Sterling sinks as traders back away from Brexit chaos: as it happened

UK factory activity hits lowest level since 2012 amid Brexit uncertainty and global trade headwinds

Sterling continues to struggle as Westminster political turmoil rattles markets

FTSE outperforms flat Europe on third day of rally

No-deal Brexit could trigger house price falls of 20pc in 2020 — here's where to bag a bargain

Wrap-up: Politics sets sterling in a spin

As I type, Cabinet ministers are heading into Number 10. What emerges from their meeting is likely to majorly dictate how things look for the next week — and quite possibly the coming months.

Sterling has looked stroppy all day, and if the news comes out rattles traders further (read: if a General Election is coming), it would be no surprise to see the currency plunge to a recent record low.

With little noise elsewhere (except distant screaming from Argentina), today saw the classic relationship in full swing: pound goes down, FTSE goes up. It’s the cleanest we‘ve seen that dynamic in recent weeks, with no US trade war shadow to reign on the equities parade.

That’s all from me today. Join me tomorrow for the latest news on business, markets and economics — when we’ll find out who’s going up and who’s going down in the upcoming FTSE reshuffle. Thanks to everyone who followed along and commented today!

Pound’s plunge puts FTSE 100 top of the tile

A fall in the value of sterling is always a bittersweet reason for a blue-chip boost, but it left the FTSE 100 looking high and mighty today, surging ahead of its European peers to close more than 1pc up. Here are the final numbers:

The FTSE 100 closed up 1.04pc, or 74.76 points, at 7,281.94

The FTSE 250 closed up 0.43pc, or 83.26 points, at 19,476.89

France’s CAC 40 closed up 0.23pc, or 12.56 points, at 5,493.04

Germany’s DAX closed up 0.12pc, or 14.5 points, at 11,953.78

Spain’s IBEX closed up 0.03pc, or 2.6 points, at 8,815.50

Italy’s FTSE MiB closed up 0.61pc, or 129.08 points, at 21,451.98

Why emerging markets are key to Unilever’s future

As I reported earlier (see 2:12pm update), Unilever shares have risen after a note predicted the company would benefit from emerging market growth. Of course, if you regularly read the Telegraph’s Questor column, you’d already know that. My colleague Robert Stephens wrote of the consumer goods giant:

On a global basis, around 5pc of the company’s sales are now conducted online. This figure is expected to grow rapidly as it invests in a range of digital tools.

They include “people data centres” that connect the company and consumers using real-time analytics. Their aim is to increase customer engagement, as well as provide greater alignment between the company’s brands and consumer tastes.

You can read his full analysis of the stock here: Questor: emerging markets offer huge growth – here’s one company investors should buy

Micro Focus: How did it end up in such as mess?

With investors asking serious questions of Micro Focus chairman Kevin Loosemore after what some think might be classic case of “overboarding”, here’s a reminder of how the IT and software firm — which is on track to lose its FTSE 100 spot — got into such a sticky situation:

Brazilian manufacturing sector rebounds

Brazil’s manufacturing sector rebounded in August according to new purchasing managers’ index data, with gave it a production score of 52.5, up from 49.9 in July (where a score above 50 indicates growth).

���� Production levels rebound in Brazil's manufacturing sector in August, as the headline Manufacturing PMI rises to 52.5 from 49.9 in July. Factory orders grow at a marked pace, spurring businesses to raise workforce numbers. More here: https://t.co/oozoOwoAGEpic.twitter.com/fYXGLOlJVw

— IHS Markit PMI™ (@IHSMarkitPMI) September 2, 2019

Increased factory orders and output underpinned the expansion, with companies using the opportunity to increase hiring and investment in stock levels.

Pollyanna De Lima, principal economist at IHS Markit said:

The Brazilian Manufacturing PMI moved back into positive territory during August, posting a growth rate that was above the survey average, after stagnation had been recorded in July. Factories ramped up production to the greatest extent in five months and created jobs for the first time since April, suggesting that there is appetite for capacity expansion amid positive growth projections.

Sterling down 1pc versus dollar

Sterling is cutting a bright red streak across Bloomberg’s index of top currencies, down against all its major peers as traders are shaken by events in Westminster.

The pound’s fall has slowed slightly since this morning, but it is still on a distinct downwards tilt, off around 1pc against the dollar, and 0.7pc down against the euro (which isn’t having its best day ever either).

