Mario Cibelli Picks Up 3 Stocks in 1st Quarter

- By Sydnee Gatewood

Marathon Partners Equity Management leader Mario Cibelli (Trades, Portfolio) disclosed three new holdings in his first-quarter portfolio, which was released last week.

The activist investor's New York-based firm, which is known for focusing on less efficient portions of the market, relies on fundamental research to find a concentrated number of long-term opportunities among undervalued stocks.

Based on these criteria, Cibelli established positions in Booking Holdings Inc. (BKNG), KAR Auction Services Inc. (KAR) and Eventbrite Inc. (EB) during the quarter.

Booking Holdings

The guru invested in 3,900 shares of Booking Holdings, dedicating 3.01% of the equity portfolio to the position. The stock traded for an average price of $1,785.18 per share during the quarter.

The Norwalk, Connecticut-based company, which operates online travel sites like Booking.com, Priceline.com and Kayak, has a $75.54 billion market cap; its shares were trading around $1,727.30 on Thursday with a price-earnings ratio of 19.86, a price-book ratio of 11.47 and a price-sales ratio of 5.70.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced.

GuruFocus rated Booking Holdings' financial strength 6 out of 10. Despite issuing approximately $1.4 billion in new long-term debt over the last three years, the company is able to manage it due to adequate interest coverage. The robust Altman Z-Score of 5.64 indicates the company is in good fiscal standing.

The company's profitability and growth fared even better, scoring a 9 out of 10 rating. In addition to an expanding operating margin, Booking Holdings is supported by strong returns that outperform a majority of competitors, consistent earnings and revenue growth and a high Piotroski F-Score of 7, which implies business conditions are stable. It also has a business predictability rank of 3.5 out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 9.3% per year.

Of the gurus invested in Booking Holdings, investment firm Dodge & Cox has the largest stake with 2.73% of outstanding shares. During the quarter, Yacktman Asset Management (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio) and the Smead Value Fund (Trades, Portfolio) established positions in the stock, while Ruane Cunniff (Trades, Portfolio), Bill Nygren (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Lee Ainslie (Trades, Portfolio), Wallace Weitz (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio) and several other gurus added to their holdings.

KAR Auction Services

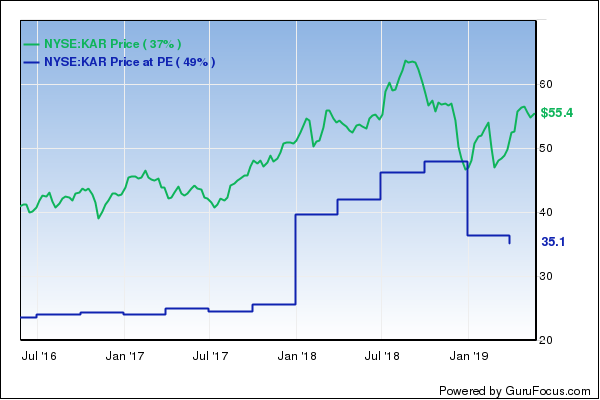

After selling out of KAR Auction Services in the second quarter of 2018, Cibelli entered a new 25,000-share holding. The trade had an impact of 0.57% on the equity portfolio. During the quarter, the stock traded for $49.89 per share on average.

Headquartered in Carmel, Indiana, the company, which provides whole car and salvage auction services, has a market cap of $7.44 billion; its shares were trading around $56.36 on Thursday with a price-earnings ratio of 23.84, a price-book ratio of 4.98 and a price-sales ratio of 1.98.

According to the Peter Lynch chart, the stock is overvalued.

Weighed down by approximately $259.1 million in new long-term debt and low interest coverage, KAR Auction's financial strength was rated 4 out of 10 by GuruFocus. Additionally, the Altman Z-Score of 1.51 warns the company is at risk of going bankrupt.

The company's profitability and growth scored a 7 out of 10 rating, driven by operating margin expansion, strong returns that outperform at least 70% of industry peers, a moderate Piotroski F-Score of 5, which suggests operations are stable, and a one-star business predictability rank. GuruFocus says companies with this rank typically see their stocks gain an average of 1.1% per year.

With 0.56% of outstanding shares, Cohen is the company's largest guru shareholder. Mario Gabelli (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Pioneer Investments (Trades, Portfolio) and Greenblatt also own the stock.

Eventbrite

The investor picked up 50,000 shares of Eventbrite, allocating 0.42% of the equity portfolio to the position. Shares traded for an average price of $28.30 during the quarter.

The event management and ticketing services website, which is headquartered in San Francisco, has a $1.30 billion market cap; its shares were trading around $16.01 on Thursday with a price-book ratio of 2.97 and a price-sales ratio of 2.95, which GuruFocus noted were near one-year lows.

Based on the price chart below, the stock has lost approximately 56% since its initial public offering on Sept. 20, 2018.

GuruFocus rated Eventbrite's financial strength 5 out of 10. While the company has a good cash-debt ratio of 5.23, its Altman Z-Score of 1.67 warns it is in danger of bankruptcy.

The company's profitability and growth fared even worse, scoring a 2 out of 10 rating on negative margins and returns that underperform at least 77% of competitors.

Chase Coleman (Trades, Portfolio) is Eventbrite's largest guru shareholder with a 17.44% stake. Jones also took a position in the stock during the quarter, while Jeremy Grantham (Trades, Portfolio) and Cohen added to their holdings. Frank Sands (Trades, Portfolio) also owns the stock.

Additional trades and portfolio composition

During the quarter, Cibelli also added to his holdings of Gildan Activewear Inc. (GIL), e.l.f. Beauty Inc. (ELF), J. Alexander's Holdings Inc. (JAX), Cott Corp. (COT) and Grubhub Inc. (GRUB).

The guru's $226.06 million equity portfolio is composed of 18 stocks. At 37.55%, the consumer defensive sector represents the largest portion of the portfolio.

Disclosure: No positions.

Read more here:

The Top 5 Buys of Steve Mandel's Lone Pine Capital

The Top 5 Buys of T Boone Pickens' BP Capital

Mariko Gordon's Top 5 Buys of the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.