Macau’s Gaming Market Is Booming Again

Macau's gaming industry isn't just going through a recovery -- the recovery is accelerating. Gaming revenue rose 22.1% in the month of October to $3.31 billion, its highest level in three years.

Once again, VIPs are driving the gains in Macau. The recovery has so far favored Wynn Resorts (NASDAQ: WYNN) over Las Vegas Sands (NYSE: LVS), MGM Resorts (NYSE: MGM), and Melco Resorts (NASDAQ: MLCO), but a rising tide will eventually lift all boats, and that's great news for investors.

Image source: Getty Images.

Why revenue jumped in October

October began with the Golden Week, an annual holiday that typically makes the month one of the best of the year. This year the month was even better than usual, exceeding the second best month by over 10%.

Reports from Macau were that the final week of the month, which was immediately after the 19th National Congress of the Communist Party of China, was unusually strong. Analysts at Nomura estimated that VIP revenue was up 30% for the last week, with mass market play up 9%.

Who wins in Macau's big month

When VIP play rises it helps all of Macau's gaming companies, but some more than others. Most of Wynn Macau's revenue comes from the VIP market, and as it rises and falls so do the company's fortunes. Melco Resorts is slightly less dependent on VIPs, but is still a VIP-heavy business.

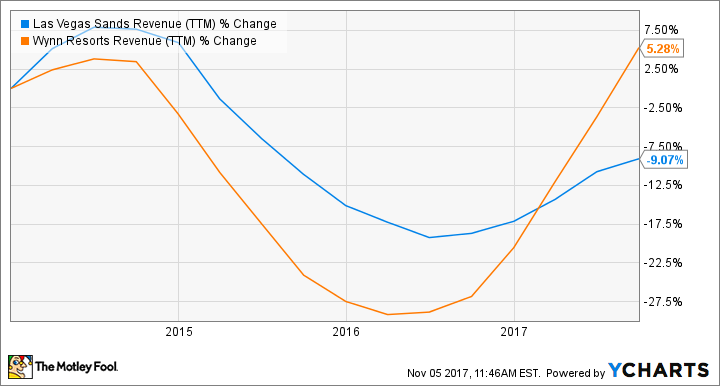

Las Vegas Sands has a business built on mass-market play, which is one reason it wasn't as affected by the drop in VIP play in recent years as Wynn or Melco Resorts. You can see this in the chart below. Wynn's revenue cratered and Macau's VIP market plunged, but Las Vegas Sands wasn't as negatively impacted. Today the opposite is true, and it's usually to Wynn's benefit.

LVS Revenue (TTM) data by YCharts

Don't bet on VIPs being there forever

What we've learned over the past decade is that Macau's VIP market is very lucrative, but also very fickle. The decline in VIP gaming that began in 2014 was driven by a corruption crackdown in China, something that investors have absolutely no control over. And this kind of policy change can go back and forth, making Macau a volatile place to invest.

Right now, Macau's VIP gaming growth is going to be a boon for Wynn Resorts, and to a lesser extent Melco Resorts, MGM Resorts, and Las Vegas Sands. It's a tide that's going to lift all boats, but investors should understand that it helps some more than others.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Travis Hoium owns shares of Wynn Resorts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.