Marathon Petroleum (MPC) to Post Q2 Earnings: What's in Store?

Marathon Petroleum Corporation MPC is set to release second-quarter 2021 results on Wednesday Aug 4, before the opening bell.

The Zacks Consensus Estimate for the to-be-reported quarter’s profit is 45 cents per share and for revenues is $17.31 billion.

Against this backdrop, let’s consider the factors that are likely to impact the company’s June-quarter results.

Factors to Consider for Q2 Results

Marathon Petroleum’s midstream unit, which mainly represents its general partner and majority limited partner interests in MPLX LP MPLX, saw a profitability of $972 million in the first quarter of 2021, reflecting a 7.4% increase from the year-ago quarter’s reported figure. Earnings were supported by stable, fee-based revenues, lower operating expenses and a contribution from organic growth projects, a trend that most likely continued in the second quarter of 2021 as well.

The Zacks Consensus Estimate for second-quarter Midstream segment’s profitability is pegged at $949 million, hinting at an improvement of 9.2% from $869 million reported in the year-ago period.

Based on regional demand, the company projects total throughput volumes for the second quarter to be 2.7 million barrels per day, suggesting a modest improvement from the sequential quarter’s reported figure.

On the flip side, the economic disruption caused by the coronavirus outbreak and the resultant shrinking demand for refined products and transportation fuels are likely to have hurt the second-quarter earnings and cash flows of Marathon Petroleum. As a result of this bleak business environment, the Zacks Consensus Estimate for the company’s second-quarter refined product yields for Asphalt is pegged at 66 thousand barrels per day (mbpd), indicating a decline from the year-ago quarter’s reported figure of 76 mbpd.

What Does Our Model Say?

Our proven model does not conclusively predict an earnings beat for Marathon Petroleum this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Marathon Petroleum has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 45 cents per share each.

Zacks Rank: Marathon Petroleum currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Highlights of Q1 Earnings & Surprise History

In the last reported quarter, this Findlay, OH-based company reported an adjusted loss of 20 cents per share, narrower than the Zacks Consensus Estimate of a loss of 72 cents. The company’s bottom line was favorably impacted by cost savings and a stronger-than-expected performance from the Midstream segment. Operating income from the unit totaled $972 million, ahead of the Zacks Consensus Estimate of $929 million.

However, the bottom line compared unfavorably with the year-earlier quarter's loss of 16 cents due to sharply lower refining margins.

Marathon Petroleum’s revenues of $22.9 billion beat the Zacks Consensus Estimate of $15.8 billion and improved 9% year over year.

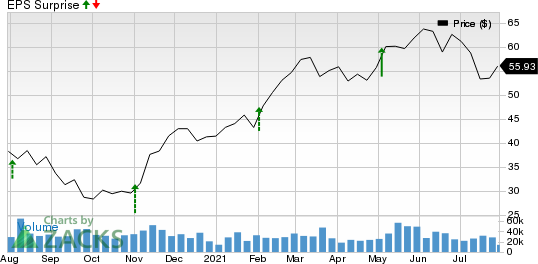

As far as its earnings surprises are concerned, the company is on a strong footing. Its bottom line exceeded the Zacks Consensus Estimate in all the trailing four quarters, the average being 44.34%. This is depicted in the graph below:

Marathon Petroleum Corporation Price and EPS Surprise

Marathon Petroleum Corporation price-eps-surprise | Marathon Petroleum Corporation Quote

Stocks to Consider

While earnings outperformance looks uncertain for Marathon Petroleum, here are some firms worth considering from the energy space on the basis of our model, which shows that these have the perfect combination of ingredients to deliver a beat this reporting cycle:

The Williams Companies, Inc. WMB has an Earnings ESP of +2.19% and a Zacks Rank #3, currently. The firm is scheduled to release earnings on Aug 2.

ProPetro Holding Corp. PUMP has an Earnings ESP of +24.21% and is a #3 Ranked player, presently. The firm is scheduled to release earnings on Aug 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research