Sterling made its strongest gains over the past fortnight against the euro, and still has some way to go before I start having to crack out the record book again. Against the dollar, however, sterling is only about 0.25pc over a nineteen-month low.

China lodges World Trade Organisation complaint against US

The Chinese commerce ministry said it has lodged an official complaint about the United States to the World Trade Organisation, a day after the countries ramped up tariffs against one another. AFP reports:

“The Chinese side is strongly dissatisfied and resolutely opposed to that. In accordance with relevant WTO rules, China will firmly safeguard its legitimate rights and interests,” Beijing’s commerce ministry said in a statement published on its website.

Round-up: Eurotunnel ‘ready for any Brexit outcome’, Woodford loses key ally

With the usually early afternoon storm as Wall Street opens failing to arrive, and Donald Trump preoccupied with Hurricane Dorian, markets appear to be holding their breath for new on the Brexit front. The latest reports suggest an Emergency Cabinet meeting will be held at 4:45pm.

Here’s the latest news from elsewhere in the business world:

Eurotunnel is ‘ready for Brexit no matter the outcome’, says owner Getlink: Hauliers criticised a statement by the operator of the Channel Tunnel that it is ready for Brexit on October 31 irrespective of whether the UK manages to secure a deal with the European Union, saying that the severity of border checks was not within its control.

Neil Woodford loses ally on Patient Capital board as Circassia chief steps down: Circassia Pharmaceuticals chief Steven Harris will step down from the board of Neil Woodford’s Patient Capital Trust at the end of this month, as the remaining board members decide whether to part company with the veteran fund manager.

Dollar hits two-year high

The US dollar has hit a two-year against other major currencies, buoyed by the pound’s Brexit wobbles, a Japanese yen weakened by more positive market sentiment, and a euro dragged down by worries about an ongoing manufacturing recession.

Sterling’s drop have slowed since the morning, but the downwards trend has continued — a when US foreign exchange traders get back to their desks tomorrow, they might find find themselves catching up on some less-than-favourable Brexit news.

Unilever rises after Goldman tip

Unilever is one of the more heavyweight movers on the FTSE 100 today, with shares up about 2pc currently.

The consumer goods giant was upgraded to a buy rating from neutral by Goldman Sachs analysts, who said growth at the company would help as emerging markets including India, Brazil and Indonesia increasingly drive sales.

Johnson calls Cabinet meeting, sending election speculation into overdrive

Boris Johnson has called a meeting of the Cabinet this afternoon. With Tory wars in full effect and blue-on-blue action across the airwaves, there is now widespread speculation that the Prime Minister may be preparing to call a General Election

Paddy Power has suspended betting on a general election to be called, following news that PM Boris Johnson has called a cabinet meeting for later today.

The odds of the election to be announced fell from 2/5 this morning, into 1/5 and finally 1/10 in the last hour....— Jim Pickard (@PickardJE) September 2, 2019

The latest updates are here: Brexit latest news: Cabinet meeting called amid growing speculation election will be announced this week

A Brit abroad: New Bank of Ireland governor holds UK passport

As Mark Carney’s tenure at the Bank of England comes towards an end, could foreigners running central banks be coming en vogue? That’s the sign from Dublin, where Egypt-born, British-passport-holding Gabriel Makhlouf has been appointed bank of Ireland governor.

My colleague Harriet Russell writes:

Some believe Makhlouf’s outsider status will be a force for good. Others think it represents a last-ditch way for Britain to maintain its influence in Europe after October 31.

His supporters compare Makhlouf’s position to Canadian Mark Carney at the Bank of England or Stanley Fischer, a dual US-Israeli citizen who previously served as the chief of the Bank of Israel. Being an outsider should bring with it a healthy dose of independence they say, but there are potential pitfalls.

You can read here full profile of Mr Makhlouf here: The only Brit at the ECB table: Who is Gabriel Makhlouf, the new governor of the Irish Central Bank?

Italian stocks rise ahead of coalition vote

The pound drop-boosted FTSE 100 may be the leader among European equity indices currently, but the Italian FTSE MiB isn’t doing too shabbily either, up about 0.9pc currently.

Investors are holding on to hopes that fresh elections in the country might be delayed, as lawmakers in the leftist Five Star party prepared for a vote tomorrow on whether to form an alliance with the Democratic Party.

