Magellan (MMP) Stock Barely Moves Despite Q2 Earnings Beat

Magellan Midstream Partners, L.P. MMP stock has shown insignificant performance since the company’s second-quarter 2021 earnings announcement on Jul 29.Despite this partnership’s impressive earnings and revenue results, and a solid Distributable Cash Flow (DCF) guidance for 2021, its units failed to display substantial growth due to uncertainty associated with the sale of the independent terminals network, which is pending regulatory approvals.

Behind the Earnings Headlines

Magellan Midstream reported second-quarter 2021 adjusted earnings per unit of $1.38, beating the Zacks Consensus Estimate of 95 cents and improving 112.3% from the year-ago bottom-line of 65 cents. The outperformance is attributable to better-than-anticipated contributions from its two segments. Revenues from the refined products and crude oil units totaled $489.1 million and $165.8 million each, ahead of the respective Zacks Consensus Estimate of $482 million and $141 million.

Quarterly revenues of $654 million outpaced the Zacks Consensus Estimate of $562 million and the top line rose 42.2% from the year-ago sales of $460 million.

Segmental Performance

Refined Products: Revenues of $489.1 million were up from the year-ago period’s $294.8 million.Total volumes shipped in the quarter under review were 138.9 million barrels, comparing favorably with 105.3 million barrels a year ago and the Zacks Consensus Estimate of 129 million barrels. Operating margin from the segment increased to $267.2million in the second quarter from $163.4 million in the corresponding period of 2020. Moreover, it came above the Zacks Consensus Estimate of $241 million on cost efficiencies.

Crude Oil: Quarterly revenues grossed $165.8 million, up 13.3% year over year on lower volumes shipped and softness in average tariff rates. Total volumes shipped in the quarter were 49.6 million barrels, up from 47.7 million barrels a year ago. However, the same was lower than the Zacks Consensus Estimate of 61 million. Operating margin contracted to $106.4 million from $128.3 million in the prior year and also fell below the Zacks Consensus Estimate of $122 million.

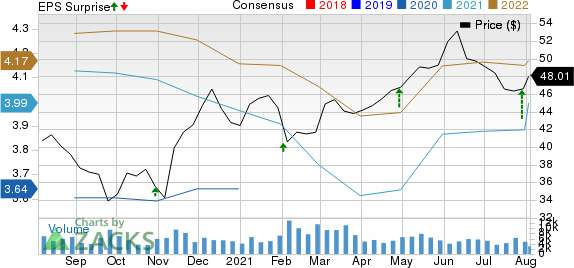

Magellan Midstream Partners, L.P. Price, Consensus and EPS Surprise

Magellan Midstream Partners, L.P. price-consensus-eps-surprise-chart | Magellan Midstream Partners, L.P. Quote

DCF & Balance Sheet

Magellan Midstream’s distributable cash flow (DCF) for the second quarter summed $268 million, rising 27.9% from the year-ago level.

On Jul 22, the firm announced second-quarter cash distribution of $1.0275 per unit ($4.11 on an annualized basis). The amount is payable Aug 13 to its unitholders of record as of Aug 6.

As of Jun 30, 2020, the firm had cash and cash equivalents worth $258 million, and a long-term debt of $5 billion.

2021 Outlook

Management reiterates its annual DCF outlook for 2021 at $1.07 billion.

For the full year, free cash flow (FCF) is expected to be $1.27 billion or $350 million after distributions, which contains proceeds from the recent sale of a partial stake in the Pasadena marine terminal joint venture.

Based on the success of projects currently underway, Magellan Midstream plans to invest $75 million in 2021 and $15 million in 2022 to complete its current array of expansion capital projects.

Zacks Rank & Key Picks

Magellan Midstream currently has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Devon Energy Corporation DVN, Matador Resources Company MTDR and Continental Resources, Inc. CLR, each presently flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research