Mason Hawkins' Firm Packs Into Carrier, Axes 4 Positions in 2nd Quarter

- By James Li

Southeastern Asset Management, the firm founded by Mason Hawkins (Trades, Portfolio), disclosed this month that its top trades during the second quarter included an increased bet in Carrier Global Corp. (NYSE:CARR) and sold out transactions in the following four companies: Raytheon Technologies Corp. (NYSE:RTX), Park Hotels & Resorts Inc. (NYSE:PK), Enerpac Tool Group Corp. (NYSE:EPAC) and Dillard's Inc. (NYSE:DDS).

The Memphis, Tennessee-based firm manages the Longleaf Partners Funds, which seek long-term growth capitalization through companies with good businesses, good people and good prices. More specifically, Southeastern looks for companies with strong balance sheets, capable management teams and a share price less than 60% of intrinsic value.

The firm believes that the equity portfolio should concentrate on the top investment ideas. Despite this, Southeastern said in its Longleaf Partners Fund shareholder letter that it "started with more ideas than money but ultimately ended up building cash" during the second quarter to maintain its value investing discipline. The fund gained 18.08% during the quarter, underperforming the 20.54% gain of the Standard & Poor's 500 Index.

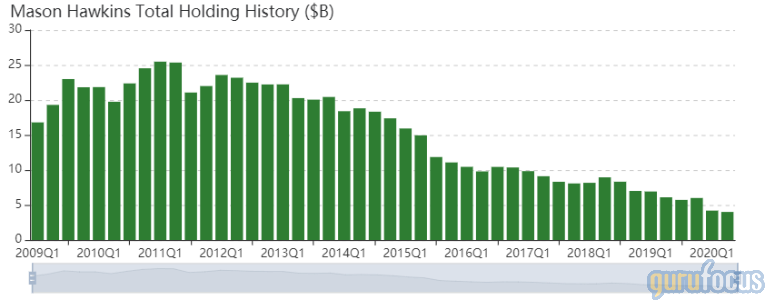

As of the quarter's end, Southeastern's $4.01 billion equity portfolio contains 29 holdings, with one new position and a turnover ratio of 7%. The top three sectors in terms of weight are communication services, industrials and energy, representing 29.77%, 19.05% and 12.55% of the equity portfolio.

Firm increases bet in Carrier, dumps Raytheon Technologies

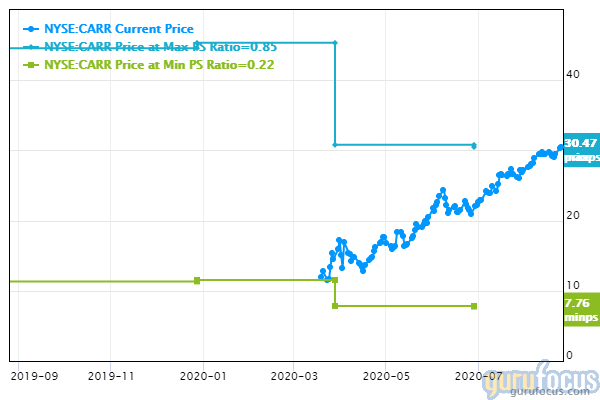

Southeastern purchased 8,876,727 shares of Carrier, giving the stake 3.72% weight in its equity portfolio. Shares averaged $18.38 during the second quarter.

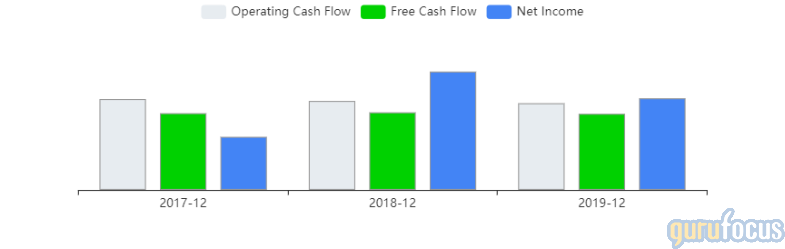

The firm said in its shareholder letter that it took advantage of Carrier's spinoff from United Technologies at a "deep discount to its absolute value." According to GuruFocus, Carrier's price-earnings ratio of 9.12 outperforms 68.54% of global competitors although the company's share price, price-book ratio and price-sales ratios are close to 52-week highs.