The overall picture is still fairly flat, but continental bourses are edging up a little, with the Europe-wide STOXX 600 up about 0.5pc.

Pound could sink further during ‘seriously eventful week in parliament’

Oanda analyst Craig Erlam, reacting to today’s dip in the price of sterling (and commensurate rise in the FTSE 100) comes down to Boris Johnson’s latest manoeuvres on Brexit. He writes:

Time will tell how successful [Mr Johnson’s] tactics are and how he’s judged for using them but sterling traders are clearly not particularly fond of them. Ultimately, all of these tactics increase the probability of no-deal, the most severe form of Brexit, which is why the currency is once again heading south and eyeing up the $1.20 handle.

A break of this could be a significant psychological blow and encourage further declines as we get nearer to Brexit day. It’s going to be a seriously eventful week in Parliament, that's for sure, as MPs opposed to no-deal do everything in their power to stop it before they’re gagged until the middle of October. I don’t think sterling volatility is going anywhere soon.

The Guardian’s chief political correspondent Jessica Elgot says there are “very strong rumours” that an election will be called in the next few days.

Very strong rumours in Westminster today that election could be called this week - with verbal commitment of polling day pre-Oct 31 https://t.co/nUodGYRYTA

— Jessica Elgot (@jessicaelgot) September 2, 2019

Amongst these 22 MPs are 10 former cabinet ministers, 21 former ministers, 2 former chancellors, a former deputy PM, a former education secretary, a former lord chancellor and a former Conservative Party chair. There can't be any precedent for expelling a group like this https://t.co/pg8AgDrOMT

— Henry Zeffman (@hzeffman) September 2, 2019

400 jobs at risk as Tata announces plans to sell Cogent arm

Tata Steel has announced plans to sell off several parts of its Cogent operation, confirming a scoop by Telegraph Industry Editor Alan Tovey from over the week.

The company has already sold off two of the three parts of Cogent, but the biggest one — Orb Electrical Sheets, which operates out of Newport, Wales — is facing closure, putting 380 jobs at risk.

The company said Orb had been loss-making for “several years”, and said converting to site to produce steels for electric vehicles would be prohibitively expensive.

Tata Steel said:

Every effort will be made by Tata Steel to mitigate the impact on affected employees including offering alternative employment opportunities where possible at other Tata Steel sites. Consultations with affected employees and trade unions at both Orb and Wolverhampton will commence shortly. This process will include assessing ways to minimise the need for compulsory redundancies.

Round-up: Full report on factories, Micro Focus chair takes second seat, Argentina imposes capital controls

Here are some of the day’s top stories, including more details on this morning’s shock data on factory activity:

Factories suffer biggest contraction in seven years as sector ‘nears recession’: Factories suffered their sharpest contraction in seven years in August as they struggled to pull out of a deepening downturn triggered by a global trade war and no-deal Brexit worries.

Micro Focus boss Kevin Loosemore takes on extra role at banknote maker De La Rue: The boss of troubled British tech company Micro Focus has taken on an extra role as chairman of struggling banknote maker De La Rue.

Argentina imposes currency controls as economic crisis deepens: Argentina’s government authorised currency controls on Sunday in an about-face by President Mauricio Macri, who had previously lifted many protectionist practices of his predecessor, Cristina Fernandez de Kirchner.

Who’s on the move?

With the FTSE 100 moving a booming 1.4pc up to a one-month high, and the FTSE 250 climbing a respectable 0.6pc, here are some of the notable movers on the UK’s top two indices:

FTSE 100

Risers

AstraZeneca, up 3pc at £75.42. As I noted earlier (see 9:00am update), the pharma giant is climbing after strong trial results for one of its new treatments.

Diageo, up 2.3pc to £38.85. Data released by HMRC last week showed spirits duty income has risen, indicating strength in the alcoholic drinks market, which may have converted into upbeat sentiment about the beverage company.

Tesco, up 2.2pc to 224p. Upbeat commentary on the supermarket by Shore Capital, who say the company’s first-half profit should increase, has lifted shares.

Fallers

Only a handful of shares are currently down on the FTSE 100, including:

Marks & Spencer, down 0.2pc to 191.9p. The struggling high street stalwart is running headlong towards relegation from the FTSE 100 on Wednesday.

