M&T Bank (MTB) Q4 Earnings & Revenues Surpass Estimates

M&T Bank Corporation MTB has reported net operating earnings per share of $3.50 in fourth-quarter 2021, surpassing the Zacks Consensus Estimate of $3.29. The bottom line however compares unfavorably with the $3.54 per share reported in the year-ago period.

A rise in non-interest income and recapture of provisions were tailwinds. Further, results highlight the company’s strong capital position during the quarter. However, a fall in net interest income (NII), net interest margin, and a rise in expenses were the key undermining factors.

Net income in the reported quarter was around $458 million compared with the $471.1 million recorded in the prior year.

For 2021, net operating earnings per share were $14.11 compared with the prior-year figure of $10.02. Net income was $1.86 billion, up 37%.

Revenues Climb, Expenses Rise

M&T Bank’s quarterly revenues totaled $1.51 billion, beating the consensus mark of $1.46 billion. The reported figure increased 3.2% year over year.

In 2021, total revenues grew 4% from the prior year to $6.06 billion. The top line outpaced the Zacks Consensus Estimate of $5.95 billion.

The NII decreased 6% year over year to $933.8 million in the fourth quarter. This was due to lower outstanding average loan balances and a reduced net interest margin. The net interest margin contracted 42 basis points (bps) to 2.58%.

The company’s non-interest income was $579 million, up 5% year over year. A rise in service charges on deposit accounts, trust income and brokerage services income resulted in the upside.

Non-interest expenses totaled $928 million, flaring up 10% from the prior-year period. The upsurge mainly stemmed from higher salaries and employee benefits, outside data processing and software expenses, and FDIC assessments costs.

The efficiency ratio was 59.7%, up from 54.6% recorded in the year-earlier quarter. A higher ratio indicates a decline in profitability.

Loans and leases, net of unearned discount, were $92.9 billion at the end of the reported quarter, down marginally from the prior quarter. Nonetheless, total deposits rose 2.2% to $131.5 billion.

Credit Quality: A Mixed Bag

For M&T Bank, credit metrics were a mixed bag in the fourth quarter. The company recorded a recapture of provision for credit losses of $15 million compared with the provisions of $75 million in the year-ago quarter. Net charge-offs of loans declined 68% on a year-over-year basis to $31 million.

However, the ratio of non-accrual loans to total net loans was 2.22%, up 30 bps year over year. Non-performing assets rose 8% to $2.08 billion.

Capital Position Strong, Profitability Deteriorates

M&T Bank’s estimated ratio Common Equity Tier 1 to risk-weighted assets under regulatory capital rules was 11.4%, up from 10% as of Dec 31, 2020. Tangible equity per share was $89.80, up from $80.52 as of Dec 31, 2020.

M&T Bank's return on average tangible assets (annualized) and average tangible common shareholder equity of 1.23% and 15.98%, respectively, compared with 1.35% and 17.53% recorded in the prior-year quarter.

Our Viewpoint

M&T Bank put up a strong performance in the fourth quarter. The contraction of margins and elevated expenses were headwinds. The fall in loan balance might hurt organic growth in the days to come. Nonetheless, a sturdy business model and acquisitions poised it well for growth.

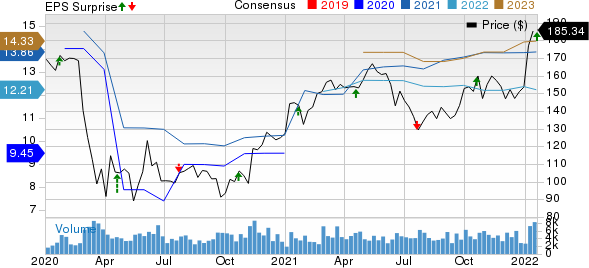

M&T Bank Corporation Price, Consensus and EPS Surprise

M&T Bank Corporation price-consensus-eps-surprise-chart | M&T Bank Corporation Quote

Currently, M&T Bank carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

First Republic Bank’s FRC fourth-quarter 2021 earnings per share of $2.02 surpassed the Zacks Consensus Estimate of $1.91. Additionally, the bottom line improved 26.3% from the year-ago quarter’s level.

FRC’s quarterly results were supported by an increase in NII and non-interest income. Moreover, First Republic’s balance-sheet position was strong in the quarter. However, higher expenses and elevated net loan charge-offs were the offsetting factors.

Citigroup Inc. C delivered an earnings surprise of 5.04% in fourth-quarter 2021. Income from continuing operations per share of $1.46 handily outpaced the Zacks Consensus Estimate of $1.39. However, the reported figure declined 24% from the prior-year quarter’s level.

Citigroup’s investment banking revenues jumped in the quarter under review, driven by equity underwriting as well as growth in advisory revenues. However, fixed-income revenues were down due to declining rates and spread products.

U.S. Bancorp USB reported fourth-quarter 2021 earnings per share of $1.07, which missed the Zacks Consensus Estimate of $1.11. Results, however, compared favorably with the prior-year quarter’s figure of 95 cents.

Though lower revenues and escalating expenses were disappointing factors, credit quality acted as a tailwind. Growth in loan and deposit balance, and a strong capital position were the encouraging factors. Moreover, U.S. Bancorp has closed the acquisition of San Francisco-based fintech firm, TravelBank, which offers technology-driven cost and travel management solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.