US stocks fail to waiver as Fed minutes reveal officials were divided on rate cut

US stocks hold there gains after the release of Fed minutes

FTSE 100 and Europe's main share indices gain ground after yesterday's losses

UK posts worse than expected public finance figures as spending rises

Italy's president set to begin talks in a bid to find a new coalition and avoid snap elections

Second Chinese suitor emerges as frontrunner to buy 'Boris bus' maker Wrightbus

Boris Johnson should remind Merkel of these four hard economic facts when they meet

Jeremy Warner: Global leaders are too divided to counter looming economic darkness

That's all folks!

Join us again tomorrow morning as Louis Ashworth brings us all the latest business and economic news.

The dollar is little changed too...

Well, dealers were speculating earlier today that the Fed's minutes would be dovish. They were right.

As well as stocks holding their gains, the dollar didn't react much either...

How has Wall Street taken the news?

Not much movement as of yet to be honest.

US stocks are still trading in a sea of green with the Dow Jones still 1.04pc higher and the S&P 500 0.85pc up.

More on the Fed...

The Fed fears that global weakness and trade tensions could slow the US economy but added that it would remain flexible.

Fed chair Jerome Powell is due to deliver a key speech in Jackson Hole, Wyoming, on Friday. This could gives us a bit more insight into the Fed’s thinking.

It seems central bankers were widely split on the decision

Records from the meeting have showed that the Federal Reserve considered cutting interest rates more aggressively.

The US central bank cut rates by 25 basis points last month.

The minutes said: "A couple of participants indicated that they would have preferred a 50 basis point cut.

"Participants generally favored an approach in which policy would be guided by incoming information ... and that avoided any appearance of following a preset course."

Fed debated bigger rate cut

Aaaaand it's out!

Full minutes of the Federal Open Market Committee can be accessed below...

$USDJPY Minutes Of The #FOMC Meeting Jul 30-31 https://t.co/NNkRjtApi5

— LiveSquawk (@LiveSquawk) August 21, 2019

US boosted by retail earnings

US stocks have received a boost today from retail earnings, with Target and Lowe's both trading higher despite concerns surrounding the broader retail industry.

Shares at retailer Target hit a fresh all-time high earlier today as it posted a 3.4pc rise in like-for-like sales in its latest quarter, beating analysts’ estimates. It also increased its full-year profit forecast by 15 cents a share.

Online sales jumped 34pc in the period.

Budget timebomb: deficit to double as spending outstrips taxes

My colleague Tim Wallace writes:

Surging government spending and weak revenues are pushing up the budget deficit, leaving the Treasury on track for a surge in borrowing of £26bn this year, economists warned, potentially taking the deficit to nearly £50bn even before any extra "no deal" Brexit spending.

In the first four months of this financial year the Exchequer borrowed £16bn, £6bn more than the same period last year, the Office for National Statistics said.

The numbers indicate a commitment to higher spending combined with a weaker economy will push up the deficit, beginning to reverse the progress made since 2010 in cutting annual borrowing.

The national debt amounts to just over £1.8 trillion, the equivalent of 83.4pc of GDP.

