Machinery Stock Q2 Earnings Due on Jul 31: XYL, AGCO & More

The U.S. economy holds a strong growth potential, despite facing hurdles — arising from trade tensions between the United States and other foreign nations, especially China. One of the major headwinds, which are threatening corporate margins today, is increasing costs of raw materials — mainly for steel and aluminum. On the other hand, the domestic corporates are enjoying the tailwinds arising from changes in tax policies that were implemented on last December.

Currently, the market is abuzz with earnings releases by corporates for the April-June quarter. Looking at the numbers of the S&P 500 group, results released so far gives us a rosy picture. Per our latest Earnings Preview report, roughly 53% of the group members have reported results till Jul 27. So far, earnings of the companies that already reported results have increased 23.6% year over year while revenues have expanded 10.1%. Beat was measured at 80.8% for earnings and 72.1% for revenues.

Here, we will talk about the machinery industry, broadly grouped under Industrial Products — one of the 16 Zacks sectors. We believe, the strengthening of industrial production in the United States, expanding manufacturing sector and rise in orders for U.S.-made machinery are likely to be a boon for industrial/machinery companies.

The sector has yielded 2.2% return in the two weeks ended Jul 27, the performance being mainly driven by results and projections released by industrial companies during the period. We believe important releases in this week and the next to be a major determinant in the movements of the sector.

The Industrial Products sector is one of the fourteen sectors that are expected to record positive earnings growth in the second quarter of 2018. The sector’s earnings in the second quarter are predicted to increase 28.5% year over year while revenues are anticipated to grow 11.6%.

For the S&P 500 group, earnings in the second quarter are projected to grow 23.6% year over year while revenues are anticipated to increase 8.8%.

What’s in Store for Machinery Companies: XYL, AGCO, TEX & HY?

Below, we briefly discussed the expectations from the four machinery stocks, slated to report their numbers for the second quarter.

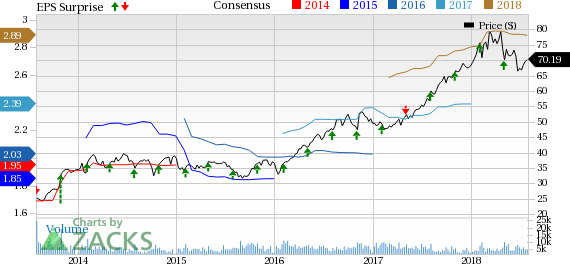

Xylem Inc. XYL: The company will release its results tomorrow, before the market opens. Xylem delivered better-than-expected results in two of the last four quarters, while reported in-line results in others. The average earnings surprise was a positive 1.27%.

Xylem Inc. Price, Consensus and EPS Surprise

Xylem Inc. Price, Consensus and EPS Surprise | Xylem Inc. Quote

Our proven model provides some idea about stocks that are about to release their earnings results. Per the model, a stock needs a combination of a positive Earnings ESP (the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate) and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Currently, Xylem carries a Zacks Rank #4 (Sell) and Earnings ESP of -0.59%. The company is dealing with adverse impacts of unfavorable revenue mix, rise in costs of inputs and expenses relating to the ongoing product-localization investments.

Over the past 60 days, the Zacks Consensus Estimate for the company’s second quarter has remained stable at 71 cents per share. (For more please read: Xylem to Report Q2 Earnings: What's in the Cards?)

Note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing a negative estimate revision momentum.

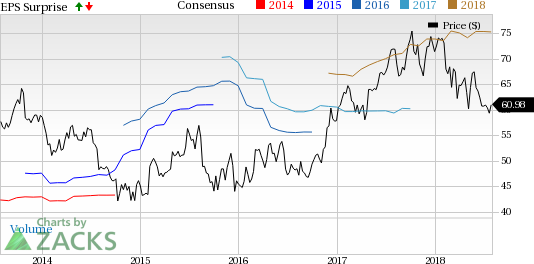

AGCO Corporation AGCO: The company will report its results tomorrow, before the market opens. It recorded better-than-expected results in three of the last four trailing quarters while lagging estimates in one. The average earnings surprise was a positive 59.40%.

AGCO Corporation Price, Consensus and EPS Surprise

AGCO Corporation Price, Consensus and EPS Surprise | AGCO Corporation Quote

Currently, AGCO Corporation carries a Zacks Rank #3. The company’s efforts to develop products and improve its business strategies as well as its solid capital-allocation plan are expected to be a boon. However, low commodity prices and rising expenses might be detrimental.

Over the past 60 days, the Zacks Consensus Estimate for the second quarter remained stable at $1.28.

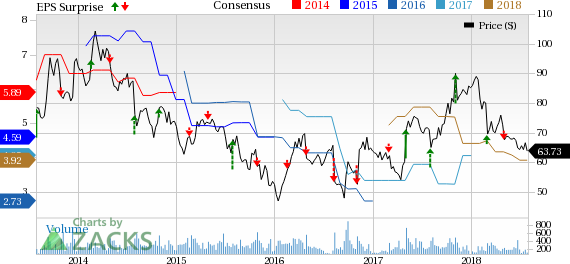

Terex Corporation TEX: The company will release its numbers tomorrow, after the market closes. It delivered better-than-expected results in the trailing four quarters, with an average positive earnings surprise of 35.24%.

Terex Corporation Price, Consensus and EPS Surprise

Terex Corporation Price, Consensus and EPS Surprise | Terex Corporation Quote

Currently, Terex carries a Zacks Rank #2. The company’s product development efforts, a stable global crane market, sound capital-allocation strategies and solid backlog will be advantageous for the company.

Over the past 60 days, the Zacks Consensus Estimate for the second quarter remained stable at 90 cents.

Hyster-Yale Materials Handling, Inc. HY: The company will release its numbers tomorrow, after the market closes. It delivered better-than-expected results in two of the trailing four quarters while lagging estimates in one and reporting in-line results in one. The average earnings surprise was a positive 17.58%.

Hyster-Yale Materials Handling, Inc. Price, Consensus and EPS Surprise

Hyster-Yale Materials Handling, Inc. Price, Consensus and EPS Surprise | Hyster-Yale Materials Handling, Inc. Quote

Currently, Hyster-Yale Materials Handling carries a Zacks Rank #4 and has an Earnings ESP of 0%. Over the past 60 days, the Zacks Consensus Estimate for the company’s second quarter decreased 16.9% to 69 cents per share.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Machinery Stock Q2 Earnings Due on Jul 31: XYL, AGCO & More

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report

Hyster-Yale Materials Handling, Inc. (HY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research