Major Indexes Enter Bear Market: 5 Low-Beta Stock Picks

Wall Street is reeling under extreme volatility since the beginning of 2022. Investors are highly concerned about soaring inflation. Moreover, the uncertainty regarding the pace and magnitude of an interest rate hike by the Fed to contain inflation has injected severe fluctuations in day-to-day trading.

At this juncture, it will be prudent to invest in low-beta, high-dividend-paying stocks with a favorable Zacks Rank. Five such stocks are — Vistra Corp. VST, Packaging Corporation of America PKG, Reliance Steel & Aluminum Co. RS, Dell Technologies Inc. DELL and C.H. Robinson Worldwide Inc. CHRW.

Wall Street’s Mayhem Continues

On Jun 13, The Wall Street Journal reported that Fed officials are seriously considering a hike in the lending rate by 75 basis points in June to combat mounting inflation. The Fed is scheduled to meet for its next FOMC during Jun 14-15.

Fed Chairman Jerome Powell announced in the May FOMC statement that the central bank would raise the benchmark interest rate by 50 basis points in both June and July. However, a hike of a higher magnitude has been considered recently after the consumer price index (CPI) jumped 8.6% year-over-year in May compared with 8.3% in April. May’s reading was the highest since December 1981. The core CPI (excluding volatile food and energy items) climbed 6% year over year, exceeding the consensus estimate of 5.9%.

The Fed raised the Fed Fund rate by 25 basis points in March and 50 basis points in May. The central bank terminated the $120 billion per month quantitative easing program in March and started systematically reducing the size of its $9 trillion balance sheet since Jun 1. Yet, inflation data are showing no signs of abatement.

Following the news of WSJ, , the S&P 500 tanked 3.9% or 151.23 points to end at 3,749.63. The broad-market index is down 22.2% from its recent high and entered a bear market territory, for the first time since March 2020, at the onset of the pandemic. The benchmark is down 21.3% year to date.

The tech-heavy Nasdaq Composite finished at 10,809.23, sliding 4.7% or 530.80 points. The index has been in the bear market since Mar 7 and has plunged 22.2% from its recent high. The tech-laden index is down 30.9% year to date.

The Dow has tumbled 2.8% or 876.05 points to close at 30,516.74. The blue-chip index is currently 17.4% below its recent high and down 16% year to date. The index closed below its strong technical barrier of 31,000 for the first time since Feb 26, 2021.

Why Low-Beta High-Yielding Stocks?

At this stage, investment in low-beta (beta > 0 < 1) stocks with a high dividend yield and a favorable Zacks Rank may be the best option. If the market’s northbound journey is reestablished, the favorable Zacks Rank of these stocks will capture the upside potential. However, if market’s downturn continues, low-beta stocks will minimize portfolio losses and dividend payment will act as a regular income stream.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) low-beta stocks with a solid dividend yield. These companies have strong potential for the rest of 2022 and have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

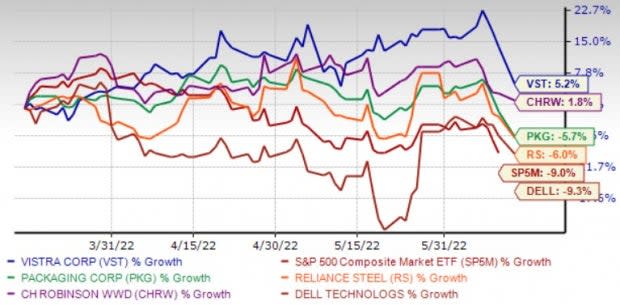

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Vistra operates as an integrated retail electricity and power generation company. VST operates through six segments: Retail, Texas, East, West, Sunset, and Asset Closure. The company retails electricity and natural gas to residential, commercial, and industrial customers across 20 states in the United States and the District of Columbia.

Zacks Rank #1 Vistra has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.2% over the last 60 days. VST has a current dividend yield of 2.67% and a beta of 0.82.

Packaging Corporation manufactures and sells containerboard and corrugated packaging products in the United States. PKG continues to benefit from robust packaging demand backed by e-commerce and rising requirement for the packaging of food, beverages and medicines.

PKG’s Packaging segment will benefit from higher corrugated products shipments with three additional shipping days. For the Paper segment, the company expects higher prices and a better mix. Packaging Corporation continues to implement price hikes that will help offset the impact of high operating costs, freight expenses and supply chain issues on margins.

Zacks Rank #1 Packaging Corporation has an expected earnings growth rate of 24.2% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.2% over the last 60 days. PKG has a current dividend yield of 2.64% and a beta of 0.76.

Reliance Steel & Aluminum is seeing a strong rebound in non-residential construction, its largest market. Demand in this market is expected to remain strong in 2022 on healthy bidding activities. RS is also witnessing steady demand in automotive and a recovery in commercial aerospace and energy.

Reliance Steel & Aluminum is expected to gain from robust demand in the majority of its end markets in 2022. It also remains focused on enhancing its operating results through the acquisition of high-margin businesses. Investments in new processing capabilities will also improve the service offerings to its customers. RS remains committed to offering incremental returns to its shareholders leveraging strong cash flows.

Zacks Rank #1 Reliance Steel & Aluminum has an expected earnings growth rate of 26.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 27.7% over the last 60 days. RS has a current dividend yield of 1.87% and a beta of 0.76.

C.H. Robinson is benefiting from favorable freight market conditions, such as increased volumes and higher pricing, amid tight capacity. CHRW’s growth-by-acquisition policy is also impressive.

To this end, in May 2021, C.H. Robinson acquired freight forwarding company Combinex Holding B.V. to strengthen its European Surface Transportation business. The acquisition not only broadens its customer base but also improves customer services by clubbing Combinex’s expertise.

Zacks Rank #2 C.H. Robinson has an expected earnings growth rate of 15.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 30 days. CHRW has a current dividend yield of 2.16% and a beta of 0.73.

Dell Technologies offers personal computers, computer hardware, and cloud and data management services. DELL’s operating segment consists of Client Solutions CS), Enterprise Solutions Group (ESG) and Dell Software Group (DSG).

The CS segment includes sales to commercial and consumer customers of desktops, thin client products, notebooks as well as services and third-party software and peripherals of Client Solutions hardware.

The ESG segment includes servers, networking and storage as well as services and third-party software and peripherals of ESG hardware. The DSG segment includes systems management, security software solutions and information management software offerings.

Zacks Rank #2 Dell Technologies has an expected earnings growth rate of 13.2% for the current year (ending January 2023). The Zacks Consensus Estimate for current-year earnings has improved 6.5% over the last 30 days. DELL has a current dividend yield of 2.69% and a beta of 0.89.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research