Marathon (MPC) Q4 Loss Narrower Than Expected, Sales Beat

Independent oil refiner and marketer Marathon Petroleum Corporation MPC reported adjusted loss of 94 cents per share, narrower than the Zacks Consensus Estimate of a loss of $1.42. The company’s bottom line was favourably impacted by cost savings and stronger-than-expected performance from the Midstream segment. Precisely, operating income from the unit totaled $974 million, ahead of the Zacks Consensus Estimates of $964 million.

However, the bottom line compared unfavorably the year-earlier quarter's earnings of $1.56 due to sharply lower refining margins.

Marathon Petroleum reported revenues of $18.2 billion that beat the Zacks Consensus Estimate of $16.7 billion but declined 35.4% year over year.

Forced by the historic oil market crash and the coronavirus-induced demand destruction for the fuel, Marathon Petroleum more than halved its 2020 capital spending from year-ago levels to $3 billion.

Marathon Petroleum, which is progressing with the conversion of its Martinez petroleum refinery into a renewable diesel facility in response to the collapsing product demand, expects the sale of its Speedway business to Japanese retail group Seven & i Holdings to conclude by Mar 31, 2021. Further, the company expects to reach peak production at its Dickinson renewable fuels facility during the same timeframe.

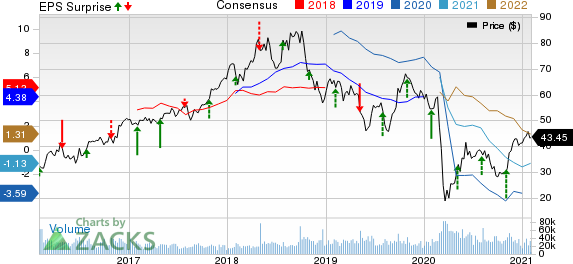

Marathon Petroleum Corporation Price, Consensus and EPS Surprise

Marathon Petroleum Corporation price-consensus-eps-surprise-chart | Marathon Petroleum Corporation Quote

Y/Y Segmental Performance

Refining & Marketing: The Refining & Marketing segment reported operating loss of $1.6 million, as against income of $1.1 billion in the year-ago quarter. The deterioration reflects lower y/y margins.

Specifically, refining margin of $7.42 per barrel decreased significantly versus $16.35 a year ago. Total refined product sales volumes were 3,223 thousand barrels per day (mbpd), down from the 3,750 mbpd in the year-ago quarter. Moreover, throughput fell from 3,069 mbpd in the year-ago quarter to 2,528 mbpd though it beat the Zacks Consensus Estimate of 2,460 mbpd. Capacity utilization during the quarter was down 12% year over year to 82%.

Midstream: This unit mainly reflects Marathon Petroleum’s general partner and majority limited partner interests in MPLX LP MPLX – a publicly traded master limited partnerships that own, operate, develop and acquire pipelines and other midstream assets.

Segment profitability was $974 million, 9.6% higher than the fourth quarter of 2019. Earnings were supported by stable, fee-based revenues, lower operating expenses, plus contribution from organic growth projects.

Costs, Capex & Balance Sheet

Marathon Petroleum reported expenses of $17.8 billion in fourth-quarter 2020, down 35.5% from the year-ago quarter.

In the reported quarter, Marathon Petroleum spent $491 million on capital programs (36% on Refining & Marketing and 41% on the Midstream segment) compared to $1.8 billion in the year-ago period. As of Dec 31, the company had cash and cash equivalents of $555 million and a total debt, including that of MPLX, of $31.7 billion, with a debt-to-capitalization ratio of 52.1%.

Zacks Rank & Stock Picks

Marathon Petroleum holds a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are PDC Energy PDCE and Royal Dutch Shell RDS.A. Both the companies sport a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PDC Energy has an expected earnings growth rate of 165.9% for the current year.

Royal Dutch Shell has an expected earnings growth rate of 161.6% for the current year

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research