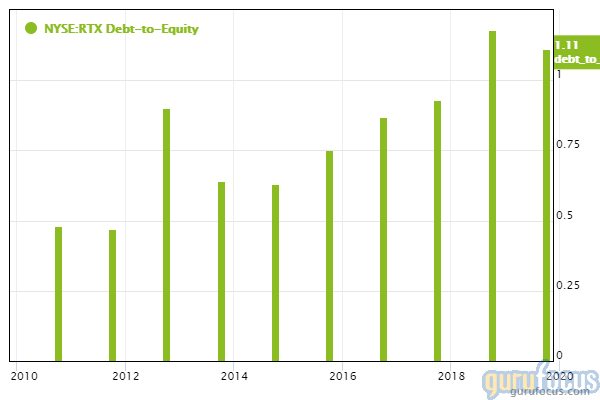

The firm sold 2,161,846 shares of Raytheon Technologies, reducing its equity portfolio 2.73%. Shares averaged $62.35 during the second quarter. Based on GuruFocus estimates, the firm gained approximately 10.12% on the stock since initially buying shares during the third quarter of 2015.

Longleaf Partners made the "hard decision" to sell out of Raytheon, citing that the commercial aerospace business has "changed for the worse" and that the fund already had a holding in the industry at General Electric Co. (GE). GuruFocus ranks Raytheon's financial strength 5 out of 10 on the back of debt ratios underperforming over 60% of global competitors, coupled with a weak Altman Z-score of 1.59.

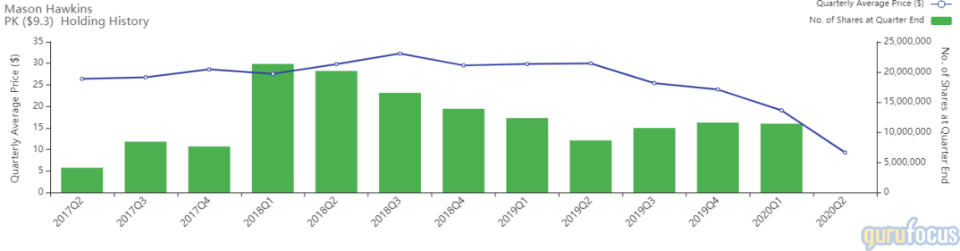

Park Hotels

The firm sold 11,407,646 shares of Park Hotels, reducing its equity portfolio 2.15%. Shares averaged $9.28 during the quarter. Based on GuruFocus estimates, the firm took a loss of approximately 23.10% on the stock since initially buying shares during the second quarter of 2017.

The firm said in its letter that the Tysons, Virginia-based hotel REIT's competitive advantages, which include emphasis on luxury, upper-upscale segments and conference rooms, pose challenges in the current market environment. The firm instead boosted its holding in Hyatt Hotels Corp. (NYSE:H).

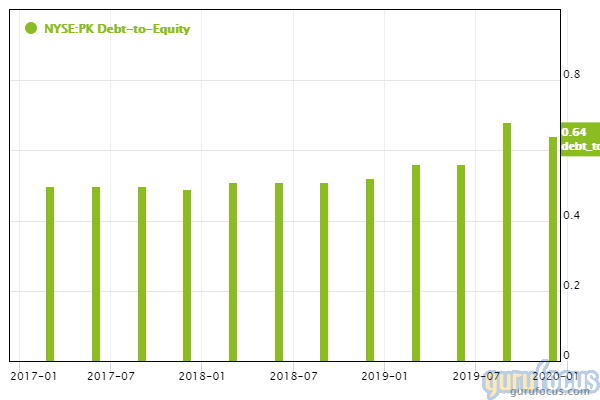

GuruFocus ranks Park's financial strength 4 out of 10 on several warning signs, which include a poor Piotroski F-score of 3, a weak Altman Z-score of 0.48 and a debt-to-equity ratio that underperforms 66.47% of global competitors.

