M&T Bank: A Strong Bet for the Long-Term Investor

- By Nathan Parsh

Regional banks have endured a very difficult 2020. The SPDR S&P Regional Banking ETF (KRE) has lost almost 14% of its value year-to-date while the S&P 500 is higher by 13%.

A significant part of this weakness is due to the increased difficulties of individuals and businesses in repaying loan obligations while facing the Covid-19 pandemic. Part of this weakness is also due to lower interest rates decreasing the net interest margins for many in the sector.

That being said, I think long-term investors who can identify quality businesses in this sector might reap significant gains in the future. One bank that might be an excellent option is M&T Bank Corporation (NYSE:MTB). The bank has been an especially poor performer in terms of stock price this year as shares are down 27%. Still, I believe the stock could be a strong long-term buy as it looks to be undervalued and pays a solid dividend yield.

Company background and historical performance

M&T Bank is a bank holding company that has more than 800 branch offices spread out over Maryland, New York, Pennsylvania and West Virginia. The bank's loan portfolio is well-diversified. Approximately 30% of the loan portfolio is made to commercial real estate, 26% to commercial, 26% to consumer and 18% to consumer real estate. M&T Bank has a current market capitalization of $15.9 billion and generated sales of $6.2 billion in 2019. The bank had total assets of almost $120 billion at the end of last year.

For the most part, M&T Bank has done an excellent job of growing revenue and earnings per share over the last 30 years:

As you can see, revenue per share has generally been higher over time. There have been a few periods of time where the top-line wasn't as strong as previous years, but growth has routinely been the norm for the bank. Revenue per share has also accelerated in recent years.

The bank's EPS had a compound annual growth rate of 9.3% from 2010 through 2019. While EPS was down considerably during the last recession, the bank has posted an improvement in EPS results every year since except 2014. This has occurred at a time where the share count has expanded by nearly 11 million. Net profit has a CAGR of more than 10% over this period of time.

Even so, M&T Bank receives a mediocre profitability rank of 5 out of 10 from GuruFocus. M&T Bank's three-year revenue growth rate of 11% is higher than almost 81% of the 1,346 companies in the banking industry. Its three-year EPS growth rate is also superior to 78% of its peers. These are both excellent figures, but the bank is hurt on net margins, which beat just 58% of peers. Return on assets is also low compared to the bank's own history.

M&T Bank scores well in some areas in terms of profitability, namely its three-year average growth rates for revenue and EPS, but comes up short in others. Despite some weakness, the bank's ability to increase its top and bottom-lines over the long-term helps to make up for short-term weakness in other areas and gives me some confidence that M&T Bank will likely to continue to grow in the future.

Dividend analysis

Unlike a lot of financials, M&T Bank didn't cut its dividend during the last recession. Following a 7.7% increase in 2008, the bank maintained its $2.80 payment until 2016. The company has raised its meaningfully in the ensuing years. An annualized dividend of $4.40 in 2020 has been increased with a CAGR of 9.5% over the last five years.

M&T Bank raised its dividend 10% for the Dec. 31, 2019 payment. Many of the large banks have not been approved to provide an increase in capital returns by the Federal Reserve in 2020 due to the unknown impact of the Covid-19 pandemic on the financial system. A raise anytime in 2020 would preserve M&T Bank's dividend growth streak.

M&T Bank receives mostly positive reviews from the GuruFocus system for its dividend and buyback ratios:

The current yield of 3.54% is almost exactly in the middle of the pack compared to peers, but is above the stock's median average of 2.5% over the last 10 years. The forward yield does top that of 60% of peers in the same industry. Where the bank really outranks its peers is in terms of buybacks. The three-year average buyback ratio is higher than 98% of M&T Bank's peer group. The bank has retired almost 20 million shares of stock since 2017.

Shares of M&T Bank have averaged a dividend yield of 2.6% since 2010. The current yield looks even better compared to the five-year average yield of 2.2%. To put it another way, the stock hasn't seen an annual average yield above 3.5% since the Great Recession.

As you can see above, M&T Bank's free cash flow per share has been very eradicate dating back all the way to the early 1990s. There are only a few periods where free cash flow didn't cover the dividend payments. And those periods were usually followed by sharp reversals to the upside for free cash flow. EPS is a little better with consistent growth leading up to the last recession followed by a nice rebound that provided more than adequate coverage for M&T Bank's dividend.

