Masimo's (NASDAQ:MASI) earnings growth rate lags the 35% CAGR delivered to shareholders

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. For example, the Masimo Corporation (NASDAQ:MASI) share price is up a whopping 351% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. On the other hand, the stock price has retraced 4.6% in the last week. However, this might be related to the overall market decline of 2.3% in a week.

In light of the stock dropping 4.6% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Masimo

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

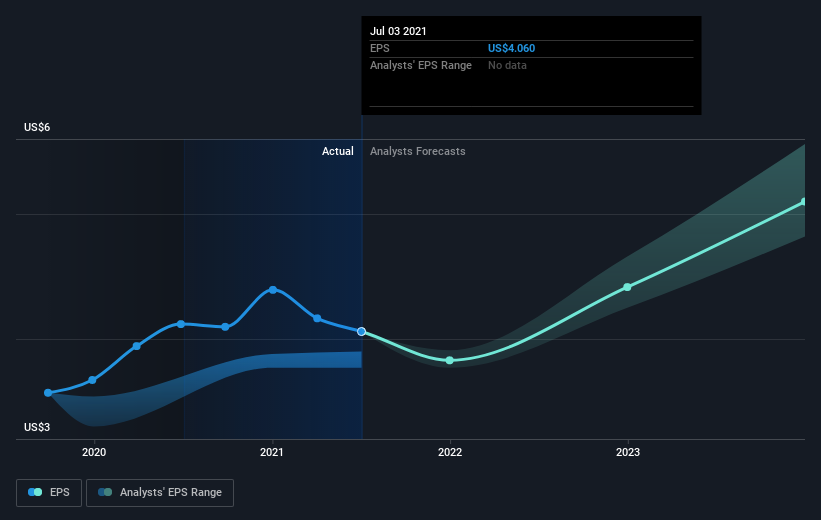

Over half a decade, Masimo managed to grow its earnings per share at 15% a year. This EPS growth is lower than the 35% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 66.57.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Masimo's key metrics by checking this interactive graph of Masimo's earnings, revenue and cash flow.

A Different Perspective

Masimo shareholders gained a total return of 15% during the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 35% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Is Masimo cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Masimo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.