The making of Binance’s CZ: An exclusive look at the forces that shaped crypto’s most powerful founder

Changpeng Zhao is perched in front of a bookshelf at his apartment in Dubai, a place that—along with Paris—he currently calls home. Speaking over video, he is affable and mild-mannered, even self-deprecating. It's a persona that clashes with the Zhao that his rivals know best: a sharp-elbowed executive who built Binance into the biggest and most influential cryptocurrency exchange in the world.

He is used to appearing in different guises. “If Americans deal with me, they’ll feel I'm Asian—slightly more Asian than most Americans, but less Asian than all other Asians they know,” he tells Fortune. “If an Asian person deals with me, they will feel I'm very American … but less American than other Americans they deal with. So I’m kind of in-between.”

The harder-edged side of Zhao has put him under harsh scrutiny of late. Zhao and Binance got ahead by outsmarting competitors and playing fast and loose with regulations, as the founder hopscotched to whatever country offered the most favorable rules. Now governments around the world—including the United States—accuse Binance of patterns of deception and of violating international sanctions and money-laundering rules.

Binance insists it has changed its ways and is now keen about compliance; the soft-spoken, modest version of Zhao is the voice of this reformed version of the company. But Binance’s about-face raises questions about who Zhao really is and how he built his business—questions made more acute by big gaps in the public record about both Zhao’s background and Binance’s operations.

A careful study of Zhao’s background fills in many of those gaps, revealing how the Binance founder evolved to become a shape-shifter who has for years played hardball to best his business rivals while maintaining the public image of a friendly everyman. In a detailed look at his past, including interviews with those who’ve known him and extensive reviews of Chinese-language media, Fortune uncovered new insights into the two worlds that shaped Zhao’s identity: the Canada of his formative years; and China, where he returned as a “sea turtle” and rode the wave of Shanghai’s emergence at the forefront of global business during the first part of this century.

Absorbing the lessons of both places, Zhao mastered many of the cut-throat business tactics that prevailed during the wild early years of China’s tech scene, while retaining the reassuring, non-threatening affect of an average Canadian—a demeanor that deflects attention from his tactical guile.

Until recently, Zhao spoke frequently to crypto and business media, but in the last few months he has curtailed such appearances entirely—a decision based on the fraught regulatory environment and on frustration with what Binance regards as media mischaracterizations of the company and Zhao. He broke his recent silence to speak with Fortune, sharing many details of his life that haven’t been previously reported. The interview provides first-hand insight into how Zhao runs his business. It also reveals how his rise dovetailed with broader trends in the Chinese diaspora, and how a brilliant but aloof father may have influenced the emergence of Binance as the big dog of crypto.

A “bookworm” moves his family abroad

The Keremeos Court buildings are a series of neat family townhouses that are unremarkable but for their setting. Nestled in a massive rain forest of pungent cedars and ferns, the homes are part of the 2,000-acre campus of the University of British Columbia, which juts into the Pacific Ocean on the far western edge of Vancouver.

It was here that 12-year-old Zhao arrived with his mother and sister in 1989, months after the Tiananmen Square massacre took place in Beijing. They came to join his father, Shengkai, whom Zhao describes as a lifelong “bookworm.” Shengkai kept studying even after the Cultural Revolution sent him, and other intellectuals like him, to learn the value of hard labor in rural villages. But thanks to Shengkai’s academic persistence, he had landed in a doctoral program in Canada to study geophysics, bringing his family to join him at UBC several years later.

The setting was a far cry from the village of Zhao’s early childhood. In Jiangsu province, schools were scarce, and classrooms were sparse and furnished with austere stone desks—common in rural counties that lacked resources—that made the winter months of learning even colder. Like his father, Zhao learned about poverty and privation in China—but also about the escape that an academic environment could provide. This came when, at the age of 10, his family left the village and moved to Hefei, a minor city in China but also home to a prominent science and technology university that enjoyed a rare degree of autonomy from the Communist Party.

