Market Weekly Review: Lower Prices Create Buying Opportunities

Despite gains for U.S. stocks on Friday, the Dow Jones Industrial Average ended lower for a fifth straight week—which is the longest streak since 2011.

After a white-hot start to 2019, it’s been a wild wide for investors in the month of May. As the war of words has progressed in the trade battle between China and the U.S., price volatility has been on the increase.

Use Volatility to Your Advantage

Investors tend to shy away from volatility, which is a word that generally is only mentioned when prices are moving lower. In fact, the CBOE Volatility Index (VIX) is often referred to as the “fear gauge.”

However, seasoned investors realize that volatility can be your friend. By taking a contrarian stance and buying when prices are lower, you have an opportunity to enter positions at optimal prices and boost long-term performance.

“When you put it all together, this is a healthy time to come into the market for the long term,” said Thorne Perkin, president of Papamarkou Wellner Asset Management told CNBC on May 16. “We always look at these pullbacks as buying opportunities for the long term.”

Short Holiday Week

The U.S. markets will be closed next Monday for the Memorial Day holiday. In a short week, Costco (COST), Dell (DELL) and Gap (GPS) are all scheduled to report quarterly results next Thursday. On the economic front, we’ll also get a revision to the reading of first-quarter GDP growth next Thursday. The initial reading last month printed a solid 3.2%.

As Memorial Day signals the unofficial start of Summer, look for trading volume to be relatively low next week. With a lot of professional investors at the beach, savvy market watchers will look to take advantage of the increased volatility that can accompany light trading volume.

I know that’s the tack I will be taking with the Smart Investor portfolio next week and into the summer. Rather than shy away from any continued volatility, I’ll look to make more purchases, if the market continues to create buying opportunities.

The fact remains that attractive investments are out there, if you’re willing to dig a little deeper.

One such consumer name that’s worth a closer look is our Stock of the Week below…

Stock of the Week: Sarepta Therapeutics (SRPT)

Sarepta is a biopharmaceutical firm that’s in the business of treating rare neuromuscular diseases. The company currently has a treatment on the market for Duchenne muscular dystrophy (DMD), Exondys 51; but Sarepta is no one-trick pony. Management filed for approval of a second DMD treatment, golodirsen, in February.

We recently added SRPT to our Smart Investor portfolio and are pleased to see that shares were flat compared with another down week for the broader markets. The stock has also gained 3% in the month of May, while the S&P 500 has lost nearly 4%.

Looking ahead, these gains should keep on coming. Here’s why:

DMD is a rare, but deadly genetic disease. The U.S. Food and Drug Administration has granted Sarepta priority review status to golodirsen and will receive an approval decision by Aug. 19, because of its potential impact.

The company is not the only entrant in the DMD market, but management believes that it has at least a one-year head start on Pfizer’s (PFE) attempt to enter the arena. In total, Sarepta has a robust clinical pipeline with over 20 therapies, in various stages of research and development.

Earlier this month, the company posted quarterly results that exceeded expectations. Sarepta lost $0.75 a share in the first quarter, while revenue increased 35% from the previous year, to $87 million.

Yes, the company is losing money and consensus analyst estimates do not expect sustainable profitability until 2021. However, if Sarepta continues to deliver success in the clinical pipeline that day could come sooner and bring a considerably higher stock price along with it.

Analysts See Higher Prices Ahead

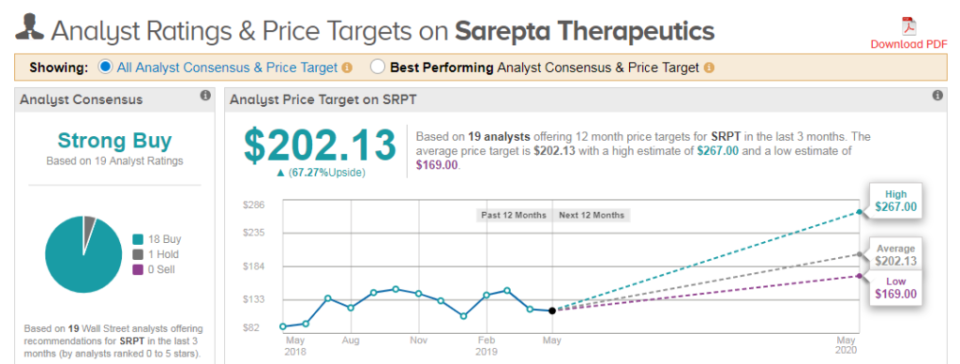

In the meantime, the analyst community is upbeat about the company’s future. 18 of 19 active analysts rate the stock a Buy (with 1 Hold) and the average price target of $202.13 suggests 67% upside potential.

Analyst Alethia Young of Cantor Fitzgerald sums up the biopharma’s outlook here: “For Sarepta, the focus remains on continued pipeline advancement and growing gene therapy manufacturing capabilities. We continue to see many transformative updates for the company over the coming months, including a potential golodirsen approval on 8/19, potential casimersen approval in 1Q2020, and PPMO data around YE19/1Q20. Key trial initiations include commercial microdystrophin by YE19 and Charcot-Marie-Tooth in 2019.”

Moreover, she adds: “We see significant revenue growth ahead with launches and also think the pipeline remains undervalued.” As a result, this top-ranked analyst reiterated her Buy rating with a bullish $231 price target on May 9. From current levels that suggests shares can surge 91%.

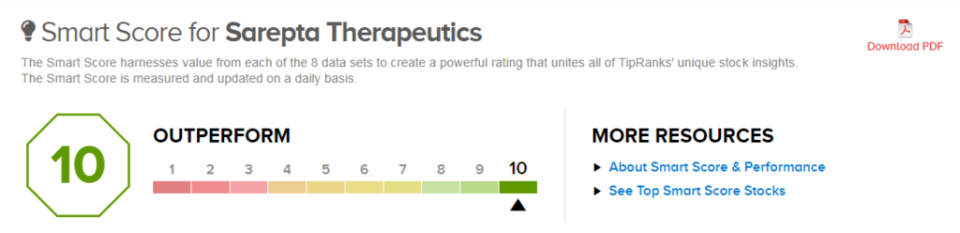

Finally, I’m encouraged to note the stock sports a Smart Score of 10/10 on TipRanks, underlining the potential for continued price momentum. This new proprietary metric utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

In addition to the catalysts mentioned above, Smart Score notes that Sarepta has positive sentiment from both hedge funds and investment bloggers.

Looking for more top-rated stocks? Check out Analysts' Top Stocks here...