FTSE 250

GVC Holdings, up 3.4pc to 650p. The Ladbrokes and Coral owner is up after announcing a €200m loan to refinance existing sterling debt.

Polymetal, down 1.65pc to £11.63. The UK’s biggest mid cap has dipped slightly, but is still easily on track to re-join the FTSE 100 later this week.

Reminder: US markets closed today

Wall Street traders will have their feet up today, with markets closed for the country’s Labor Day holiday. That means we might be free from the shifts on UK markets that often spill over the Atlantic on current trading patterns. Here’s more on that phenomenon:

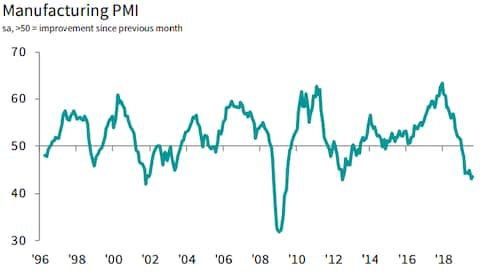

Will PMI fall set the stage for a Bank of England rate cut?

Today’s alarming PMI data raises the very real possibility that the UK could be heading for a third quarter contraction, which would mean Britain has entered a technical recession.

Negotiations over Europe aren’t the only pressure on the British economy, which is suffering (along with the rest of the world) as the US and China trade blows over trade.

Against that backdrop, the Bank of England has been keeping its powder dry, resisting the temptation to cut interest rates and adopting a wait-and-see-what-happens-with-Brexit attitude. A sharp drop might mean that policymakers decide it is better to act early, however.

Markets.com’s Neil Wilson says:

The manufacturing PMI data is simply shocking. The headline PMI reading fell to 47.4, its weakest since July 2012. New orders declined at the fastest clip in seven years. And crucially confidence is on the floor, with manufacturers as pessimistic as they have ever been.

It’s wrong to pin this all on Brexit. As the report authors make clear, the global economic slowdown is the primary cause of the decline, albeit there was some impact from supply chain reshoring as businesses seek to mitigate the impact of a no-deal Brexit. Uncertainty over the outcome of Brexit is certainly a drag on sentiment but we should be hopeful that this will be resolved presently.

The data for the UK economy may well now get worse before it gets better. We need to assess the Services PMI on Wednesday for more clues about whether Q3 could herald a contraction. And as consistently stated, it also makes the next move for the Bank of England down, not up. Ultimately though the economic data this week will play second fiddle to what’s going on in Westminster.

looking at the week ahead in parliament pic.twitter.com/whKsCZepg3

— Esther Webber (@estwebber) September 2, 2019

Focusing on the pound, Fidelity’s Andrea Iannelli adds that a fall in sterling could help the UK shift some of its accumulated debts:

Looking at the balance of payments, the UK faces significant imbalances (e.g. trade deficit, current account deficit) with the rest of the world and, in the now-famous words of BoE governor Carney, “relies on the kindness of strangers” to finance its deficits. Sterling weakness is likely to act as a rebalancing tool over time, both in terms of helping to inflate away some of the debt and in making UK goods cheaper for overseas consumers and UK companies more attractive to global investors.

Best you can say about UK manufacturing right now is that it's not as bad as Germany -- and that's not saying much.

UK clearly underperforming other European markets. Not just a global problem - #Brexit is clearly a factor for PMI survey respondents. pic.twitter.com/Bn1YP43Qrp— Andy Bruce (@BruceReuters) September 2, 2019

Sterling finds a shelf despite factory worries

The pound seems to have arrested its fall at around 0.66pc down against the dollar and 0.5pc down against the euro — another drop like that, however, and we’ll begin once again testing the record lows hit in he middle of August. Political news is rattling currency prices, with the poor PMI data seemingly having little extra impact.

Far more important for GBP than PMI in the near-term https://t.co/S8EIGJUN4E

— David Cheetham (@DavidCheetham3) September 2, 2019

You can follow the latest political updates here: Brexit latest news: Tory rebels accuse Boris Johnson of setting a trap to force a snap election

Pre-Brexit preparations currently offering ‘little support’ to economy

The UK economy has had an up-and-down 2019 so far, with first-quarter growth stimulated by companies preparing for Britain’s expected exit from the EU.

After the delay, the second quarter saw a sag, with companies burning through their stockpiles.