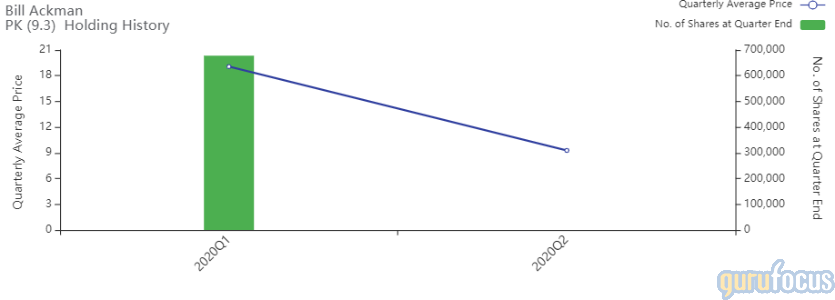

Bill Ackman (Trades, Portfolio)'s Pershing Square also sold out of Park during the second quarter.

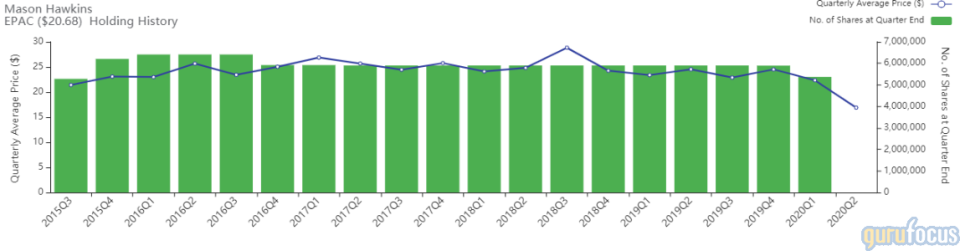

Enerpac

Southeastern sold 5,370,459 shares of Enerpac, reducing its equity portfolio 2.11%. Shares averaged $16.89 during the quarter. Based on GuruFocus estimates, the firm took a loss of approximately 17.04% since initially buying shares during the third quarter of 2015.

GuruFocus ranks the Menomonee Falls, Wisconsin-based industrial company's financial strength 5 out of 10: Although the company has a high Altman Z-score of 4 and a solid Piotroski F-score of 6, Enerpac's interest coverage and debt ratios are underperforming over 78% of global competitors.

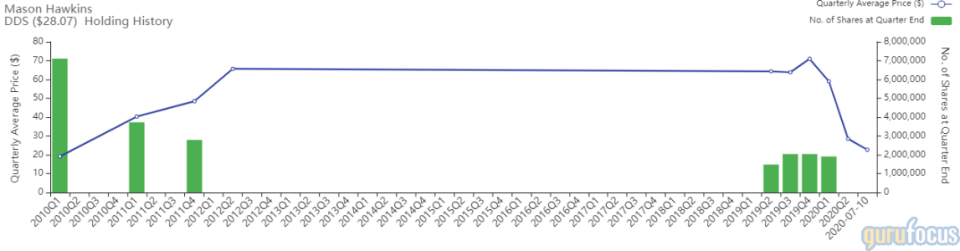

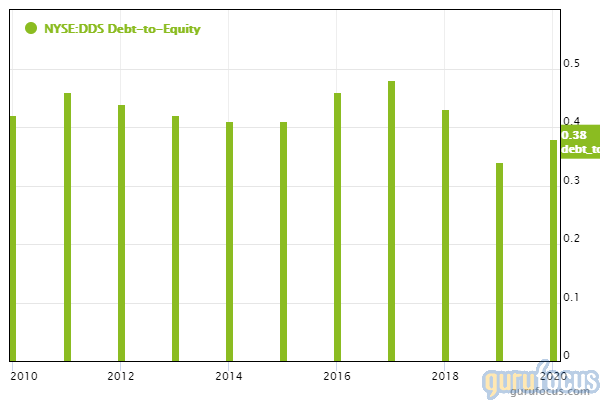

Dillard's

The firm sold 1,907,204 shares of Dillard's, reducing its equity portfolio 1.68%. Shares averaged $28.47 during the second quarter.

GuruFocus ranks the Little Rock, Arkansas-based department store chain's financial strength 4 out of 10 on the back of debt ratios underperforming over half of global competitors, coupled with a low Altman Z-score of 2.04.

Disclosure: No positions.

Read more here:

Top 5 Trades of Al Gore's Firm in the 2nd Quarter

Ken Heebner's CGM Reveals Top Trades for 2nd Quarter

Top 5 Buys of Philippe Laffont's Coatue Management in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.