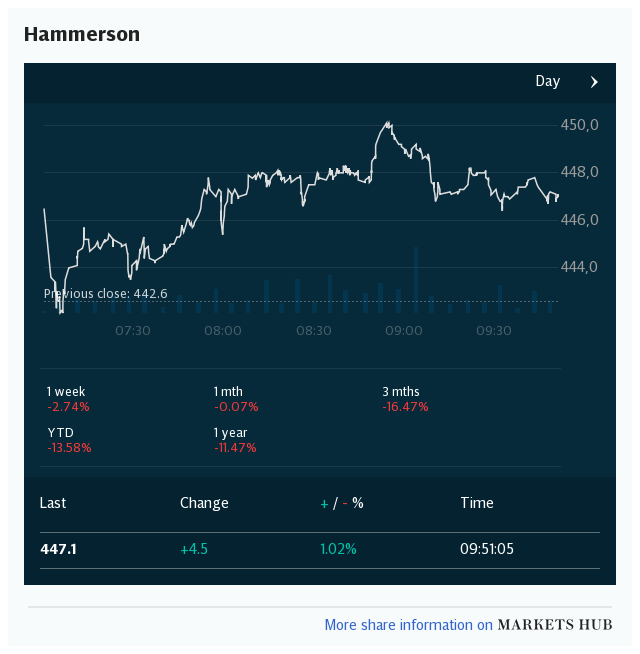

Struggling shopping centre owner Hammerson names new finance chief

Retail property developer Hammerson has named a new finance chief after coming under pressure from activist investor Elliott to sell assets more quickly.

James Lenton will join the FTSE 250 company on September 16 and take on the role as chief financial officer on October 1.

He replaces Timon Drakesmith, who departs on November 15 after announcing his decision to leave Hammerson in May.

Read Alan Tovey's full article here

Boris in Berlin...

Boris Johnson is now in Berlin with German Chancellor Angela Merkel.

On no-deal Brexit Angela Merkel said "should this happen, we are prepared for it but obviously we also think of the life of the many British citizens living in member countries of the EU."

Meanwhile Mr Johnson said: "there is ample scope to do a deal".

He added: "I've explained pretty clearly what needs to happen. The back stop, that arrangement, that had to go. Once we get rid of it, there is the real prospect of making progress very rapidly and that's why I'm here."

For more on this you can follow our Telegraph Politics blog here

Wall Street rallies ahead of Fed minutes

US stocks are pushing higher in advance of the Fed minutes...

David Madded of CMC Markets says:

"The bullish momentum is frim as traders are hoping the Fed minutes will include hints about further interest rate cuts, but seeing as the latest US inflation and retail sales reports have been strong, the bulls might be in a for a shock."

The Dow is currently 1.06pc higher at 26,236.73 points while the S&P 500 is 0.84 ahead at 2,924.69 points.

Trump's trade war to cost American families $1,000 a year as he mulls new tax cuts

The cost of the trade war to American families will surge to $1,000 (£819) a year each after the US imposes a new round of tariffs on Chinese goods, according to Wall Street analysts

US shoppers will face a surge in costs from a 10pc tariff hitting another $300bn of Chinese goods later this year, lifting the impact of Mr Trump’s trade war on households from around $600 to $1,000, JPMorgan calculated.

The next tranche of tariffs would significantly hit “the wallet of the US consumer” in the run-up to next year’s US election, warned JPMorgan strategist Dubravko Lakos-Bujas. Shoppers would face an annual hit of more than $1,500 if the tariffs are lifted to 25pc.

Read Tom Rees' full report here

Good evening!

Evening everyone, LaToya Harding here. We are keeping the blog open a bit later than usual tonight ahead of the Fed minutes, which will be released at 7pm (UK time), and Boris Johnson meeting with Angela Merkel in Berlin.

Stay with us and keep up-to-date with everything that's happening...

In late July, the Fed cut rates, and dealers are banking on dovish language in the report, which might signal further rate cuts this year. Since the rate cut, the global macroeconomic mood has soured – US-China trade tensions, the UK and Germany saw negative growth, and increased unrest in Hong Kong.

Market update: US shares rise but Brexit buffets the pound

As mentioned, strong results from retailers have helped US shares today but what else is at play?

Connor Campbell at Spreadex said that investors "appear to be putting all their eggs in a central bank basket" as they await hints on whether the Fed is likely to cut rates further when the minutes of its July meeting are released this evening. But it's not all rosy, he argues:

"There, arguably, is plenty of reason for markets to be in the red. Donald Trump keeps poking the Beijing bear, stating that he is determined to ‘take China on’ regardless of whether the short term impact is good or bad for America.

The Italian political situation is yet to be resolved (even if President Sergio Mattarella has begun talks with the country’s political parties). And, let’s not forget, the economic situation globally remains troubling."