That drop sent the UK economy into contraction during the second quarter, putting Britain on track for a technical recession if the shrinking continues.

Wide expectations were that the October Brexit deadline would prevent this, as companies would once again begin stockpiling.

Pantheon Macroecnomics’ Samuel Tombs says that may not be the case just yet, however. He writes:

The renewed fall in the manufacturing PMI in August—to its lowest level since July 2012—indicates that support from another round of no-deal Brexit preparations currently is too modest to insulate UK producers from the global downturn...

...With only two months to go until the Brexit deadline, the boost from stockpiling appears to have been surprisingly meagre. The stocks of finished goods balance rose only to 52.0 in August, from 51.8 in July, while the stocks of purchases balance increased only to 49.8, from 49.6. By contrast, these balances picked up four months before the original Brexit date in March. All this suggests that the boost to GDP growth in Q3 from stock-building won’t be as big as it was in Q1. That said, GDP data showed that U.K. firms returned stock levels to near-normal levels in Q2, so we still expect some boost from stockpiling to emerge soon.

PMI data show little pre-Brexit stockpiling by UK manufacturers at present. Note the boost began four months before the March deadline. That said, this jars with GDP data, which showed a big drawdown in stocks in Q2 & thus scope for another build in Q3. Don't write off Q3 GDP yet pic.twitter.com/0Wuu0DvJbz

— Samuel Tombs (@samueltombs) September 2, 2019

Incidentally, if all this talk of PMI has got you reaching for Google, here’s an explanation of what the figure tell us:

Reaction: Third-biggest output drop since financial crisis

UK #manufacturing downturn deepened in Aug as PMI fell to 47.4, lowest since July 2012 indicating 4th successive monthly deterioration of business conditions. Only on 3 occasions since the global financial crisis ten years ago has the sector reported a steeper rate of contraction pic.twitter.com/eTpnau27NR

— Chris Williamson (@WilliamsonChris) September 2, 2019

Another weak month for UK manufacturing in August. Slightly better than the Euro area average but that showed a contraction as well. https://t.co/mCoTNAjSyK

— Shaun Richards (@notayesmansecon) September 2, 2019

When you account for the move higher in Q1 as due to Brexit stockpiling the manufacturing and industrial production figures in the UK do not make for pretty viewing. Today's release the lowest since July 2012 pic.twitter.com/ertcSEEsHq

— David Cheetham (@DavidCheetham3) September 2, 2019

the PMI stupid. not a great start to the week. pic.twitter.com/2BWyvXXMqY

— Neil Wilson (@marketsneil) September 2, 2019

UK factory PMI hits lowest level since 2012

Activity in the UK’s manufacturing sector has hit a seven-year low as Brexit weighs on the economy.

Data gathered by IHS Markit and CIPs gave a manufacturing purchasing managers’ index score of 47.4 for August, indicating a contraction in the sector deepened.

IHS said:

The high levels of economic and political uncertainty pervasive across domestic and global markets continued to weigh heavily on the performance of UK manufacturing during August. Output volumes fell as intakes of new work contracted at the fastest pace for over seven years, while business optimism dropped to a series-record low.

You can read the groups’ full report here

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, said:

The sector’s illness took a turn for the worse in August with the sharpest decline in domestic and export orders for seven years. Investment continued to peter out and heightened concerns about the UK’s political situation and the strength of the global economy acted as a drag on activity.

As some clients from the Eurozone continued to move their supply chains away from the UK, declining orders from the US and Asia dashed any hopes of redemption, resulting in the sharpest fall in business optimism since at least 2012.

Soured by the continuing intensely difficult conditions, the sector resorted to some job shedding and increased their own prices as a last-ditch effort against renewed pressure from a weakening pound.

As Brexit planning intensifies, some firms were resorting to more inventory building whilst others were unravelling their stocks. With some supplies impacted by port delays and poor supplier performance, a creeping dread is descending on the sector that there will be more of these obstacles to come.