In this intellectual oasis, Zhao would sit and listen to debates between older students who would sometimes indulge him in strategy games. “Those guys they taught me how to play chess, how to play Go. They talked about different things on campus, even to the point where they were talking about politics,” Zhao recalls. “I think hanging out with people who are like seven to ten years older than you does [make] you think about things slightly differently, compared to kids your age.”

When Zhao’s family arrived in British Columbia, it meant moving from one of the world’s most ancient civilizations to one of its youngest ones. When Vancouver was founded in the 1870s, few people besides First Nations communities had stepped foot there. The city quickly became a gateway connecting the flow of goods and people from China to Canada—and, for decades, was a stronghold of anti-Chinese racism. Manifestations of that bias included the notorious “head tax,” which discouraged Chinese men from bringing their wives to Canada even as they built the country’s railroads and much of the city of Vancouver. “Even though there were always Chinese [in Vancouver], they lived under the stairs like Harry Potter,” says Henry Yu, a historian and scholar of Chinese migration at UBC. “They were servants—not homeowners.”

By the 1980s, though, the government had changed its tune completely. Canada, seeking to rev up and diversify its natural-resources-based economy, sought to attract the same migrants from across the Pacific it had once disdained. The plan included offering visas to those who invested C$400,000, and luring academics like Zhao’s father. Ottawa intended to signal to ambitious Chinese that “if you want to rise in the global economy, Canada was now open for business,” says Yu.

Anti-Asian sentiment still lingered in Vancouver—jokes about Chinese drivers and the pronunciation of “fried rice” were common, and Asians could feel very unwelcome in some parts of the community—but Zhao did not encounter racism often. The high school he attended was composed of students of all ethnicities, most of whom had ties to the university. Still, Zhao was different from his classmates in key respects. He recalls that, even though there were dozens of other Asian students, he was one of only two from mainland China. Most of the others were from more affluent Hong Kong and Taiwan and, unlike Zhao, did not live in the modest homes reserved for graduate students and campus workers.

Zhao remembers a giant wealth disparity between his own family and other students, but also recalls distinctions within the groups of affluent Chinese-speaking arrivals. “The Hong Kong kids were more into brands, fashion brands, sports cars, etc.,” he says. “The Taiwanese guys, although all very, very clearly rich … had a more of a humble attitude, and I got along with them better. I got a lot of the humble values from the Taiwanese families.”

Today, the high valuations Binance and its BNB token enjoy mean that Zhao is worth billions, but he still projects, in public at least, the “humble values.” Unlike the more obnoxious elements of the crypto crowd—those who buy Lamborghinis they can’t drive and tell crypto skeptics to “have fun staying poor”—Zhao has never adopted a flashy persona.