Meanwhile, the pound has suffered a bit today as the likelihood of a no-deal Brexit appeared to remain high. Boris Johnson is due to meet German chancellor Angela Merkel this evening but it looks as though the prime minister's European counterparts may be resigning themselves to the increased possibility of a no-deal Brexit. Here's Michael Hewson from CMC Markets:

French official - No deal Brexit has become central scenario #gbp

— Michael Hewson ���� (@mhewson_CMC) August 21, 2019

The pound has lost ground against both the dollar and the euro and is trading at $1.213 and €1.094.

US markets rise on strong retail results

Shares on the major US indices have risen after major retailers Target and Lowe's reported strong financial results.

Investors are also waiting for further clues on whether the Federal Reserve is planing a further interest rate cut in the US when the minutes of its July meeting are released later this evening. The July meeting brought the first cut in US interest rates in more than a decade.

"A significant rally will be difficult until traders have clarity on the Fed's policy path," said Edward Moya, senior market analyst at OANDA.

There may be further clues when Fed chair Jerome Powell speaks at the annual Jackson Hole gathering on Friday.

For more, read Tim Wallace's preview of the event: When you’re in a (Jackson) Hole… central bankers try to avert a new slump at Wyoming pow-wow

Here's how the main US share indices were faring about 15 minutes ago:

the Dow Jones Industrial Average is up 0.8pc

the S&P 500 is up 0.73pc

the tech-heavy Nasdaq Composite is up 0.84pc

Remember to take a look at our Markets Hub tool at the top of the blog for the latest prices and data.

Stelios loses battle to block easyHotel takeover

Sir Stelios Haji-Ioannou has been defeated in his bid to fight off a takeover of easyHotel, the chain he founded in 2004 and in which he retains a minority stake.

A bidding consortium made up of property investors ICAMAP and Ivanhoe Cambridge announced on Wednesday that it had received enough acceptances of its 95p per share offer to tip its shareholding over the 50pc threshold. The offer values the company’s shares at £139m.

The remaining shareholders have until September 17 to accept the offer, which has been recommended by easyHotel’s board.

Shortly before the announcement that the bidders had received acceptances to acquire the majority of the shares, Sir Stelios called on shareholders to “reject the offer at 95p and hang on in there”.

He had previously criticised the offer as “very low” and had urged other shareholders not to accept it “until the true value and future potential of easyHotel can be evaluated”.

Read the full report here.

More woe for Neil Woodford

Neil Woodford has been selling off a number of investments in a bid to ensure his equity income fund can meet redemptions by investors when it reopens.

In the latest twist, one of his investments, Sabina Estates, a property development company that builds luxury villas in Ibiza, has been delisted from the Guernsey stock exchange. The move increases the level of "illiquid" assets held by Woodford.

Harriet Russell reports:

The delisting of Sabina Estates from the Guernsey stock exchange has exacerbated embattled fund manager Neil Woodford's breach of fund rules around the proportion of unquoted or "illiquid" stocks held in the portfolio.

Mr Woodford started listing his stakes in several unquoted companies in Guernsey in 2017 to maintain the balance of these kinds of stocks held in his flagship equity fund, including preference shares in Sabina Estates

Last month, it was revealed that Mr Woodford’s suspended £3.2bn flagship equity income fund had breached the 10pc limit on the amount of unquoted stocks a fund can hold after two of his stock picks, Benevolent AI and Industrial Heat, delisted from the Guernsey stock exchange.

Read the full report: More woe for Neil Woodford with Guernsey delisting

The graphic below shows how returns on Woodford's flagship fund have sunk:

Trump hits out at Fed chief Jerome Powell

Around now is usually an interesting time of day to check in on the Twitter account of the US's commander-in-chief.

There are some familiar targets so far today, including Fed chairman Jerome Powell, who has taken another pasting from the president for not cutting interest rates further.

Trump has also had a swipe at the mainstream ("LameStream" - see what he's done there?) media, who he accused of trying to create a recession in the US. As you'd expect, Trump remained bullish on his country's prospects: "Our Economy is sooo strong, sorry!"

