MarineMax (HZO) Lined Up for Q2 Earnings: Factors to Note

MarineMax, Inc. HZO is likely to register an increase in the top line when it reports second-quarter fiscal 2022 numbers on Apr 28, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $537.3 million, indicating an improvement of 2.7% from the prior-year reported figure.

The bottom line of this world’s largest recreational boat and yacht retailer is expected to increase year over year. Although the Zacks Consensus Estimate for earnings per share for the quarter under review has declined by a couple cents over the past 30 days to $1.70, the figure suggests a marginal increase of 0.6% from the year-ago period.

This Clearwater, FL-based company has a trailing four-quarter earnings surprise of 55.8%, on average. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by a significant margin of 43.2%.

Factors to Note

MarineMax’s significant geographic reach, product diversification and stellar demand are likely to get reflected in the to-be-reported quarter’s top line. We note that the company has mainly been benefiting as consumers embrace and enjoy the boating lifestyle. The company’s digitization endeavors have been helping it better engage with customers.

The company’s investments in high-margin businesses such as finance, insurance, brokerage, marina and service operations bode well. Impressively, its strategic acquisitions have been playing a major role in driving the top line.

While the aforementioned factors raise optimism, we cannot ignore the ongoing supply chain issues and rising SG&A expenses. Industry experts cautioned that persistent supply chain issues may cause delivery delays.

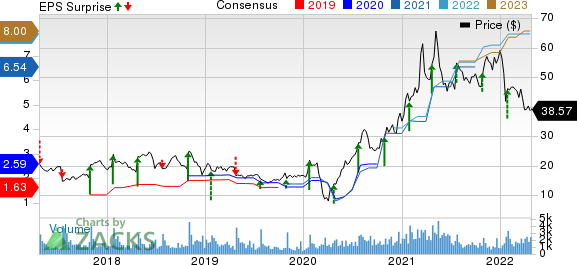

MarineMax, Inc. Price, Consensus and EPS Surprise

MarineMax, Inc. price-consensus-eps-surprise-chart | MarineMax, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for MarineMax this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

MarineMax has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Gildan Activewear GIL currently has an Earnings ESP of +10.20% and a Zacks Rank #1. The company is likely to register bottom-line improvement when it reports first-quarter 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 49 cents suggests an improvement from 48 cents reported in the year-ago quarter.

Gildan Activewear’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $656.7 billion, which indicates growth of 11.4% from the prior-year quarter. GIL has a trailing four-quarter earnings surprise of 66.6%, on average.

Costco COST currently has an Earnings ESP of +1.39% and a Zacks Rank #2. The company is likely to register bottom-line improvement when it reports third-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $3.03 suggests an improvement from $2.75 reported in the year-ago quarter.

Costco's top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $50.84 billion, which indicates an improvement of 12.3% from the figure reported in the prior-year quarter. COST has a trailing four-quarter earnings surprise of 13.3%, on average.

Designer Brands DBI currently has an Earnings ESP of +4.55% and a Zacks Rank #2. The company is likely to register an increase in the bottom line when it reports first-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 22 cents indicates an increase of 83.3% from the year-ago reported number.

Designer Brands’ top line is expected to increase year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $806.7 million, which suggests growth of 14.7% from the prior-year quarter. DBI has a trailing four-quarter earnings surprise of 112.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research