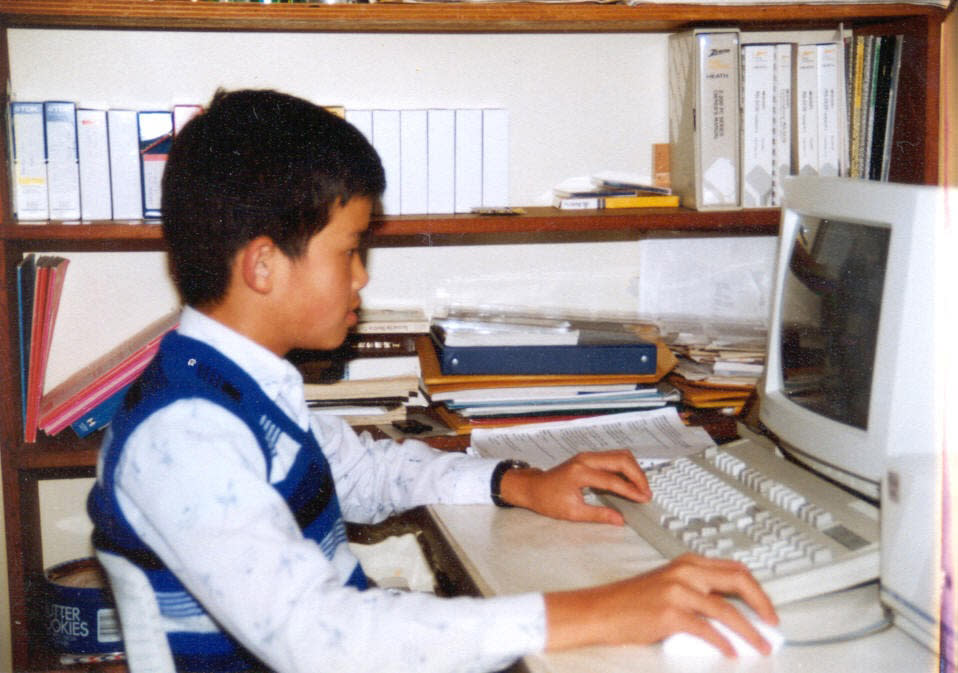

In Vancouver, while his mother worked sewing jobs and his father drove a decrepit Datsun, Zhao often got lifts in the BMWs of his friends’ parents to and from volleyball games, where he was team captain. The only splurge he recalls was his dad spending $7000 Canadian dollars—a staggering sum at the time—for an IBM-compatible 286 computer, which the senior Zhao used for his research but also to teach his son how to program. If you want to squint at Zhao’s early life for clues he would become a billionaire, this could be one. The time he spent learning coding from a parent, who others have described as a genius, was likely indispensable in Zhao’s later life, when he built the technology that would power Binance. “My father,” Zhao says, “is a mentor on the technical side.”

In high school, where some of his more affluent friends worked for kicks or because their parents wanted them to learn the rigors of a job, Zhao stood out as one of only a few students who worked to make ends meet. That included a summer of overnight shifts at Chevron gas station, and two years at McDonald’s. In his later life as a crypto baron, trolls have mocked Zhao’s stint at the fast-food chain, calling him “fry bitch.” But unlike some wealthy people from poor or modest upbringings, Zhao has never sought to distance himself from his working-class past, even retweeting memes of himself in McDonald’s garb.

https://twitter.com/binance/status/1615679282302570496

Overall, Zhao portrays his high school years as pleasant and even idyllic. He relished his four years as captain of the volleyball team and participating in Canadian national math competitions. He picked up the nickname “Champ” from a P.E. teacher. Zhao’s high school friend, Ted Lin, says the name likely caught on because many at the school struggled to pronounce “Changpeng.” Zhao only adopted his current moniker, CZ—by which he is universally known today—after entering the crypto world. Zhao says that he earlier tried going by “CP,” but ditched the name after online pals told him it was shorthand for “child porn” on the illegal marketplace Silk Road.

Despite his affinity for Vancouver—where he says he would like to retire—and Canada, Zhao’s professed affection is belied by some of his actions. He admits he has not stepped foot in the city for years, and he has no active ties there in the form of either family or philanthropy. Nonetheless, Zhao maintains he is Canadian not just by his passport, but by disposition. “I think like a Canadian,” he says. “We are nice people. Not aggressive. Not overly competitive and generally want to help others.”

The words are a warm testament to the country where he grew up—but are also hard to square with the achievements that made him CZ, the billionaire crypto king.

A life-changing encounter with a best-seller

As of early April, Zhao sat at number 46 on Bloomberg’s billionaires list, with a net worth of $29 billion (Zhao describes that figure as "not accurate; it's hard to estimate with all the fluctuations"). And his name was in the news on a daily basis. Last fall, many media accounts focused on his bold crypto trade that sank his rival, Sam Bankman-Fried, at FTX; more recent stories have examined the mounting clashes between Binance and regulators over Zhao’s own fast-and-loose business dealings. But while a lot of future rule-breaking tech entrepreneurs show off their audacious, defiant traits in their college years—think Mark Zuckerberg as portrayed in The Social Network—that doesn’t seem to have been the case with Zhao.