The Fake News LameStream Media is doing everything possible the “create” a U.S. recession, even though the numbers & facts are working totally in the opposite direction. They would be willing to hurt many people, but that doesn’t matter to them. Our Economy is sooo strong, sorry!

— Donald J. Trump (@realDonaldTrump) August 21, 2019

.....We are competing with many countries that have a far lower interest rate, and we should be lower than them. Yesterday, “highest Dollar in U.S.History.” No inflation. Wake up Federal Reserve. Such growth potential, almost like never before!

— Donald J. Trump (@realDonaldTrump) August 21, 2019

Public finances: work to do for new Chancellor Sajid Javid?

There's now been some time to take a more detailed look at this morning's worse than expected public finance figures.

Tim Wallace has been digging through the numbers, gauging reaction and looking at what comes next for Sajid Javid, the new Chancellor:

"This comes even before any post-Brexit budget designed to see the economy through any turmoil after 31 October.

As a result the Government may have to rewrite the fiscal rules designed to keep the deficit falling and eventually to balance the books."

You can read Tim's full report here:

Government bonds: risk-free return or return-free risk?

Normally when countries borrow money in the bond market they pay for the privilege. But Germany has today issued 30-year bonds with a coupon - effectively, an interest rate - of zero.

Europe's largest economy didn't manage to sell the full €2bn (£1.8bn) it had hoped but the issuance of bonds that will pay out nothing shows that many investors are struggling to find low risk assets that offer a positive return.

The miserly yields available in the bond market have prompted Chris Bowie at Twenty Four Asset Management to ask: "Have Bonds Ever Been This Expensive?"

He points out that the average yield in the bond market today is just 1.46pc, adding:

"The key point with government bonds right now [is that] they might just as easily be described as offering return-free risk rather than risk-free return.

They offer no yield (increasingly they offer negative ones), and owning them only makes sense if either further capital gains are expected, or they are held in a balanced portfolio as a risk-off asset acting as a counterbalance to credit risk."

Message for Merkel

Boris Johnson is set to meet Angela Merkel today. Something tells me there might be a few words exchanged about Brexit.

This excellent piece from my colleague Tom Rees has been attracting a lot of interest from readers today and is well worth a moment of your time. Here's a taste:

"More products enter the UK from Germany than anywhere else, amounting to around $92bn in 2018. That total is higher than the value of goods arriving from France, Italy and Ireland combined. The UK is a huge market for German businesses, being their third-most important in Europe and fifth globally."

Read the full story: Boris Johnson should remind Merkel of these four hard economic facts over dinner

Greene King takeover a sign of the times

The takeover of Greene King by Li Ka-Shing's Hong Kong-based investment group is the latest in a string of acquisitions of UK companies and assets by foreign buyers.

What can we expect from the new owners of one of Britain's best known beer companies? Our Banking Editor Lucy Burton has delved into the fascinating story behind the world's 28th richest person:

The deal also raises question as to which UK-listed company could be next to succumb to a foreign takeover bid. The Telegraph Money team has taken a look at some of the candidates:

Who's next? Three British giants ripe for a foreign takeover

More on Ryanair: London hearing expected to last several hours

The court hearing in London at which Ryanair will seek another injunction to stop UK-based pilots from striking is reported to be underway.

The hearing is expected to last several hours. We'l bring you any news when we get it.

Ryanair welcomes decision by Irish court

The decision by the Irish court means that the 180 Ryanair pilots based in Ireland who had planned to halt work for 48 hours from midnight tonight will now have to turn up for work.

Ryanair had argued that the strike would breach an agreement reached between the airline and its employees after several strikes last summer. The agreement requires disputes to be referred to a mediator and go through a dispute resolution process before the launch of any industrial action.

The budget airline also alleged that the union's ballot of its members was unlawful, which the union denied.

The victory was welcomed by Ryanair, which said the ruling would "come as a huge relief to thousands of Irish passengers and their families during the last week of the school holidays".