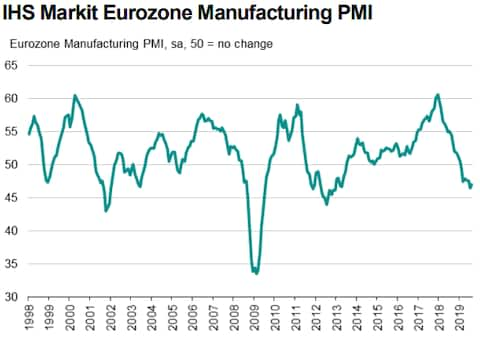

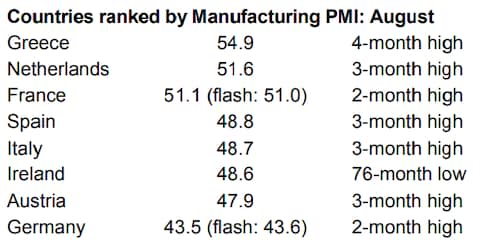

German manufacturing sector stays in contraction as eurozone factories falter

A swathe of manufacturing data for the eurozone was just released, showing a factory slump across the common currency area continued during August.

Purchasing managers’ index data gave a score for the eurozone of 47 (where a score above 50 indicates growth), a slightly improvement from July’s 46.5.

Germany “remained firmly in contraction”, data gatherer IHS Markit said, hitting a bittersweet two-month high of 43.5. Manufacturers in Europe’s biggest economy have been struggling amid global headwinds that have damaged demand for exports. Here’s how Germany PMI looks over time:

Here’s how the eurozone countries stood overall:

#Greece continues to show remarkable resilience in the face of the wider eurozone (and global) manufacturing malaise https://t.co/8VSE94IvWj

— Chris Williamson (@WilliamsonChris) September 2, 2019

Chris Williamson, chief business economist at IHS Markit said:

Eurozone producers are suffering as the summer slump in factory production persisted into August. Although up on July, August’s manufacturing PMI was the second-lowest since early 2013, and a marked deterioration in optimism about the year ahead suggests companies are expecting worse to come...

...Trade wars and tariffs remain the biggest concerns among producers, and the escalation of global trade war tensions in August encouraged further risk aversion.

Germany is suffering the steepest decline, in part reflecting slumping global demand for autos and business machinery. While France bucked a wider downturn trend, even here growth was only very modest.

Euro Area manufacturing still contracting according to August PMIs (rough indicator of official stats). 47.0 up from 46.5 in July only 2nd lowest since Apr-13 (so..."yay!" I guess?). Falls concentrated in intermediate & investment goods. Germany, Italy & Spain all had falls. pic.twitter.com/PnvduKUlwP

— Rupert Seggins (@Rupert_Seggins) September 2, 2019

Sterling staggers as political tensions grow

The pound has fallen fairly sharply since London markets opened, down about 0.45pc against the dollar and 0.4pc against the euro.

Investors are being rattled by uncertainty over what will emerge from the next week of politics, which is expected to be a crucial one for both Boris Johnson’s premiership and Brexit itself.

Here’s a smattering on tweets to give a sense of the raging firestorm that is Westminster currently:

NEW: @Sandbach confirms to @adamboultonSKY that she’ll vote against the govt and is prepared to lose her job if that’s what it takes to block a No Deal exit. “I stood on manifesto that said we’d leave with a deal and in an orderly way.” Says PM should bring back May deal

— Beth Rigby (@BethRigby) September 2, 2019

Gauke is also seeking clarity on whether the government respects the rule of law.

I'll type that again: David Gauke, who was justice secretary until six weeks ago, is also seeking clarity on whether the government respects the rule of law.— Matt Chorley (@MattChorley) September 2, 2019

If Cummings can get the UK out of the EU, destroy the Tory party, and fundamentally reform the civil service, his victory will be total.

— Owen Bennett (@owenjbennett) September 2, 2019

AstraZeneca’s Farxiga gets investors’ blood pumping

Pharma firm AstraZeneca is leading risers on the FTSE 100 currently, up around 2pc.

Investors have been encourage by positive trial data for AstraZeneca’s Farxiga cardiovascular medication.

Citi analyst Peter Verdult said the treatment would be quickly picked up after strong health and safety results, and was better positioned for take-up than rival Entresto, made by Novartis.

Deutsche Bank’s Richard Parkes called the findings “exceptionally impressive”, adding:

Most importantly, we expect the data to enable approval in heart failure patients without diabetes. We believe this represents an additional $1-4bn market opportunity for the class, which is not reflected in consensus forecasts.

Overnight: Argentina imposes capital controls amid latest economic crisis

Argentina’s government has imposed capital controls today, restricting the movement of money in an effort to spot foreign currency reserves leaving the country, which is buckling under debt.