After finishing high school in 1995, Zhao moved 3,000 miles to attend McGill University, leaving the temperate climate of Vancouver for French-speaking Montreal, a place gripped by winters so cold that large portions of downtown are connected by underground tunnels. By Zhao’s own account, he did little to distinguish himself academically or socially at McGill, though he switched majors from biology to computer science because "in high school, biology dealt with humans. In university, it was back to animals. I didn’t find interest in that.” In his free time, he went rollerblading or went out for pho with friends, and hung out late in a campus computer lab, bashing code into rudimentary Apple desktops.

Towards the end of his time of McGill, however, Zhao did publicly flash the brilliance he would later show in his professional career, co-writing a scholarly paper in 1999 about A.I.—a topic that only became sexy 20 years later—with his professor, Jeremy Cooperstock. Sitting in a Montreal coffee shop, Cooperstock says he remembers Zhao well, in part because he was the only undergraduate student in his graduate seminar. “He told me, ‘It’s not good pay but it’s good experience,’” Cooperstock recollects. The professor added that he recalls Zhao as a personable guy who was highly intelligent—but that he was surprised years later to discover his former student had become a billionaire.

During this time, Zhao says, he read something that changed his life. It wasn’t an academic treatise, nor a man-versus-the-state screed like Atlas Shrugged, a favorite in the crypto-bro canon. Instead, it was a quintessentially middle class, everyman selection: Rich Dad Poor Dad. Published in 1997, the perennial personal-finance best-seller uses parables to tell the story of two fathers—one who works hard his whole life and has little to show for it, and another who gets wealthy as an entrepreneur or investor. The book made Zhao question his own father’s advice. By then, Shengkai Zhao had finished his own Ph.D. and had gone to work in the private sector, where over the next two decades he would earn professional respect—but not much material wealth.

“My dad has always taught me to go work hard, you know, to get a decent job, and both my parents had that kind of mentality,” Zhao recalls. “They're not into business. After I read Rich Dad Poor Dad, I started thinking, maybe I want to own a business. It wasn't so much I have to be the CEO. But it was just creating a business that was kind of intriguing.”

As Zhao’s thoughts turned to getting wealthy, he did make a choice that tracks with Zuckerberg and other wunderkind future billionaires: he dropped out of college. In 2000, he parlayed a summer internship with the Tokyo stock exchange into a full-time gig and decided not to return to McGill. (Many press accounts state, inaccurately, that Zhao is a McGill graduate.)

His math and coding prowess soon landed him a job in another financial capital, New York City, where he developed futures-trading software for Bloomberg Trading. But four years later, even New York couldn’t compete with the allure of the hottest center of global business and Zhao moved again—to a country he had last seen over a decade before.

A ”sea turtle” learns new rules in Shanghai

Shanghai, on China’s prosperous southeastern coast, was the “head of the locomotive” driving China’s economic engine at the time, says Miu Chung Yan, a social work professor at UBC who studies Chinese migration. In 2005, the year that Zhao moved to Shanghai, the city became the third-busiest container-shipping port in the world, just behind Hong Kong and Singapore; it also posted an 11% GDP, increase for its fourteenth straight year of growth. China was on the upswing and Shanghai was at the center of it all.

Critically, Zhao’s early years in Shanghai coincided with China’s golden era of tech, a time

when the nation’s homegrown technology companies and free-wheeling entrepreneurs were making their meteoric ascent. Robin Li, Jack Ma, and Pony Ma—the founders, respectively, of Baidu, Alibaba, and Tencent—had launched their companies at the start of the millennium and were experiencing exponential investment and growth.

“I was taught to go where the growth is, not… where things are already established,” Zhao says.

He was hardly the only young Canadian who had returned to Shanghai. A severe economic downturn in Canada during the 1990s helped spur a reverse migration that surged in the mid-2000s. Returnees like Zhao became known as “sea turtles”—a Chinese pun denoting individuals who migrated abroad but returned home to China. One study estimates that, by 2017, nearly half a million sea turtles had arrived from Canada and the rest of the world.