All Ryanair flights from Dublin, Cork and Shannon airports will now operate as normal on Thursday and Friday, the airline said.

What next for Ryanair's Irish pilots?

Ryanair had the following message for Forsá, the union representing the pilots who voted to strike:

"Ryanair calls on the Forsá union, and this small minority of very well paid Irish pilots, to return to mediation... so that any disputes can be resolved without unnecessarily disrupting the travel plans of thousands of Irish passengers and their families."

The airline has claimed that pilots earning over €172,000 (£157,500) are seeking pay increases of 101pc.

See my earlier post (8.34am) for more details on the budget airline's different disputes in Ireland, the UK and across Europe.

BREAKING: Irish court blocks Ryanair pilots from striking

The Irish High Court has granted Ryanair an injunction preventing the carrier's pilots based in the country from going on strike this week.

Remember, a London court will rule separately on whether to grant an injunction to block UK-based pilots from striking.

'Strong economic case' for completing HS2 in full

Adam Marshall, director general of the British Chambers of Commerce has given his reaction to the launch of a review into HS2, arguing that there is "a strong economic case for delivering all phases of HS2". Here's what he had to say:

“HS2’s importance goes far beyond train services. Its anticipated completion is already attracting investors and will continue to attract investment to surrounding areas, rejuvenate local economies and create opportunities for businesses across the supply chain.

While no project should have a blank cheque, business communities across the UK will be concerned about the potential for further delays to HS2. This review must work at pace with our business communities to improve and hone this crucial infrastructure project, which is so important to business confidence.”

What will the HS2 review mean?

The HS2 review is to consider whether the ambitious rail project should go ahead. But the terms of reference also state that it will consider how much "realistic potential" there is for cost reductions by amending the scope of the project. This could include:

Reducing the speed of the trains

Making Old Oak Common the London terminus instead of Euston, "at least for a period"

Building only Phase 1, between London and Birmingham

Combining Phase 2a - extending the line to Crewe - with Phase 1

Altering plans for Phase 2b, which currently involves taking the line to Manchester and Leeds

The Department for Transportsaid limited, largely preparatory work on the project will continue in parallel with the review.

Government launches independent review of HS2

The Government will launch an independent review into HS2 to assess whether and how the high speed rail project should continue.

The review will be led by Douglas Oakervee, the former chairman of HS2 Ltd. Lord Berkeley, a long-term critic of the scheme, will act as his deputy.

The review will consider a number of factors relating to HS2, including its benefits, impacts, affordability, efficiency, deliverability, scope and phasing, the Department for Transport (DfT) said.

A final report will be sent to Transport Secretary Grant Shapps, with oversight from Prime Minister Boris Johnson and Chancellor Sajid Javid, later this year.

The report will "inform the Government's decisions on next steps for the project", the DfT said.

The end of falling budget deficits?

Today's public finance data could signal an end to the trend of falling budget deficits in the UK, according to PwC's top economist, John Hawksworth.

"Today's public finance data provide a further indication that the long period of falling budget deficits in the UK since 2009/10 is likely go into reverse in 2019/20.

This partly reflects a slowing economy and partly government action to cut taxes from April and ease off on austerity as we approach Brexit.

It is still early days in the financial year, but if these trends continue then the budget deficit for 2019/20 as a whole could be higher than the OBR's [Office for Budget Responsibility's] March forecast of £29.3bn, excluding the impact of methodological changes."

Government 'opens the spending taps'

Economists and experts have been reacting to this morning's public finance figures. Economist Shaun Richards said the rise in expenditure shows that the spending taps are now open at the Treasury.

Okay the takeaway from the UK Public Finances data is that the spending taps are now open with an extra 6.5% being spent by the UK government compared to July last year. #GDP

— Shaun Richards (@notayesmansecon) August 21, 2019

Rupert Seggins, another economist, has been digging into the specific areas that held back tax income and drove the rise in spending.

