What makes Nvidia's chips so special during this AI boom?

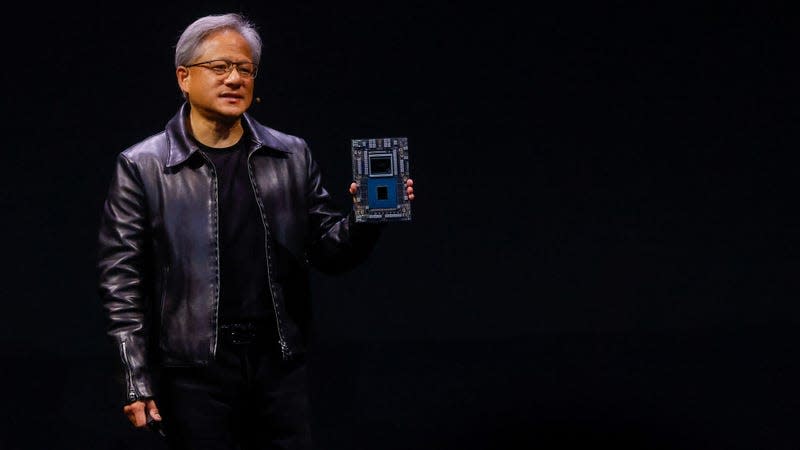

Nvidia CEO Jensen Huang.

On Tuesday (May 30), Nvidia became the first semiconductor company to (briefly) hit a $1 trillion valuation. Its stock has been rising for months, and particularly after it reported earnings last week that exceeded Wall Street’s expectations.

Amid the heated popularity of tools like ChatGPT and Bard, the generative AI industry craves Nvidia’s chips more than ever. Generative AI systems, capable of writing essays or composing emails in human-sounding prose, require vast computing power. Companies such as Google and Microsoft are racing to bake AI into their services and products. OpenAI’s ChatGPT reportedly runs on thousands of Nvidia A100 chips.

Read more

“We have procured substantially higher supply for the second half of the year,” said Colette Kress, Nvidia’s CFO, on a conference call with investors and analysts.

Why are Nvidia chips so well-suited to AI?

But what makes Nvidia’s microprocessors so highly sought after by AI companies? Part of it is because of the capabilities of their underlying technology; part of it, also, is just the virtue of being at the right place at the right time.

Nvidia, founded in 1993 by a Taiwanese-American electrical engineer named Jensen Huang, initially focused on computer graphics, said Willy Shih, a professor at Harvard Business School. Driving high-resolution graphics for PC games requires particular mathematical calculations, which are more efficiently run using a “parallel” system, Shih explained. In such a system, multiple processors simultaneously run smaller calculations that derive from a larger, more complicated problem.

In the 21st century, along came machine learning: a subset of AI that involves training algorithms to learn from data and to extrapolate from it. By chance, machine learning too is the kind of computation that requires many quick and simultaneous calculations, making it amenable to the type of parallel architecture Nvidia’s chips provided, Shih said. “They were smart,” Shih said. “They capitalized on that.”

As the number and variety of AI applications surge, running from smart devices to predictive hiring tools, the demand for chips grows. Nvidia will likely tailor future chip versions for specific uses of AI, said Shih. Last week, Nvidia revealed a host of AI-related products, including a cloud service to train generative AI models.

Nvidia’s complete ecosystem from chips to software—the latter enabling applications to take the best advantage of the chips’ computing capabilities—provides another distinctive company advantage, said Chirag Dekate, a Gartner analyst of AI infrastructures and supercomputing.

Nvidia’s AI windfall is actually a comeback story

Nvidia’s recent success is a massive turnaround for a company that, late last year, reported a 17% decline in revenue. After a pandemic boom in gaming and crypto, both industries slumped, leading to a drop in demand for Nvidia’s chips.

In a way, Nvidia is adept at positioning itself as the indispensable supplier of chips for the tech hype of the moment. In 2021, the company rolled out a specific chip for crypto miners, promising to drive crypto mining machines faster and more efficiently.

“Nvidia and its CEO are able to connect the product with communities that are rising—and have a lot of enthusiasm,” said Jens Gamperl, the CEO and founder of Sourceability, a global distributor of electric components. But alongside that canny marketing, Gamperl added, is the underlying sophistication of Nvidia’s chip technology.

Are Intel and AMD also riding the AI boom?

Nvidia’s primary rivals, among existing semiconductor companies, are Intel and Advanced Micro Devices (AMD), and their stocks have risen alongside Nivdia’s stock rally as well. Tech giants such as Google and Amazon are also developing their own chips for AI applications.

Though Intel and AMD are working on producing faster chips, they are still behind the curve, according to analysts. Intel had also started out with a general-purpose processor technology, unlike Nvidia’s specialized one for gamers.

How long will the Nvidia boom last?

Since at least the early 2000s, developers have been turning to Nvidia’s chips for AI applications. Shih, the professor at Harvard Business School, suspects that a hype cycle is also driving Nvidia’s stock now.

There has been so much interest in generative AI—to the point that the technology is being described as having an iPhone moment—that Nvidia doesn’t have to worry about demand for its microprocessors. But eventually, the increasing competition to produce AI chips will bring down Nvidia’s price advantage, said Dekate. Nvidia may be currently winning the AI boom, but the industry is developing so fast that its dominance can never be taken for granted.

More from Quartz

Sign up for Quartz's Newsletter. For the latest news, Facebook, Twitter and Instagram.