The timing for Zhao and others like him couldn’t have been better. He and other young professionals held “all the advantages” of returning to China for work, Yan says. English-speaking, western-educated, and well-versed in Chinese language and culture, sea turtles were well-received in China and received outsized wages compared to their local peers.

But even as he landed in a city eager to receive him, and where he spoke the language, Zhao claims it was difficult to navigate China’s faster, fiercer, free-wheeling business environment, where vague rules and regulations were the norm. “I didn’t know the business culture and had to learn everything from scratch,” he recalls. After stints in New York, Tokyo, and Vancouver, where rule-based corporations and ideals of egalitarianism prevailed, the critical importance of nurturing “guanxi”—a person’s connections, particularly with state officials who could act as patrons—seemed foreign to Zhao. So did alcohol’s special role in cultivating these business relationships. Baijiu, a strong Chinese liquor, is often served during business negotiations to signify goodwill and respect.

“I’d read about it, I’d heard about it,” he says. “But you know, when you actually do business, you sit down at a dinner with government officials, they drink baijiu…the way they talk about guanxi and sometimes other things you have to take care of, those things are very foreign to me, so I was never very comfortable with that.”

Still, Zhao quickly prospered in Shanghai. In 2005, he and four other expats founded Fusion Systems, a software-as-a-service (SaaS) firm that provided high-frequency trading systems and inked deals with the world’s biggest banks, including Goldman Sachs and Credit Suisse. During this time, he learned the rules quickly—that in China, as he puts it, the rules are “deliberately unclear,” which gives the government great power in interpreting and selective enforcement of laws. The newly minted entrepreneur flexed his math and coding skills, but his role at the company also taught him how to “think like a salesperson,” as he leveraged his sea turtle identity to act as a broker between the east and the west. As a junior partner and the only “Chinese-looking guy… in a Chinese environment,” Zhao was always thinking “how do I sell the company services? How [are we] going to get the next contract?”

Then—as CZ lore goes—a late-night poker game in 2013 changed the trajectory of his life. At the game, China’s top Bitcoin evangelist Bobby Lee and U.S.-educated Chinese venture capitalist Ron Cao introduced Zhao to cryptocurrencies. Zhao went all in. He sold his Shanghai apartment and invested $1 million into Bitcoin. The future billionaire left Fusion Systems and first joined crypto startup Blockchain.info—which in its early days functioned as a website tracking Bitcoin transactions—as head of technology. One year later, he was hired as the chief technology officer for Chinese exchange and token startup OKCoin.

OKCoin was the battleground where Zhao sharpened his credentials as a swashbuckling public crypto figure, unafraid to engage in open warfare. At first, Zhao engaged the public on platforms like Reddit—something few CTOs were doing—using those forums to politely, but firmly, rebuff criticisms of OKCoin and crypto. But eight months in, in 2015, Zhao clashed with company CEO Star Xu over the direction of OKCoin. Zhao left the company, and he turned to the same platforms to rescind his earlier claims and blast his former employer.

In one 1,600-word Reddit post, Zhao detailed the company’s use of bots to boost trading volumes, fake proof-of-reserves, and opaque financials, all under the direction of Xu. Xu, in turn, accused Zhao of fabricating his academic credentials and committing other deceitful acts. The spat eventually died down, but it showed Zhao’s willingness to throw sharp elbows in a dispute—while also helping to put the emerging crypto industry on the radar of distrustful regulators in China.

Zhao would court controversy and push boundaries even further with his next venture,Bijie Technology, another SaaS firm that provided software for exchanges and trading platforms. Over the next two years, Bijie’s technology would become the bedrock for 30 such Chinese exchanges—and later, it would go on to power Binance.