3. On the spending side of the coin, it's current spend, staff costs & investment that have been the biggest boosts this year, with the only major downward contribution to overall growth coming from public sector pensions (net of contributions). pic.twitter.com/4BwiUxGvcM

— Rupert Seggins (@Rupert_Seggins) August 21, 2019

UK public finance figures disappoint

The UK's public finances were in surplus by £1.3bn in July compared to a £3.5bn surplus in the same period last year. The surplus was less than half of what a Reuters poll of economists had predicted.

July is traditionally a strong month for the exchequer due to the timing of tax receipts from self-assessed individuals.

Government spending jumped 4.2pc during the month but income dropped 0.5pc despite a rise in income tax and VAT receipts.

Total borrowing so far this financial year has reached £16 billion putting the UK on course to miss its borrowing targets for the year.

Here's the Office for National Statistics, which published the figures:

Borrowing in the current financial year-to-date (April 2019 to July 2019) was £16 billion, £6 billion more than in the same period last year https://t.co/Vgs4aMMrB4pic.twitter.com/YvIblKHxvf

— Office for National Statistics (@ONS) August 21, 2019

Transatlantic mergers slump

Our mergers and acquisitions reporter, Vinjeru Mkandawire, has been taking a look at the latest figures:

The number of transatlantic mergers and acquisitions (M&A) between the US and UK fell by nearly a quarter in the first half of this year, according to research by Deloitte. This was on the back of an 18pc decline in global dealmaking, which was partly driven by increasing uncertainty around trade tariffs and the global economy, the firm said.

Transactions between the US and the UK were down 20pc compared to 2018 but still exceeded the combined number of deals between the US and Germany, France and Spain.

Deloitte’s Paul Lupton said that despite the fall in transatlantic deal volumes across many of the major European markets, there was still “strong appetite” for technology assets, which accounted for 28pc of all US-UK deals in the first half of the year.

“This is attributable to the asset‑light business models which enable greater potential for geographical expansion and scalability,” he said.

Goldman Sachs predicting a 'very volatile' three months for Italian economy

Economists at Goldman Sachs are predicting a bumpy few months for Italy's economy.

"In our view, the next three months will be very volatile and challenging for the Italian economy and its assets."

They are also predicting a delay to the preparation of next year's budget if a new coalition cannot be formed and fresh elections have to be called.

What next for Italy?

The political upheaval in Rome has come at an awkward time for the country, as Berenberg's European economist Florian Hense has observed:

"With the submission of the 2020 budget to the Italian parliament and European Commission looming by 30 September and 15 October, respectively, the timing is unfortunate: Italy needs to find more than €20bn (£18.3bn) in savings to avoid the already legislated rise in the VAT by 3 percentage points in 2020."

Berenberg has set out the three most likely scenarios for Italy:

1. Italy avoids snap elections for at least nine months: Five Star join forces with the Democratic Party (PD) for a new centre-left government, probably with Giuseppe Conte returning as prime minister. Markets could rally if the short-term uncertainty of snap elections is averted. The centre-left coalition could then focus on agreeing a budget and compromises with the EU over its deficit.

2. No poll for now but elections in early 2020: President Sergio Mattarella appoints a technocratic government to draw up the 2020 budget, with snap elections to follow early next year. Five Star and the PD could support the move as it would shield them from having to announce painful adjustments to the 2020 budget themselves. This option could avoid a volatile reaction from markets.

3. Snap elections later this year: The final option is for Mattarella to call snap elections for late October or early November. Current opinion polls suggest far right Matteo Salvini would likely win and become prime minister. A Salvini government could set Italy on a collision course with the EU over its budget. Bond yields could surge, driving up Italy's cost of borrowing.

Italy seeks a new coalition in a bid to avoid fresh elections

Italian president Sergio Mattarella will begin intensive talks with the country's political leaders today as he seeks to determine whether a new ruling coalition can be found after prime minister Giuseppe Conte resigned yesterday.

If a coalition cannot be found, Matarella will be forced to call fresh elections.

Conte resigned just over a year after agreeing to lead a populist alliance of the League party, led by Matteo Salvini, and the Five Star Movement.

