What Makes Citizens Financial Group, Inc. (NYSE:CFG) A Hard Investment?

As a large-cap stock with market capitalization of US$13b, Citizens Financial Group, Inc. (NYSE:CFG) is classified as a major bank. As these large financial institutions revert back to health after the Global Financial Crisis, we are seeing an increase in market confidence, and understanding of, these “too-big-to-fail” banking stocks. Following the crisis, a set of reforms termed Basel III was enforced to bolster risk management, regulation, and supervision in the financial services industry. The Basel III reforms are aimed at banking regulations to improve financial institutions’ ability to absorb shocks caused by economic stress which could expose banks to vulnerabilities. CFG operates predominantly in and is held to stringent regulation around the type and level of risk it can take on, exposing it to higher scrutiny on its risk-taking behaviour. We should we cautious when it comes to investing in financial stocks due to the various risks large banks tend to face. Today we will analyse some bank-specific metrics and take a closer look at leverage and liquidity.

View our latest analysis for Citizens Financial Group

Is CFG’s Leverage Level Appropriate?

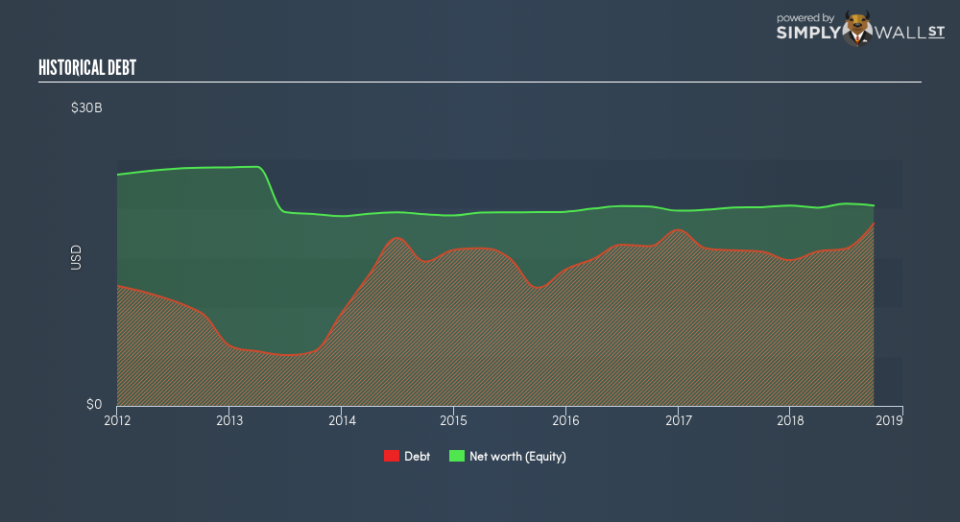

A low level of leverage subjects a bank to less risk and enhances its ability to pay back its debtors. Leverage can be thought of as the amount of assets a bank owns relative to its shareholders’ funds. Financial institutions are required to have a certain level of buffer to meet capital adequacy levels. Citizens Financial Group’s leverage level of 7.82x is significantly below the appropriate ceiling of 20x. This means the bank exhibits very strong leverage management and is well-positioned to repay its debtors in the case of any adverse events since it has an appropriately high level of equity relative to the debt it has taken on to remain in business. Should the bank need to increase its debt levels to meet capital requirements, it will have abundant headroom to do so.

What Is CFG’s Level of Liquidity?

As abovementioned, loans are quite illiquid so it is important to understand how much of these loans make up Citizens Financial Group’s total assets. Generally, they should make up less than 70% of total assets, but its current level of 72% means the bank has lent out 1.55% above the sensible upper limit. This level implies dependency on this particular asset class as a source of revenue which makes the bank more exposed to defaulting relative to banks with less loans.

Does CFG Have Liquidity Mismatch?

Banks operate by lending out its customers’ deposits as loans and charge a higher interest rate. Loans are generally fixed term which means they cannot be readily realized, yet customer deposits on the liability side must be paid on-demand and in short notice. The disparity between the immediacy of deposits compared to the illiquid nature of loans puts pressure on the bank’s financial position if an adverse event requires the bank to repay its depositors. Relative to the prudent industry loan to deposit level of 90%, Citizens Financial Group’s ratio of over 97% is higher, which places the bank in a relatively dangerous territory to go into negative discrepancy in liquidity. Essentially, for $1 of deposits with the bank, it lends out more than $0.9 which is risky.

Next Steps:

Keep in mind that a stock investment requires research on more than just its operational side. There are three pertinent factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for CFG’s future growth? Take a look at our free research report of analyst consensus for CFG’s outlook.

Valuation: What is CFG worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether CFG is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.