Mack-Cali (CLI) Q4 FFO & Revenues Miss Estimates, NOI Declines

Mack-Cali Realty Corp’s CLI fourth-quarter 2020 core funds from operations (FFO) per share of 16 cents missed the Zacks Consensus Estimate of 24 cents. Also, the figure compares unfavorably with the year-ago quarter’s 44 cents.

Results reflect a decrease in same-store cash net operating income (NOI) for the office portfolio. Moreover, lease rate decreased in the multi-family portfolio.

Quarterly revenues of $76.6 million missed the Zacks Consensus Estimate of $105.3 million. The revenue figure was also 13.2% lower than the prior-year quarter’s number.

For 2020, Mack-Calireported core FFO per share of $1.07, down 34% year over year. Also, the figure missed the Zacks Consensus Estimate of $1.15. Total revenues of $313.6 million decreased 12.2% year over year.

Quarter in Detail

As of Dec 31, 2020, Mack-Cali’s consolidated core office properties were 78.7% leased, reflecting an increase from 78.2% as of Sep 30, 2020. Notably, the Class A suburban portfolio was leased 86.6%, while Suburban and Waterfront portfolios were leased 74.2% and 77.3%, respectively, as of the same date.

Same-store cash revenues for the office portfolio declined 1.1% and the same-store cash NOI was down 4.4% year over year.

During the reported quarter, Mack-Cali executed 10 lease deals, spanning 122,574 square feet, in the company’s core office portfolio. Three deals for 8,413 square feet were new leases, while seven leases for 114,161 square feet were lease renewals and other tenant retention transactions.

Further, Roseland, the company’s subsidiary engaged in multi-family residential operations, reported that its overall operating portfolio was 90.2% leased at the end of the quarter, contracting 70 basis points (bps) from the prior quarter’s end. The multi-family portfolio, which comprised 3,813 units, witnessed a same-store NOI decline of 32.8% from the prior-year quarter.

Portfolio Activity

During the fourth quarter, the company sold four office buildings and land in its Suburban portfolio.

Subsequent to 2020-end, it completed the sale of 100 Overlook Center for $38 million. The office property in Princeton, NJ, spans 149,600 square feet.

Balance Sheet Position

The company exited fourth-quarter 2020 with $38.1 million in cash, up from $25.6 million as of Dec 31, 2019.

Mack-Cali’s net debt to adjusted EBITDA was 15.8 X for the reported quarter compared with the prior-year quarter’s 9.7X.

Dividend Update

On Sep 30, the company announced the suspension of its dividend payments for the third and fourth quarters of 2020. The move has been taken to support its financial flexibility amid the uncertainties due to the pandemic.

Notably, the dividend suspension will enhance Mack-Cali’s financial flexibility during the pandemic. It will also help preserve the incremental capital required to support leasing initiatives at the company’s Harborside campus on the Jersey City waterfront.

Since Mack-Cali satisfied the dividend obligation on taxable income expected for 2020, the move does not affect the company’s REIT status.

Outlook

The Company provided core FFO guidance of 12-15 cents per share for first-quarter 2021. The Zacks Consensus Estimate for the same is 27 cents.

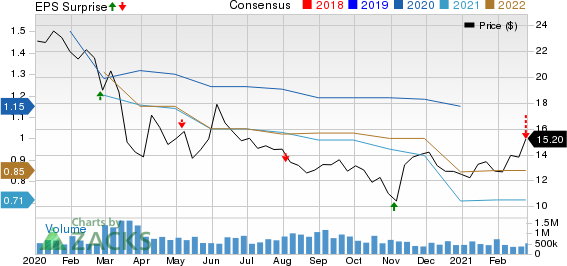

MackCali Realty Corporation Price, Consensus and EPS Surprise

MackCali Realty Corporation price-consensus-eps-surprise-chart | MackCali Realty Corporation Quote

Mack-Cali currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other REITS

Ventas, Inc. VTR reported fourth-quarter 2020 normalized FFO per share of 83 cents, surpassing the Zacks Consensus Estimate of 73 cents. However, the figure declined 10%from the year-ago quarter’s number.

American Tower Corporation AMT reported fourth-quarter 2020 adjusted FFO per share of $2.07, missing the Zacks Consensus Estimate of $2.08. Nonetheless, the reported figure improved 6.2% year over year.

Iron Mountain Incorporated IRM reported fourth-quarter 2020 adjusted FFO per share of 66 cents, which surpassed the Zacks Consensus Estimate of 60 cents. However, the reported figure was 18% lower than the year-ago quarter’s 81 cents.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

MackCali Realty Corporation (CLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research