Trouble soon loomed, however, as most of the exchanges powered by Zhao’s technology dealt in “youbika”—stamps from China’s imperial times and revolutionary era that became the object of a tulip-style mania. As the youbika frenzy grew, stamp-trading online exchanges—and dubious sellers—began sprouting up seemingly overnight. So-called “stamp teachers” and “wealth consultants” lured unwitting investors into joining investment chats on messaging platforms like QQ and WeChat, where they’d advise them to buy shares of stamps and collectibles via digital exchanges on the promise of outsized returns. But many were pump-and-dump schemes. Ordinary investors—especially elderly Chinese—lost hundreds of millions of yuan, with some losing the entirety of their pension funds, according to a 2016 investigation by Chinese state-owned paper the Securities Times.

Zhao had no direct connection to the stamp scams, but his technology arguably helped drive their explosion. What’s more, the rampant craze helped put the authorities on high alert: China’s government quickly established new rules to restrain the unencumbered growth of digital platforms that rewarded rule-breaking and risk-taking—and became more suspicious of digital financial innovation in general. In January 2017, the state ordered stamp-and-collectible exchanges to clean up or shut down; by August that year, it halted their operations. The bulk of Bijie’s clients shuttered.

Zhao’s ambitions, meanwhile, were seeking other outlets. In 2017, a massive boom in crypto prices drew millions of new investors into the space. Zhao watched the then-industry leader, San Francisco-based Coinbase, profit from it. He saw an opportunity, and he launched an exchange of his own—Binance—from Shanghai in July of that year.

In barely a year Binance—which offered a sleek trading platform, a global customer base, and little in the way of regulatory oversight—eclipsed Coinbase to become the biggest trading platform in the world. Soon after, the company would become the first exchange to launch its own blockchain—a formidable technical undertaking—where customers could receive token perks for trading, and it added the ability to trade hundreds of digital assets, including coins whose origins were sketchy. Such tactics would help Binance poach customers from Coinbase and other rivals, as would the company’s policies of undercutting competitors with rock-bottom trading fees and of asking few or no questions when it came to vetting customers.

By now, Zhao had clearly internalized the faster and fiercer business norms of Asia—a set of practices that, to some, made competing against North American companies seem like relative child’s play. In the book Kings of Crypto, an Asian-American entrepreneur scoffed at media outlets that marveled at the sudden rise of Binance. “What’s happening here is arrogance and bias in favor of company that came up in a Western market,” said the entrepreneur, who asked not to be identified. “Asia’s not in Coinbase’s DNA. I see a cultural gap that’s not closable for them.”

For all its success, however, Binance was on borrowed time in China. The country first restricted banks from handling crypto transactions in 2013. In a bid to stem capital outflow, stamp out financial fraud, and maintain a tighter grip over the country’s financial system, the Chinese authorities in September 2017 banned initial coin offerings (ICOs) and began to shut down crypto exchanges. In response, Zhao oversaw a frantic but stealthy weeks-long effort to move data hosted on more than 200 Alibaba servers to those hosted by Amazon Web Services and others, outside the Great Firewall. The effort was successful and Zhao and other Binance staff decamped to Tokyo—ending Zhao’s 12-year stint as a Chinese entrepreneur.

Zhao’s power grows in exile

In some ways, exile from China served Binance’s long-term interests. Zhao and his company have long been subject to whisper campaigns by U.S.-based rivals who portray Binance as allied with the government in Beijing. Such an alliance would make Zhao’s relationships with U.S. regulators even more difficult, at a time of rising Sino-U.S. tensions. The company has been accused over the years of actively obscuring its Chinese origins and past business activities there; it disputes those allegations.

But for a company and a founder that preferred to operate without government oversight, no country was hospitable for long. Binance’s Japan stint was short-lived. In 2018, crooks used fake Google ads to trick customers into entering their Binance log-in details, and then drained their accounts. Binance was not directly responsible for the losses, but the debacle led Japanese regulators to demand the company register as an exchange—a non-starter for Zhao. Instead, Zhao decided to relocate his crypto empire to Malta, whose prime minister at the time, Joseph Muscat, was willing to welcome anything crypto, no questions asked.