The measure comes amid efforts by stricken President Mauricio Macri to keep the country’s economy afloat.

The country’s economic minister told Argentinian media this morning that the country has $57bn left in its reserves, which is plans to burn through. He said a run on the banks is not expected. That figure, incidentally, is the same size as the bailout package the International Monetary Fund agreed with Buenos Aires last year.

An IMF spokesperson said it will “continue to stand by Argentina during these challenging times”, adding that its staff are examining the government’s decision.

#Argentina is imposing currency controls to halt the flight of dollars out of the country as it teeters on the brink of default. Reserves drain away w/ CenBank lost $2bn on Friday alone. https://t.co/Qi2HJx92a5pic.twitter.com/OVQRj8YcoN

— Holger Zschaepitz (@Schuldensuehner) September 2, 2019

Amazing how little time it took for #Argentina to go from issuing an oversubscribed 100-year bond to currency controls and seeking a “voluntary re-profiling” of debt payments—all this under an IMF arrangement.The large depletion of reserves will add to the intense growth concerns https://t.co/RZdrpFeFqe

— Mohamed A. El-Erian (@elerianm) September 1, 2019

Here’s some more on the background of the issue, and what it means for former IMF leader Christine Lagarde:

Argentina’s plea over $100bn debt mountain is ‘tantamount to default’

Matthew Lynn: Argentina is Christine Lagarde’s latest disaster — next up Europe

European markets firm up at open

Without strong winds blowing in either direction, markets have opened on the upside, with the FTSE leading risers currently.

“European indices are mildly higher at the start of the new trading month, but gains may be fragile,” says Markets.com’s Neil Wilson.

Trade war cheat sheet

With China and the US having made good on their promises to ramp up levies on one another over the weekend, here’s a reminder of what you need to know about the trade war raging between the world’s two biggest economies:

What happened overnight?

Trading in Asian stocks was mixed and US futures were lower after the latest tariffs kicked in on Chinese goods.

Japan’s Nikkei 225 fell 0.4pc while Hong Kong’s Hang Seng has surrendered 0.6pc currently.

Chinese stocks rose amid words of support from authorities but new data showed further weakness in the country's manufacturing sector. The Shanghai Composite Index rose 1.3pc.

In Argentina, the government is imposing currency controls to halt the flight of dollars out of the country as it teeters on the brink of default.

Agenda: Manufacturing PMI to offer sense of slowdown

Good morning. September is here, Brexit drama is most certainly back (did it ever go away?) and, as ever, Telegraph Business is here to guide you through what it all means for business, tech, markets, economics and your money.

Today could be quiet as September begins with a mumble rather than a shout. There’s plenty of scope for volatility however, especially if events in Westminster escalate. Manufacturing purchasing managers’ index (PMI) data at 9:30am will be closely watched for a sense of how much Britain’s factories have been slowing down.

5 things to start your day

1)Cobham’s private equity suitor hits back at claims its £4bn takeover poses threat to national security or UK jobs. Cobham’s British operations are assured according to Advent, the US private equity fund trying to buy the historic aerospace and defence company.

2)Offshore wind boom is reviving the east coast towns, some of the most neglected and depressed in Britain, reports Ambrose Evans-Pritchard in Grimsby.

3)Sajid Javid summons City leaders to sell no-deal ‘opportunities’. Jes Staley, the Barclays boss, David Schwimmer, the London Stock Exchange’s chief and Howard Davies, the RBS chairman are among more than a dozen business leaders who will meet Mr Javid.

4)No-deal Brexit could trigger house price falls of 20pc in 2020, says KPMG. Analysis by KPMG found that house prices are likely to drop by around 6 per cent across every region in Britain if there is no Brexit deal.

5)Are British investors missing out on their share of a £5bn Swiss banks scandal? Britain’s mega-rich are missing out on thousands of pounds worth of payouts as they are unaware of a scandal in Switzerland that could become “PPI on steroids”, a Swiss company has argued.

Coming up today

With extra US-China tariffs now in place, sentiment on Wall Street may be muted – but US markets will be closed for Labor Day, so it won’t be until Tuesday that the impact will be known.

Full-year results

Dechra Pharma

Interims

Old Mutual

Economics

Manufacturing PMI (UK and eurozone)