How Many Pembina Pipeline Corporation (TSE:PPL) Shares Did Insiders Buy, In The Last Year?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Pembina Pipeline Corporation (TSE:PPL), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Pembina Pipeline

The Last 12 Months Of Insider Transactions At Pembina Pipeline

Over the last year, we can see that the biggest insider sale was by the President, Michael Dilger, for CA$826k worth of shares, at about CA$16.51 per share. That means that even when the share price was below the current price of CA$34.08, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 20% of Michael Dilger's stake. Notably Michael Dilger was also the biggest buyer, having purchased CA$2.7m worth of shares.

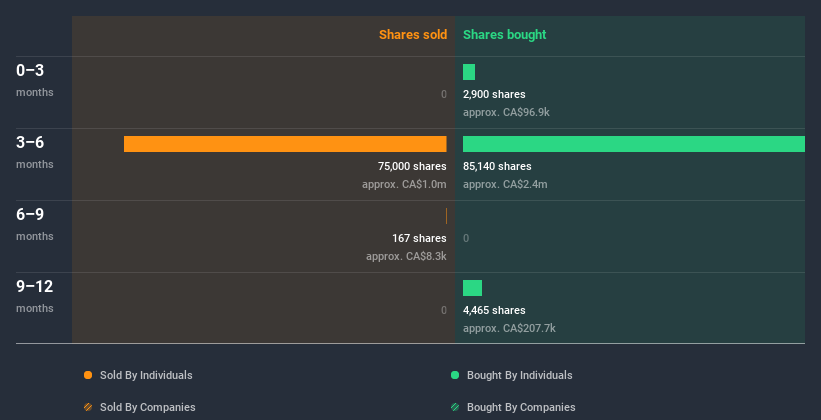

Over the last year, we can see that insiders have bought 92.51k shares worth CA$2.7m. But insiders sold 75.17k shares worth CA$1.1m. In the last twelve months there was more buying than selling by Pembina Pipeline insiders. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Pembina Pipeline is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at Pembina Pipeline Have Bought Stock Recently

Over the last quarter, Pembina Pipeline insiders have spent a meaningful amount on shares. Overall, two insiders shelled out CA$96k for shares in the company -- and none sold. This makes one think the business has some good points.

Does Pembina Pipeline Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Insiders own 0.1% of Pembina Pipeline shares, worth about CA$24m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Pembina Pipeline Insider Transactions Indicate?

It is good to see recent purchasing. We also take confidence from the longer term picture of insider transactions. Insiders likely see value in Pembina Pipeline shares, given these transactions (along with notable insider ownership of the company). In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Pembina Pipeline. Case in point: We've spotted 3 warning signs for Pembina Pipeline you should be aware of, and 1 of these can't be ignored.

Of course Pembina Pipeline may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.