The Malta period was also brief, and, rather than shop for a new headquarters, Binance declared it would now operate without one. For a while, Binance was so decentralized that Zhao appeared, for all intents and purposes, to go off the grid. In 2021, a Binance adversary sued the company in the U.S. in a dispute over the delisting of the plaintiff’s token. The plaintiff hired a private investigator to find Zhao. In a report about his findings, the P.I. said his team had made “exhaustive” efforts to track down Zhao but failed, and that he suspected Binance had hired others to obscure his past and whereabouts, making him “virtually undetectable.” Reached recently by Fortune, the P.I. confirmed that the remarks in the report were accurate. (The lawsuit was eventually dismissed.) It wasn’t until 2022 that Zhao emerged in Dubai, where there are virtually no restrictions on the trading of crypto.

Binance’s migratory ways made sense and earned Zhao praise among crypto purists fixated with decentralization. Unsurprisingly, they displeased regulators in most other countries, who have come to regard Binance as a lawless, off-shore casino. And not without reason. In the last three years, it has emerged that Binance has engaged in a series of acts that are ethically dubious or possibly outright criminal. These include loose know-your-customer controls that have allowed figures in Iran to trade on Binance’s exchange, despite international financial sanctions against that country; as well as an unfulfilled scheme in 2018 to set up a U.S. registered subsidiary whose purpose, according to the Binance executive who proposed it, was to serve as a “regulatory sinkhole” to distract American regulators from shenanigans underway at the rest of the company.

Binance acknowledges it has engaged in questionable tactics but says it has since disavowed them. The company in February claimed it is on the verge of a sweeping settlement with the U.S. Justice Department and other regulators that will see it address past misdeeds and plot a path forward, though a recent lawsuit against Binance by another U.S. regulator, the Commodity Futures Trading Commission, has raised questions about the viability of that settlement.

The company’s professed desire to turn the page on its past has been complicated, meanwhile, by regulators’ deep mistrust of crypto in general, following the collapse of the exchange FTX, and the disgrace of its one-time golden boy founder Sam Bankman-Fried.

Even though it was his tweets that kicked in the rotten door of FTX in November, Zhao says he was surprised as everyone else to discover the extent of fraud performed by Bankman-Fried—who Zhao knew, having invested in FTX during its early days.

Zhao and Bankman-Fried were the two most dominant figures in crypto during the boom that ran from 2020 through early 2022, and there some notable parallels in their biographies. Most obviously, both are the children of academics—though Zhao’s father was only on the periphery of the university world. Bankman-Fried, by contrast, grew up as the child of two Stanford law professors who owned a fine house on campus and enjoyed life at the top of the academic pecking order.

Today, of course, the two men’s situation is very different. Bankman-Fried is still in his parents’ house as he awaits trial on a spate of fraud charges that could see him go to prison for life. Zhao, meanwhile, is now a father himself after deciding to become a parent with Binance’s co-founder Yi He, who is now the company’s chief customer officer; they have two toddler-age children together.

It's easy to imagine Zhao resenting his rival’s privilege and sense of entitlement. Bankman-Fried has taunted him on Twitter multiple times—including suggesting on Twitter, in the summer of 2022, that Zhao would be arrested if he stepped on U.S. shores. (Binance says that Zhao has visited Canada several times in recent years, including for his father’s funeral, but maintained a very low profile while doing so). But Zhao claims he feels no personal animosity towards his one-time rival.

“He just felt to me like one of those young kids who were smart, who were brilliant, but who's very aggressive,” Zhao says. He tells Fortune that he has met Bankman-Fried three to five times, and viewed him primarily as a client, since the latter’s Alameda hedge fund used Binance as a trading platform.

As of mid-April, Binance appears to have weathered the twin headwinds of a crypto market collapse in the wake of FTX’s implosion, and regulators’ increasingly aggressive attempts to go after the company. Though its finances remain a black box, blockchain data shows Binance has gained market share from rivals in recent months, and its trading volume is up—and presumably its revenue as well—due to a rebound in the price of Bitcoin and other cryptocurrencies.

Meanwhile, Zhao continues to hew to a position that he and his company are decentralized and belong to no country at all. From this perspective, he has transcended the influence of China, Canada, and everywhere else, to become a truly stateless individual.