Let's look at dividend coverage over the recent term. M&T Bank has distributed $4.40 of dividends per share over the last four quarters while producing $10.14 of EPS for a payout ratio of 43%. This is higher than the average payout ratio of 36% since 2010 and would be the second highest ratio over this period of time. I am not very concerned with this payout ratio as it more than covered by EPS and the bank has demonstrated over a lengthy period of time that it can grow its bottom-line most years.

Free cash flow is a different item, but not yet in a dangerous spot. M&T Bank has distributed $640 million of dividends over the last four quarter while generating $1.07 billion of free cash flow for a payout ratio of 60%. This is more than double the average free cash flow payout ratio of 28% that M&T Bank has averaged over the three previous years.

M&T Bank doesn't have the long dividend growth streak that I am usually looking for in an investment, but I do appreciate that the bank was able to maintain its dividend during the last recession. Few large companies in the banking industry can say the same thing. Investors interested in the stock need to be aware that the company has paused its dividend for a very long time and might again in the future due to a deterioration in the economy. The EPS payout ratio is reasonable, though the free cash flow payout ratio is higher than normal, something perspective investors should keep an eye on.

Recession performance

Let's look closer at M&T Bank's performance during a difficult economic environment. Listed below are the bank's EPS results for the years before, during and after the last recession:

2006 EPS: $7.37

2007 EPS: $5.95 (19.3% decrease)

2008 EPS: $5.01 (15.8% decrease)

2009 EPS: $2.86 (42.9% decrease)

2010 EPS: $5.69 (99% increase)

2011 EPS: $6.74 (18.5% increase)

2012 EPS: $7.54 (11.9% increase)

M&T Bank's EPS began to free fall in 2007. By 2009, the bank had seen more than a 61% decline from its 2006 results. This, of course, coincided, with an extremely challenging time for the financial sector. M&T Bank did begin to see rising EPS starting in 2010, but it took until 2012 to make a new high on the bottom-line. As stated above, this began a streak of EPS growth that has only been interrupted once since. Again, what made this eventual return to growth even more impressive was the spike in the bank's share count in the middle of the last decade.

Listed below are the company's dividends paid before, during and after the last recession.

2005 dividends: $1.75

2006 dividends: $2.25 (28.6% increase)

2007 dividends: $2.60 (15.6% increase)

2008 dividends: $2.80 (7.7% increase)

2009 dividends: $2.80 (flat)

2010 dividends: $2.80 (flat)

2011 dividends: $1.64 (flat)

Heading into the recession, M&T Bank's dividend has increased at a solid rate. Then the bank maintained the same dividend for nine years before the recent streak of growth.

Valuation

M&T Bank closed Monday's trading session at $124.76. According to Yahoo Finance, analysts expect that the bank will earn $9.38 of EPS in 2020. This gives the stock a forward price-earnings ratio of 13.3, a slight premium to the 12.9 times earnings valuation that M&T Bank has averaged from 2010 through 2019.

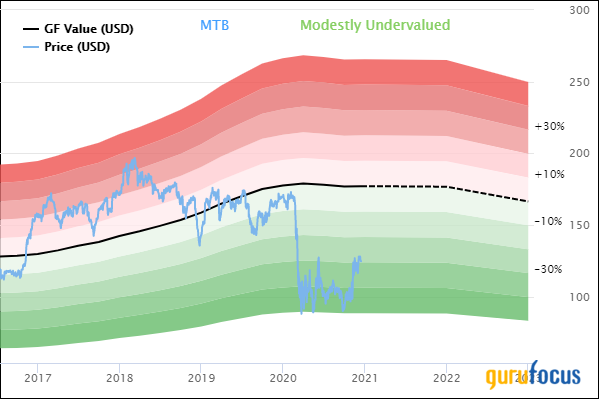

GuruFocus finds the stock to be significantly below its intrinsic value as well:

M&T Bank has a GF Value of $177.11, which is 42% higher than Monday's close. This gives the stock a price-to-GF Value of 0.70, earning M&T Bank a rating of modestly undervalued. Add in the stock's yield, which would be 2.5%, and total returns for M&T Bank could be almost 45% from the most recent price.

Final thoughts

M&T Bank's has underperformed not only the S&P 500 index by a wide margin this year, but also its own sector ETF. There are some positives for the stock, including high growth rates for both revenue per share and EPS over a long period of time. The bank also was able to maintain, if not grow, its dividend during the last recession. Shares also offer the prospect of very high returns if they were to trade with their GF Value. In the meantime, shareholders can collect a higher than usual dividend yield as they wait. Patient, long-term investors could be rewarded with outsized gains in M&T Bank, in my view.

Author disclosure: the author has no position in any stock mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.