Mattarella, whose role as president is normally a largely ceremonial one, has the sole power to appoint governments and call elections. He is ready to give Five Star and the opposition Democratic Party, or PD, time to strike a deal. But he will allow them days, not weeks, to reach an agreement, Italian media reported.

The talks are set to begin this afternoon.

Rome's FTSE MiB index fell 1pc yesterday but has risen a healthy 1.46pc so far today.

Fiat-Renault merger hopes buoy markets

A report in Italy about continuing merger talks between Fiat Chrysler and Renault has helped to push shares in the car industry higher.

The pair abandoned talks on a mega merger in June after meeting resistance from the French government, which is a major shareholder in Renault.

Take a look at the long road that led to Fiat Chrysler to propose a tie-up with the French manufacturer:

For more on why we're seeing a wave of deals in the car industry, take a look at Alan Tovey's long read from the weekend: Automotive industry alliances: who's joining forces with who and why?

A strong start for European shares

European stock markets have enjoyed a strong start to the day, with all of the major indices gaining ground.

Here’s how the continent’s blue-chip bourses stood as of about 15 minutes ago:

The FTSE 100 was 0.5pc up

France’s CAC 40 was 0.75pc up

Germany’s DAX was 0.5pc up

Spain’s IBEX was 0.75pc up

Italy’s FTSE MiB was 1.19pc up

Remember you can use our handy Markets Hub tool at the top of the blog to keep tabs on the latest stock market and currency movements!

Ryanair - what's happening today?

There's a lot to keep track of in this Ryanair story so this might help:

When are the strikes? Pilots in the UK and Ireland are planning separate 48 hour stoppages starting from midnight tonight in disputes over pay and conditions.

What's happening in the London courts? An application by the airline for an injunction to block UK pilots striking is to be heard by a judge in London on Wednesday.

What's happening in the Irish courts? The Irish High Court will rule on whether to grant the airline an injunction to block the planned strike by 180 pilots based in Ireland.

Anything else? Quite a bit, actually. The airline is also facing a wave of strikes over the next month by staff across its Spanish and Portuguese bases. The first Portuguese strike action is set to begin today. Belgian unions have told members not to comply with the carrier's request for them to staff flights that have been hit by the Portuguese industrial action.

And the share price? It's dropped 17pc in the past month.

Ryanair could attempt to break strikes

Ryanair has been drawing up plans to keep as many services as possible in operation if it fails in its legal action.

Just in from our transport correspondent Oliver Gill:

One senior insider has told me @Ryanair has contingency plans in place to run all, or nearly all, UK flights even if the legal action fails and #strikes go ahead. This will be announced after the High Court decision this morning.

— Oliver Gill (@ojngill) August 21, 2019

Ryanair's last ditch bid to avoid strike chaos

Ryanair should learn this morning whether its request to block 180 of its Irish pilots from striking tomorrow and Friday has been successful.

The Irish High Court is due to issue its decision on whether the 48 hour stoppage can proceed.

Ryanair claims that the strike action breaches an agreement it reached with the union last year. The budget airline also claims that the union has failed to submit detailed proposals ahead of balloting its members or issuing its strike notice and that the industrial action is timed to cause maximum disruption by coinciding with a scheduled strike by UK pilots.

We'll keep you up to date on developments throughout the day.

Facebook moves to address privacy concerns

Facebook is launching a long-promised tool that lets users limit what information the social network can gather about them on external websites and apps.

The move is an attempt by tech firm to head off criticism of its privacy practices which have been heavily scrutinised in the wake of the Cambridge Analytica scandal.

Facebook said it is adding a section where users can see the activity it tracks outside its service, including through its "like" buttons. Users will be able to turn off the tracking.

The feature has been launched in South Korea, Ireland and Spain and is due to be rolled out in other markets in the "coming months".

Ryanair in bid to stop pilot strikes

Ryanair is going to the High Court today in an attempt to block Thursday's strike action.

An application by Ryanair for an injunction is to be heard by a judge in London on Wednesday.

