Markets in Correction Mode: Here's What it Means for Banks

The markets are in correction mode. This is the first time since March 2016 that all three major U.S. indexes — the S&P 500, Nasdaq and the Dow Jones — are down more than 10% from their respective 52-week highs.

Weaker-than-expected economic numbers from China and Europe aggravated fears of a slowdown in the global economy and spooked investors. Also, concerns related to Brexit, uncertainty pertaining to trade war and declining business confidence of Japan lowered market sentiments.

Additionally, the U.S. Commerce Department’s report showed lower-than-expected retail sales growth in November. This was mainly due to a sharp decline in sales by gas stations.

Further, a report published by Pacific Investment Management Company, LLC (better known as PIMCO) estimated that odds of recession over the next 12 months have reached a nine-year high level of 30%. In the report, PIMCO's Joachim Fels and Andrew Balls wrote, “The models are so far flashing orange rather than red.”

What This Means for Banks

We all know that banks’ financial performance is majorly dependent on the nation’s economic health. Thus, fears of a slowdown in the United States as well as globally will have an adverse impact on the performance of banks.

To make the matter worse, yield curve inverted earlier this month. An inversion of yield curve means short-term interest rates are higher than the long-term ones. Many see this as an early indication of an impending recession.

For banks, which benefit from steepening of yield curve, this is bad news. Banks earn net interest income by charging borrowers higher long-term interest rates while doling out smaller interest rates to depositors. This results in improvement in net interest margin (NIM). But growth in banks’ net interest income is expected to get hampered over time owing to yield curve inversion. This could lead to decline in NIM as well.

So far this year, the S&P 500 Financials (Sector) has lost 13.63%. Also, the SPDR S&P Regional Banking ETF KRE and SPDR S&P Bank ETF KBE have declined 17.6% and 18.3%, respectively.

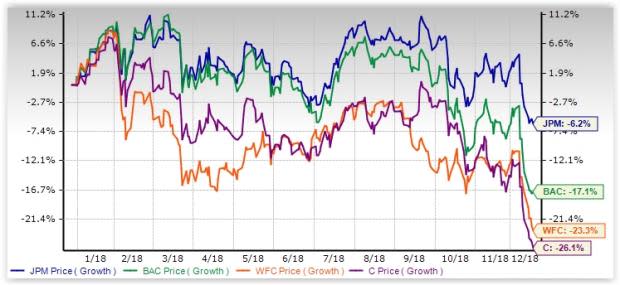

Further, major banks including JPMorgan JPM, Bank of America BAC, Wells Fargo WFC and Citigroup C are trading at a significant discount. Year-to-date, shares of these behemoths have lost more than 5%, with Citigroup being the worst performer.

Year-to-Date Price Performance

All these matters as well as the Fed officials’ statements that interest rates are at “near neutral” have made investors skeptical about future hikes. While the chances of interest rate hike later this week are high, investors will be looking for signs about future rate increases in the accompanying statements and economic forecasts.

Per the CME Group FedWatch tool, the odds of an interest rate hike this time are 78.4%. Moreover, though three more hikes are expected in 2019, this may not occur given the current situation.

At present, banks (one of the biggest beneficiaries of rising interest rates) are performing well financially, driven by several restructuring and streamlining measures, loan growth and higher interest rates. Nonetheless, any indication that the central bank is going to halt future increase in rates will hurt their growth prospects.

The above-mentioned big banks except Wells Fargo currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

SPDR-KBW REG BK (KRE): ETF Research Reports

SPDR-KBW BANK (KBE): ETF Research Reports

To read this article on Zacks.com click here.