plants will commence operations using Avant Z 501 and Avant Z509-1 catalysts to produce a comprehensive range of multi-modal HDPE products.

The company enables its new licensees to take advantage of its in-house expertise of constant improvements and product development and its know-how in high-pressure design by optionally joining the Technical Service program.

The company stated its excitement about being able to license its PE technology to PetroChina, as the newly added lines will enable the latter to manufacture differentiated polyethylene resins through LYB’s state-of-the-art Lupotech technology as well as its multi-modal HDPE technology.

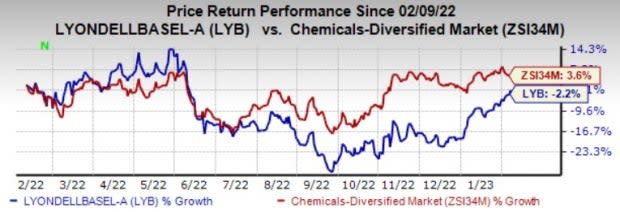

Shares of LyondellBasell have lost 2.2% in the past year against 3.6% rise of the industry.

Image Source: Zacks Investment Research

The company, in its fourth-quarter call, said that it expects the challenging economic environment to continue, at least in the first half of 2023. It noted stable demand from consumer packaging, oxyfuels and refining markets during January. While aligning its production process with global demand trends, LYB expects utilization rates for its operating assets to be 80% for its Olefins & Polyolefins and intermediates & derivatives segments. The company also sees seasonal demand improvements in 2023.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the basic materials space include Carpenter Technology Corporation CRS, Cal-Maine Foods, Inc. CALM and Clearwater Paper Corporation CLW. CALM and CLW both sport a Zacks Rank #1 (Strong Buy), while CRS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS’ shares have gained 62.3% in the past year. The company has an earnings growth rate of 203.8% for the current year. The firm outpaced Zacks Consensus Estimate in all of the last four quarters. It delivered a trailing four-quarter earnings surprise of 33.6% on average.

Cal-Maine’s shares have gained 29.3% in the past year. The company has an earnings growth rate of 417.7% for the current year. The Zacks Consensus Estimate for CALM’s current-year earnings has been revised 73.8% upward in the past 60 days.

The company topped Zacks Consensus Estimate in three of the last fourth quarters. It delivered a trailing four-quarter earnings surprise of 15.3% on average.

CLW’s shares have gained 21% in the past year. The company has an earnings growth rate of 278.6% for the current year.

Clearwater Paper beat Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 13% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Clearwater Paper Corporation (CLW) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report