In Ireland, Ryanair has also sought an order at the High Court in Dublin to prevent around 180 pilots based in Ireland from going on a 48-hour strike from midnight on Thursday.

The application was contested by Forsa, the parent union of the Irish Airline Pilots Association. A judge is expected to give a ruling on Wednesday morning.

Boris heads to Boris, while crisis reigns in Italy

Good morning. Equities across Europe were lower yesterday amid political uncertainty, not least in Italy where prime minister Giuseppe Conte said he would resign. The pound went in the opposite direction after comments from Angela Merkel that Europe would think about practical solutions to the current Brexit impasse were interpreted as a chink of light in the stand-off between Downing Street and Brussels. Today the German Chancellor will be meeting with Boris Johnson in Berlin.

5 things to start your day

1) Second Chinese suitor emerges as frontrunner to buy 'Boris bus' maker Wrightbus: One of China’s biggest engineering companies has emerged as the frontrunner in the race to save “Boris Bus” maker Wrightbus. Weichai, part of giant state-owned conglomerate Shandong Heavy Industry, is in detailed discussions to buy the struggling bus company, The Daily Telegraph has learnt.

2) Shareholder revolts at annual meetings have “little impact” on restraining runaway pay across FTSE 100 companies, despite a fall in the average salary paid to chief executives last year, according to the CIPD and the High Pay Centre. Between 2014 and 2018 shareholders approved all FTSE 100 company pay policies presented at an AGM, with most votes sailing through, a report by the association for human resource professionals and the think tank found.

3) Yellowhammer port chaos is not even Project Fear: it is slapstick, writes Ambrose Evans-Pritchard. The Yellowhammer report excited my interest because it makes extraordinary warnings about ports in a no-deal Brexit, and I happen to have been talking to port officials over the past two weeks. These included the Boulogne-Calais chief and the head of the UK’s biggest port complex on the Humber. My conclusion is that the Yellowhammer section on ports cannot be true.

4) Britain is a touch richer than previously realised after new sums by the Office for National Statistics added an extra £26bn to annual GDP. The Government and charities replace buildings, machinery and other capital more frequently than expected, businesses develop more software in-house than was known, and services exports are larger than had been appreciated.

5) Lucy Burton finds out who the Hong Kong 'Superman' that's taking on British beer is: Hong Kong's richest man Li-Ka Shing. The 91-year-old was determined to change his circumstances from a young age, telling Forbes in 2010 that the "burden of poverty and this bitter taste of helplessness and isolation" that he felt as a child drove him on in adult life. He is the 28th richest person in the world with a net worth of around $32bn.

What happened overnight

Asian shares flatlined on Wednesday as investors took a step back after recent gains, with focus now turning to a key speech by Federal Reserve boss Jerome Powell at the end of the week.

Rising hopes for China-US trade talks have provided a much-needed lift to markets over the previous two days but with few fresh catalysts, dealers are keeping their powder dry ahead of Friday's address.

After positive signals from Donald Trump and some of his top advisers on Monday over progress in the talks with Beijing, and an olive branch with the delay of a ban on Huawei purchases, there have been few developments for traders to buy on.

"Our trade-war headline-inspired relief rally appears to have run its course as I suspect there is still a lot of nervousness among US investors as the global economic realities are just too hard to ignore," said Stephen Innes at Valour Markets.

With so much riding on the Fed, investors were understandably anxious. MSCI's broadest index of Asia-Pacific shares outside Japan dithered either side of flat after three straight days of gains.

Japan's Nikkei slipped 0.3%, while Shanghai blue chips added a slim 0.06%.

Hong Kong stocks went into the break slightly higher after swinging throughout the morning. The Hang Seng Index added 0.11 percent, or 28.98 points, to 26,260.52.

Coming up today

Interim results: Charter Court, Costain, Hansteen Holdings, Hostelworld, OneSavings

Economics: Public sector net borrowing (UK), mortgage applications and house sales (US), Federal Reserve minutes