Macy's (M) Operational Strategies Help Gain Market Share

Macy's, Inc. M operational strategies, including store revamping, loyalty program, technology enhancement and merchandise initiatives, position it well to gain market share. The company’s sustained focus on price optimization, private label offering and customer-oriented endeavors are steps toward improving sales.

Let’s Introspect

This New York based-company is benefiting from efforts undertaken as part of its Polaris Strategy, including boosting assortments, strengthening customer relations, accelerating digital growth, optimizing store portfolio and reducing costs. Macy’s has been witnessing sturdy growth for a while across all its three brands, namely Macy’s, Bloomingdale’s and Bluemercury.

Management is on track to strengthen its omni-channel capabilities with investments in online shopping experiences, data and analytics, technology infrastructure as well as better fulfillment capabilities. Macy’s’ expanded omni-channel offerings, such as curbside, store pickup and same-day delivery, bode well.

During first-quarter fiscal 2022, Macy’s digital sales increased 2% from the year-ago period. The metric surged 34% from first-quarter fiscal 2019 levels. Digital penetration was 33% of net sales in the quarter under review. This reflected a 4-percentage point contraction from the prior-year period’s level but a 9-percentage point improvement over first-quarter fiscal 2019. Approximately 61% of digital demand sales came from mobile devices. Stores fulfilled 25% of the digital sales in the quarter. We note that Macy’s app active customers increased 14% to 7.4 million.

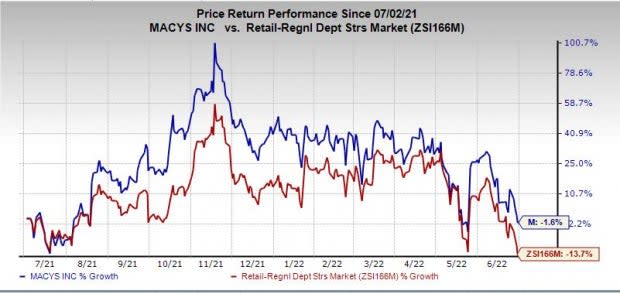

Image Source: Zacks Investment Research

Macy's came up with a host of initiatives to deliver customers a seamless shopping experience. Its tie-up with DoorDash for expediting the delivery service is yielding results. The company collaborated with Sweden-based buy-now, pay-later group Klarna to offer its online customers financial ease and payment flexibility. The company added PayPal and Venmo payment options. It is also constantly improving its mobile and website features to enhance the shopping experience.

Macy’s plans to launch a curated digital marketplace to strengthen its omnichannel retailing capabilities. The new marketplace will expand Macy’s assortment significantly and help introduce new categories and brands by enabling third-party merchants to sell products on macys.com and bloomingdales.com. To power the platform, Macy’s partnered with Mirakl, a leading enterprise marketplace technology company. The platform is anticipated to be launched in the third quarter.

Macy’s continues to invest in physical stores to support its digitally-led omnichannel business. The company is aiming for around five to 10 off-mall locations in fiscal 2022, a mix of Market by Macy’s, Freestanding Backstage, Bloomie’s and Bloomingdale’s the Outlet.

Macy's, one of the nation’s premier omnichannel retailers, currently carries a Zacks Rank #3 (Hold). The company’s shares have fallen 1.6% in the past year compared with the industry’s decline of 13.7%.

3 More Stocks Looking Red Hot

Here are three more top-ranked stocks, namely, Delta Apparel DLA, Boot Barn Holdings BOOT and G-III Apparel GIII.

Delta Apparel designs, manufactures, sources, and markets activewear and lifestyle apparel products. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Delta Apparel’s current financial year revenues and EPS suggests growth of 14.6% and 45.8%, respectively, from the year-ago reported figure. DLA has a trailing four-quarter earnings surprise of 41.1%, on average.

Boot Barn Holdings, a lifestyle retailer of western and work-related footwear, apparel and accessories, flaunts a Zacks Rank #1. BOOT has an expected EPS growth rate of 20% for three-five years.

The Zacks Consensus Estimate for Boot Barn Holdings’ current financial year sales and EPS suggests growth of 17% and 4.4%, respectively, from the year-ago period.

G-III Apparel designs, sources and markets apparel and accessories under owned, licensed and private label brands. The stock currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for G-III Apparel’s current financial year revenues and EPS suggests growth of 12.9% and 10.4%, respectively, from the year-ago reported figure. G-III Apparel has a trailing four-quarter earnings surprise of 97.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research