All Markets Summit, Tesla earnings — What you need to know in markets on Wednesday

It’s hard to know what to think now.

After the Dow endured its worst point loss in history on Monday, stocks soared on Tuesday after a choppy day of trading was punctuated by a huge rally into the market close.

When the dust settled, the Dow led markets with a 567 point, or 2.3% gain, while the S&P 500 added 46 points, or 1.7%, and the Nasdaq rose 148 points, or 2.1%. Earlier in the session, the Dow was down 560 points, and this 1,200-point range made for the second-straight day of truly stunning market action.

We’ll see if equity markets can regain sounder footing on Wednesday.

Outside of tracking the market action, on the economic calendar on Wednesday the only report of note out will be the monthly reading on consumer credit balances. And on the earnings front, notable reports are expected from Tesla (TSLA), 21st Century Fox (FOXA), Hasbro (HAS), O’Reilly (ORLY), Humana (HUM), and Yelp (YELP).

Also on Wednesday, Yahoo Finance will host its latest All Markets Summit, this time focusing solely on the cryptocurrency markets. This conference will bring together some of the biggest names in crypto and comes at a fascinating time for the space, with the price of major cryptocurrencies like bitcoin (BTC-USD) and Ethereum (ETH-USD) down 50% from their highs while interest in cryptocurrencies remains sky high.

Earnings expectations have rarely been better

The abrupt sell-off seen in the equity market over the last several days has come at an interesting time for investors.

Not only are we in the thick of a fourth quarter earnings season that has seen 74% of S&P 500 companies top expectations, according to data from Credit Suisse, but aggregate expectations for earnings in the current quarter are rising at the fastest pace on record.

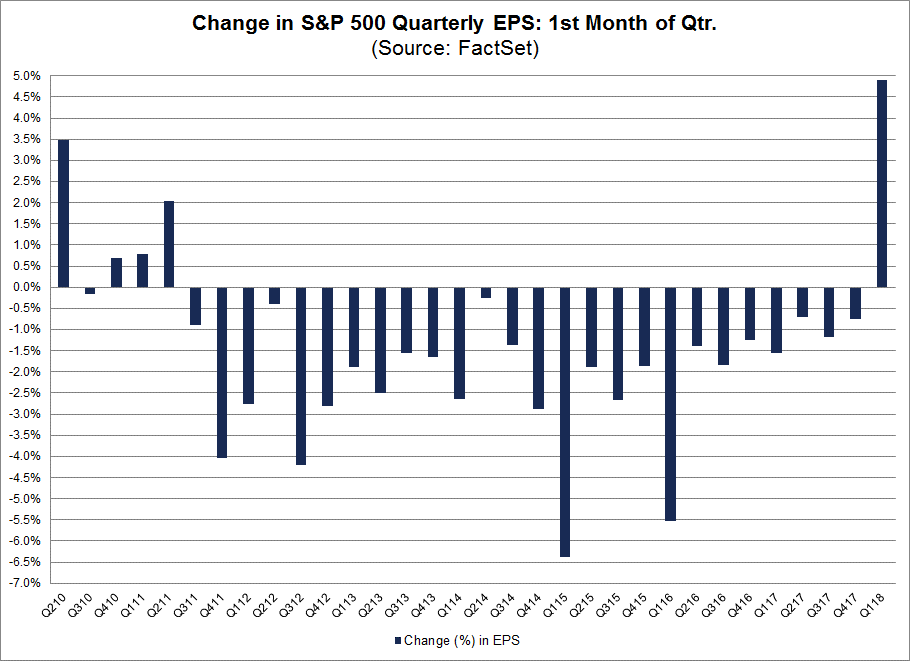

According to FactSet’s John Butters, first quarter earnings per share estimates are up 4.9%, the largest increase on record since FactSet began tracking these numbers in 2002. The previous largest increase came in 2010 when earnings estimates for the current quarter rose 3.5%.

“On average, the bottom-up EPS estimate usually decreases during the first month of a quarter,” Butters wrote. “During the past year, the bottom-up EPS estimate has recorded an average decline of 1.0% during the first month of a quarter. During the past five years, the bottom-up EPS estimate has recorded an average decline of 2.1% during the first month of a quarter. During the past 10 years, the bottom-up EPS estimate has recorded an average decline of 2.5% during the first month of a quarter.”

Catalyzing this increase in expectations, of course, is tax reform. But the strong global economy, the prospect of higher interest rates, and rising oil prices have also bolstered prospects for corporates.

“Other factors also have fueled the increase in earnings estimates as well,” Butters adds. “For example, rising oil prices have contributed to the large increase in earnings estimates for companies in the Energy sector. Expectations for higher interest rates in 2018 have also likely contributed to the significant increase in earnings estimates for companies in the Financials sector.”

After Monday’s sell-off, Wall Street analysts were nearly uniform in their emphasis that the sell-off did not change the positive picture for the economy and corporate earnings. Or in analyst speak, the fundamentals underwriting the rally had not deteriorating overnight. And as FactSet’s works shows, earnings remain not only solid, but historically strong.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession

It’s been 17 years since U.S. consumers felt this good about the economy