Manitowoc (MTW) Q4 Earnings Beat Estimates, Revenues Lag

The Manitowoc Company, Inc. MTW reported fourth-quarter 2020 adjusted earnings per share of 19 cents, which beat the Zacks Consensus Estimate of 10 cents. However, the bottom line figure plunged 46% year over year.

Including one-time items, the company reported earnings per share of 5 cents in the quarter compared with 26 cents in the prior-year quarter.

Manitowoc’s revenues declined 7% to $430 million from the prior-year quarter figure of $463 million. The top line missed the Zacks Consensus Estimate of $433 million.

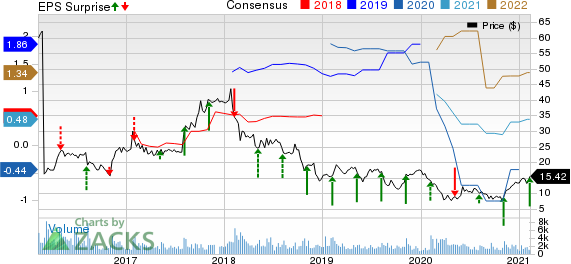

The Manitowoc Company, Inc. Price, Consensus and EPS Surprise

The Manitowoc Company, Inc. price-consensus-eps-surprise-chart | The Manitowoc Company, Inc. Quote

Orders in the fourth quarter improved 8% year over year to around $509 million. Backlog as of the end of the reported quarter was $543 million, up 14% from the year-ago quarter’s end.

Operational Update

Cost of sales declined 8% year over year to $352 million in the reported quarter. Gross profit decreased 3% year over year to $78 million. Gross margin came in at 18.1%, reflecting an expansion of 80 basis point year over year.

Adjusted engineering, selling and administrative expenses fell 8% year over year to $53.7 million. Adjusted operating income was $24.2 million in the quarter, up from $22.18 million in the prior-year quarter. Adjusted operating margin in the reported quarter was 5.6% compared with 4.8% in the year-ago quarter. Adjusted EBITDA in the reported quarter was $34.2 million, up from $30.9 million in fourth-quarter 2019.

Financial Updates

Manitowoc reported cash and cash equivalents of $129 million as of Dec 31, 2020, down from $199 million as of Dec 31, 2019. Long-term debt was $300 million as of Dec 31, 2020, compared with $308 million as of Dec 31, 2019. The company used $35 million of cash in operating activities in 2020 compared with cash utilization of $53 million in the prior year.

2020 Performance

Manitowoc reported adjusted loss per share of 35 cents for 2020, which came in narrower than the Zacks Consensus Estimate of a loss per share of 44 cents. The company had reported adjusted earnings per share of $1.89 in 2019. Including one-time items, loss per share was 55 cents against an earnings per share of $1.31 in 2019.

Sales slumped 21% year over year to $1.4 billion from the prior-year figure of $1.8 billion. The top line matched the Zacks Consensus Estimate.

Although there has been improvement in order levels, the company noted there still remains significant amount of uncertainty in its end markets, growing material cost inflation, a weakening dollar, and a less favorable product mix. The company has refrained from providing guidance for 2021. The company meanwhile continues to look for acquisition opportunities and accelerate product development in its all-terrain product line. It also plans to scale-up its Chinese tower crane business and grow tower crane rental fleet in Europe.

Share Price Performance

Over the past year, Manitowoc’s shares have gained 21%, against the industry’s rally of 44.4%.

Zacks Rank and Other Stocks to Consider

Manitowoc currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the Industrial Products sector include AGCO Corporation AGCO, Avery Dennison Corporation AVY and AptarGroup, Inc. ATR. While AGCO Corporation currently sports a Zacks Rank #1, Avery Dennison and AptarGroup carry a Zacks Rank of 2.

AGCO Corporation has a projected earnings growth rate of 11.4% for the current year. Shares of the company have soared 83% over the past year.

Avery Dennison has an estimated earnings growth rate of 8.8% for 2021. The company’s shares have rallied 28% in a year’s time.

AptarGroup has an expected earnings growth rate of 14.4% for the ongoing year. Over the past year, the stock has appreciated 23%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research