MarketAxess' (MKTX) December Trading Suggests Decent Volumes

MarketAxess Holdings Inc. MKTX reported total monthly trading volume of $472.3 billion for December 2020, reflecting an improvement of 1.1% year over year. Howver, the same declined 6.3%, sequentially.

With the release of December trading volume numbers, the company’s fourth-quarter 2020 total trading volumes came in at $1.46 trillion, up 8.6% year over year. This increase is led by 8.6% and 4.3% rise in trading volumes pertaining to rates and credit products, respectively.

For the fourth quarter, this operator of a leading electronic trading platform for fixed-income securities and a provider of market data and post-trade services reported average daily volume (ADV) of $23.6 billion, which rose 12% year over year. This upside is driven by higher trading in U.S. high-grade bonds and other credit bonds.

The company’s strong volumes for the December quarter reflect its accelerating market share gains, robust credit market volumes and a global shift among dealers and investors toward fixed income trading automation.

The company also reported preliminary variable transaction fees per million (FPM) for the quarter ended Dec 31, 2020 of $187 for U.S. high-grade, $202 for other credit, $195 for total credit and $3.95 for rates, which represented a decline of 6.2%, 2.9%, 4.3% and 5.7%, respectively.

MarketAxess is steadily growing its share of U.S. credit market by virtue of its Open Trading platform. Launched in 2012, MarketAxess Open Trading is an electronic all-to-all credit trading marketplace, enabling market participants to source liquidity from a network of more than 1,100 institutional investors and dealer firms. Open Trading delivers real cost savings by ramping up trading efficiencies and vastly expanding the liquidity pool for global credit trading. This means those investors can more easily find buyers or sellers at a moment's notice.

Notably, the large fixed income market is undergoing a major structural shift owing to regulatory and market trends. The company has the leading electronic trading network for the institutional market in U.S. credit products. Even though the electronic trading market share is widening, the same is in early stages of market penetration, which provides the company with ample room to grow.

MarketAxess’ acquisition of Liquidity Edge provided an attractive entry point in the U.S. bond Treasury market. It is on course to buy MuniBrokers and Deutsche Börse Regulatory Reporting Hub. The purchase of the Regulatory Reporting Hub will further help expand MarketAxess’ post-trade reporting and pre- and post-trade data services across a broader European client base, particularly in Germany, France and the Nordics. The MuniBrokers’ buyout will broaden MarketAxess’ existing municipal bond trading solution for global institutional investors and dealer clients.

The company’s solid progress in core products, superior financial model, large and increasing addressable market, significant operating leverage and an expanded suite of electronic trading protocols poise it well for long-term growth.

However, one risk that the company may face is a decline in volatility in the credit markets and a slowdown in corporate debt. This might hurt the company’s trading volumes, eventually, eroding its revenues.

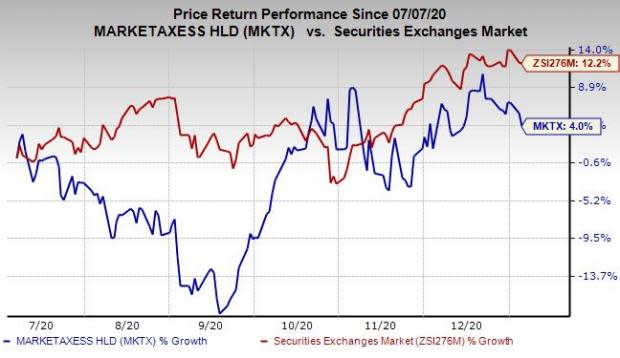

In six months’ time, the stock has gained 4% compared with its industry’s growth of 12.2%.

Other securities exchange companies in the same space, such as Intercontinental Exchange Inc. ICE, CME Group Inc. CME and Nasdaq, Inc. NDAQ have also rallied 22.7%, 8.2%and 9.6%, respectively.

The stock currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research