Nonetheless, Zhao the globe-trotting crypto baron remains very much human; like the rest of us, he can never totally escape where he came from and the forces that shaped him. And in Zhao’s case, those forces may have less to do with geography than they do with family.

A father’s legacy

Zhao’s English is not perfect and, as his Twitter feed reflects, he has never mastered North American idioms—for instance, he referred to MLB umpires last year as “baseball referees.” But his humble and thoughtful affect feel very much Canadian. Over the course of a 30-minute interview, his mannerisms suggest that—despite his newer identity as a peripatetic billionaire with a pad in Dubai—a part of him is still the teenager who slung fries in a Vancouver McDonald’s thirty years ago.

Still, it is hard to pin down what drives him. Crypto in many respects remains a frontier industry, and every major participant, including long-established brands like Coinbase, has resorted to slippery tactics to gain an edge or simply to survive. Binance, notwithstanding its recent pledges to walk the straight and narrow, has probably pushed the legal envelope farther than most of its rivals.

Still, asked if he learned to bend the rules while growing up in Vancouver, Zhao rejects the premise of the question. “I was always a fairly close, rule-abiding citizen … My personality is always conservative, as much as people may not think that way,” says Zhao. But he suggests that crypto’s culture changed his outlook: “Then you find out, okay, this new thing has different rules in different places. So it's not so much that we want to bend the rules or even avoid them, we just want to look for places that are more favorable.”

The argument is in some ways persuasive, but also feels tailored for Binance’s self-interest. Zhao has clearly been able to find the places where the rules—or the absence of rules—serve him and Binance best. That’s a stark contrast to his father, who played by a different generation’s set of rules, and never attained comparable heights.

Jean Legault, a geophysicist at the Ontario firm GeoTech, hired Shengkai Zhao on shining recommendations from industry bigwigs; he managed Shengkai for six years in the 2010s. During that time, Legault remembers the senior Zhao as an exceptional geophysicist and extraordinary technical mind. Shengkai crafted original code that allowed GeoTech to use software to create 3D inversions of geophysical data, an invaluable tool for miners and engineers; the company still uses his user manual today. Legault adds that he has “since asked other, extremely knowledgeable, Ph.D. geophysicists to do the same work. They could never replicate it. Shengkai was that exceptional.”

Legault believes that Shengkai, who lived for his work, could have reached high pinnacles of the academic or business world—but that he was perhaps restrained by his humble demeanor. Shengkai never boasted about his knowledge or accomplishments, Legault says. Changpeng agrees: the younger Zhao tells Fortune that his father, who began his career in the Cultural Revolution era and struggled with English, “never had exposure to doing business. He couldn’t commercialize… the problems he was able to solve. So he never really made a lot of money.”

Zhao recalls watching his father work from morning to evening investigating complex math equations, in his lab or at his desktop. But despite this brilliance, historical forces and the social dynamics of migration meant that Shengkai Zhao would only toil at the margins of academia, and never enjoy the prestige or fame he could have won if he had been born in a different time or place.

His son’s life would also be shaped by historical forces—new ones that favored a young Chinese emigré to Canada. Zhao’s Binance empire, then, may be an attempt to fulfill a destiny his father could never have.

Or it could be the opposite—a decision to push away from a father who was brilliant but remote. Shengkai died last year of leukemia; in remembering him, Zhao’s voice takes on a regretful tone as he remembers his own teenage years. “My dad spent all his days in his lab or his computer, and he never came to a single game volleyball game that I was playing. I was playing as team captain. I was playing multiple games twice a week, my parents never came to watch a single game.”

What the richer dad and the poorer dad share, perhaps, is a single-mindedness about work. And even for a billionaire, that quality comes with a cost. Zhao worries that in his own role as a father, he may be emulating what he describes as a “neglectful” quality in his own parent. “I do have that trait,” he says.

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

This is how much money you need to earn annually to comfortably buy a $600,000 home