How Many Insiders Sold First Financial Bancorp. (NASDAQ:FFBC) Shares?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we’d be remiss not to mention that insider sales have been known to precede tough periods for a business. So we’ll take a look at whether insiders have been buying or selling shares in First Financial Bancorp. (NASDAQ:FFBC).

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

We don’t think shareholders should simply follow insider transactions. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that ‘insider purchases earn abnormal returns of more than 6% per year.’

Check out our latest analysis for First Financial Bancorp

The Last 12 Months Of Insider Transactions At First Financial Bancorp

Executive Chairman of the Board Claude Davis made the biggest insider sale in the last 12 months. That single transaction was for US$1.1m worth of shares at a price of US$32.27 each. So what is clear is that an insider saw fit to sell at around the current price of US$26.99. They might be selling for a variety of reasons, but it’s hard to argue this is a bullish sign. We usually pause to reflect on the potential that a stock has a high valuation, if insiders have been selling at around the current price.

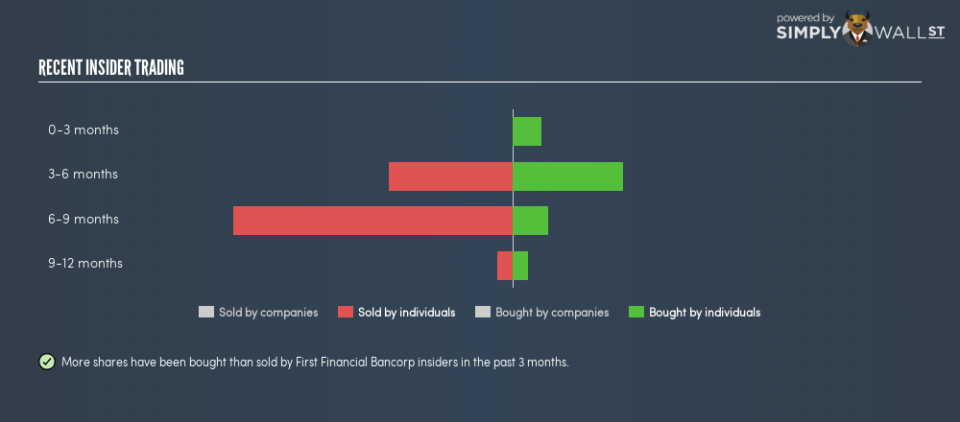

Happily, we note that in the last year insiders paid US$651k for 24.29k shares. But they sold 53.70k for US$1.7m. All up, insiders sold more shares in First Financial Bancorp than they bought, over the last year. The average sell price was around US$32.00. It’s not too encouraging to see that insiders have sold at below the current price. Of course, the sales could be motivated for a multitude of reasons, so we shouldn’t jump to conclusions. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insiders at First Financial Bancorp Have Bought Stock Recently

It’s good to see that First Financial Bancorp insiders have made notable investments in the company’s shares. Not only was there no selling that we can see, but they collectively bought US$88k worth of shares. This makes one think the business has some good points.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. I reckon it’s a good sign if insiders own a significant number of shares in the company. First Financial Bancorp insiders own about US$60m worth of shares. That equates to 2.3% of the company. We’ve certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The First Financial Bancorp Insider Transactions Indicate?

It’s certainly positive to see the recent insider purchases. However, the longer term transactions are not so encouraging. The more recent transactions are a positive, but First Financial Bancorp insiders haven’t shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. In short they are likely aligned with shareholders. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for First Financial Bancorp.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.