Marsh & McLennan's (MMC) Earnings Beat in Q2, Improve Y/Y

Marsh & McLennan Companies, Inc. MMC delivered second-quarter 2020 adjusted earnings per share of $1.32, surpassing the Zacks Consensus Estimate by 15.8% on reduced expenses and a solid contribution from its Risk and Insurance Services segment. Moreover, the bottom line increased 11.9% year over year.

Marsh & McLennan’s consolidated revenues of $4.2 billion dipped 2% on an underlying basis. However, the top line beat the Zacks Consensus Estimate by 0.5% on the back of its strong Risk and Insurance Services segment.

Total operating expenses of $3.3 billion in the second quarter were down 10% year over year owing to lower compensation and benefits as well as other operating expenses.

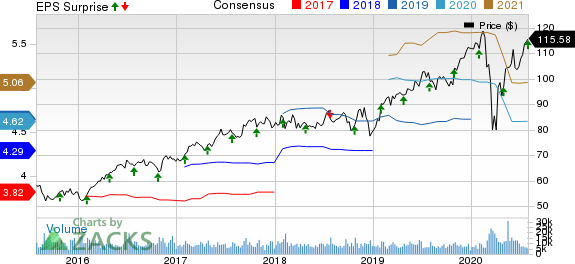

Marsh McLennan Companies, Inc. Price, Consensus and EPS Surprise

Marsh McLennan Companies, Inc. price-consensus-eps-surprise-chart | Marsh McLennan Companies, Inc. Quote

Quarterly Segmental Results

Risk and Insurance Services

Revenues at the Risk and Insurance Services segment were $2.6 billion, up 2% on an underlying basis. Adjusted operating income rose 19% to $762 million from the prior-year quarter’s level.

Marsh, a unit within this segment, generated revenues of $2.2 billion, up 1% on an underlying basis. In U.S./Canada, underlying revenues rose 3% year over year.

Underlying revenue growth from international operations was flat year over year, which includes 4% increase of the underlying metric in the Asia Pacific, a 4% rise in Latin America and a 3% drop in EMEA.

Another unit under this segment, Guy Carpenter, displayed 9% revenue growth on an underlying basis in the quarter under review.

Consulting

The Consulting segment's revenues were down 6% on an underlying basis to $1.6 billion. Also, adjusted operating income fell 13% to $265 million.

A unit within this segment, Mercer, generated revenues of $1.1 billion, down 3% on an underlying basis. Wealth’s revenues were down 2% on an underlying basis. Health and Career’s revenues were up 1% and down 16% year over year on an underlying basis.

Another unit Oliver Wyman Group registered revenues of $467 million, down 13% year over year on an underlying basis.

Business Update

The company issued $750 million of 10-year senior unsecured notes in the second quarter.

Dividend Update

The company hiked its quarterly dividend to 46.5 cents per share, effective with the third-quarter dividend, payable Aug 14, 2020.

Financial Update

Marsh & McLennan exited the second quarter with cash and cash equivalents of $1.7 billion, up 48.1% from the level at 2019 end.

Net cash provided by operating activities totaled $578 million, up 139.8% year over year.

As of Jun 30, 2020, Marsh & McLennan’s total assets were $32.2 billion, up 2.6% from the figure as of Dec 31, 2019.

Total equity was $8.3 billion, up 5.7% from the level at 2019 end.

Zacks Rank and Performance of Other Players

Marsh & McLennan carries a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Of the insurance industry players, which have reported second-quarter results so far, earnings of Cincinnati Financial Corporation CINF, First American Financial Corporation FAF and RLI Corp. RLI beat the respective Zacks Consensus Estimate.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Marsh McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.