Marsh & McLennan (MMC) Q4 Earnings Beat, Revenues Down Y/Y

Marsh & McLennan Companies, Inc. MMC reported fourth-quarter 2022 adjusted earnings per share of $1.47, which beat the Zacks Consensus Estimate of $1.40 by 5% and our estimate of $1.33. The bottom line improved 8% year over year.

Consolidated revenues of MMC fell 2% year over year but grew 7% on an underlying basis to $5,022 million in the quarter under review. The top line lagged the consensus mark by 4% and our estimate of $5,063.5 million.

Strong contribution from the Consulting segment coupled with an expanding adjusted operating income margin benefited the quarterly results of Marsh & McLennan. However, the upside was partly offset by a softer Risk and Insurance Services segment and an elevated expense level.

Total operating expenses of $4,342 million escalated 4.6% year over year in the fourth quarter due to increased compensation and benefit, and other operating expenses. The metric surpassed our estimate of $4,172.6 million. Total expenses at the Risk and Insurance Services segment witnessed a 3.8% year-over-year rise, while the same at the Consulting segment increased 3.2% year over year.

Consolidated adjusted operating income improved 13% year over year to $1,024 million. Adjusted operating margin of 22% improved 160 basis points (bps) year over year in the quarter under review.

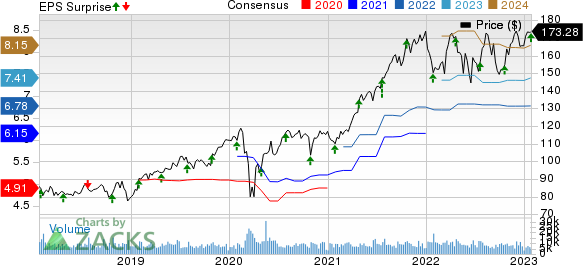

Marsh & McLennan Companies, Inc. Price, Consensus and EPS Surprise

Marsh & McLennan Companies, Inc. price-consensus-eps-surprise-chart | Marsh & McLennan Companies, Inc. Quote

Segmental Performances

Risk and Insurance Services

The segment generated revenues of $2,945 million, which tumbled 3% year over year but grew 8% on an underlying basis in the fourth quarter. The metric fell short of the Zacks Consensus Estimate of $3,162 million and our estimate of $2,968 million. Adjusted operating income climbed 23% year over year to $685 million and outpaced the consensus mark of $682 million as well as our estimate of $663.3 million.

A unit within the segment, Marsh, recorded revenues of $2,711 million. The figure dropped 6% year over year but rose 6% on an underlying basis in the quarter under review. In the United States/Canada, underlying revenues improved 5% year over year. International operations witnessed underlying revenue growth of 8%. Among the international operations, the Asia Pacific generated the highest underlying revenue growth of 12%, followed by increases of 7% and 4% in EMEA and Latin America, respectively.

Revenues of Guy Carpenter, another unit under the Risk and Insurance Services segment, came in at $171 million. The figure increased 1% year over year or 5% on an underlying basis.

Consulting

The segment’s revenues of $2,094 million advanced 6% on an underlying basis in the fourth quarter but came lower than the Zacks Consensus Estimate of $2,128 million and our estimate of $2,112.6 million. Adjusted operating income dipped 1% year over year to $407 million and came higher than the consensus mark of $383 million.

Mercer, a unit within this segment, generated revenues of $1,329 million. The figure decreased 3% year over year but improved 5% on an underlying basis in the quarter under review. Career and Health revenues climbed 12% and 8%, respectively, on an underlying basis. The same at Wealth remained flat on an underlying basis.

Revenues of Oliver Wyman, another unit under the Consulting segment, rose 6% year over year or 8% on an underlying basis to $765 million in the fourth quarter.

Financial Update (as of Dec 31, 2022)

Marsh & McLennan exited the fourth quarter with cash and cash equivalents of $1,442 million, which plunged 17.7% from the 2021-end level. Total assets of $33,454 million decreased 2.7% from the figure at 2021 end.

Long-term debt amounted to $11,227 million, up 2.7% from the figure as of Dec 31, 2021. Short-term debt of $268 million increased nearly 16-fold from the 2021-end figure.

Total equity slid 4.2% from the 2021-end level to $10,749 million.

Cash Flows

During 2022, Marsh & McLennan generated a cash flow of $3,465 million from operations, which dipped 1.5% from the 2021 figure.

Capital Deployment Update

Marsh & McLennan bought back 2.2 million shares worth $350 million in the fourth quarter.

In January 2023, management sanctioned a quarterly dividend of 59 cents per share, which will be paid out on Feb 15, 2023, to its shareholders of record as of Jan 26, 2023.

Full-Year Update

For 2022, Marsh & McLennan’s adjusted earnings per share of $6.85 advanced 11% year over year. Consolidated revenues improved 5% year over year or 9% on an underlying basis to $20,720 million.

Consolidated adjusted operating income of $4,766 million grew 11% year over year. Adjusted operating margin improved 80 bps year over year to 24.7%. Revenues at Risk and Insurance Services as well as Consulting segments witnessed year-over-year increases of 5% in 2022.

Zacks Rank

Marsh & McLennan currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Insurers

Of the insurance industry players that have reported fourth-quarter results so far, The Progressive Corporation PGR, Brown & Brown, Inc. BRO and AXIS Capital Holdings Limited AXS beat the respective Zacks Consensus Estimate for earnings.

Progressive reported fourth-quarter 2022 earnings per share of $1.50, which beat the Zacks Consensus Estimate of $1.49. The bottom line improved 42.9% year over year. PGR’s net premiums earned grew 11% to $12.9 billion. The combined ratio of Progressive improved 80 bps from the prior-year quarter’s level to 93.9 in the quarter under review.

Brown & Brown’s fourth-quarter 2022 adjusted earnings of 50 cents per share beat the Zacks Consensus Estimate by 13.4%. The bottom line increased 19% year over year. Total revenues of $901.4 million beat the Zacks Consensus Estimate by 0.6%. The top line of BRO improved 22.1% year over year. The upside can be primarily attributed to commission and fees, which grew 21.3% year over year to $864.8 million. Investment income increased year over year to $4.7 million from $0.2 million in the year-ago quarter.

AXIS Capital posted fourth-quarter 2022 operating income of $1.95 per share, which beat the Zacks Consensus Estimate by about 14.7%. The bottom line declined 8.5% year over year. The total operating revenues of AXS amounted to $1.5 billion, which increased 8.6% year over year on higher net premiums earned and net investment income. The top line beat the consensus estimate of $1.4 billion. AXIS Capital’s underwriting income of about $132 million, down 2.8%. Its combined ratio deteriorated 100 bps to 94.1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report