Mason Hawkins' Southeastern Curbs Stake in Summit Materials

Mason Hawkins (Trades, Portfolio), chairman and CEO of Southeastern Asset Management, disclosed this week that his firm trimmed its position in Summit Materials Inc. (NYSE:SUM). This and other recent Guru trades can be found using GuruFocus Real-Time Picks, a Premium feature.

Southeastern seeks long-term capital appreciation by acquiring equity securities in understandable businesses with strong balance sheets, run by capable management and trading for less than intrinsic value.

Transaction details and company background

Southeastern disclosed a holding of 5,117,610 shares, down 60.08% from the holding of 12,820,469 shares at the end of the quarter. The shares traded around $23.87 on the Nov. 30 transaction date.

Summit Materials is a Denver, Colorado-based company that produces white cement and aggregates, as well as downstream products like asphalt, ready-mix concrete and paving. Summit operates in 23 U.S. states and in British Columbia.

The company said in its September quarterly report that net revenues for the three months ending Sept. 28 were $665.85 million, up $40.8 million from the prior-year quarter. This was driven primarily by organic volume growth in each of the company's business segments, including an 11.4% growth in aggregates and a 3.8% growth in cement. For the first nine months of the year, revenues increased $60.2 million from the prior-year period on the heels of strong growth in sales of materials, especially in aggregates and asphalt.

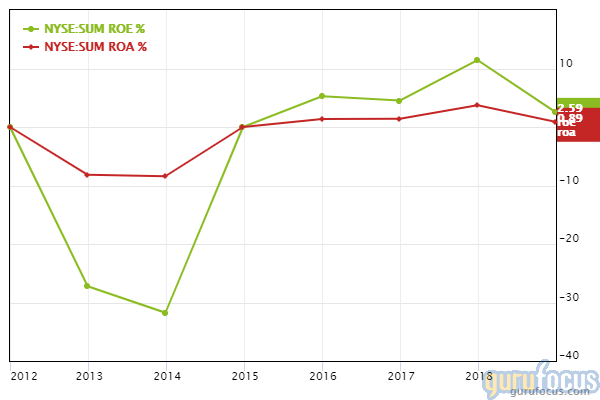

Despite the increase in revenues, Summit's revenue growth for the past three years averaged 5.9% per year, outperforming just 54.52% of global competitors. The modest three-year revenue growth, coupled with returns that underperform over 77% of global building material companies, contributed to a GuruFocus profitability rank of 4 out of 10.

Company financial strength overview

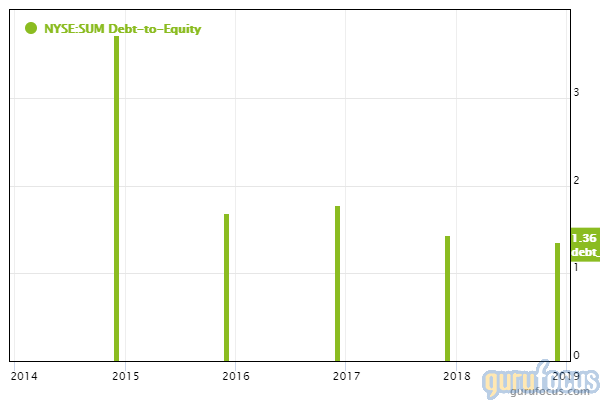

Summit's financial strength ranks 3 out of 10 on the heels of several weak signs, which include a weak Altman Z-score of 1.46 and a debt-to-equity ratio that underperforms 90.23% of global competitors. GuruFocus also warns that Summit's interest coverage of 1.75 is below Ben Graham's safe threshold of 5 and that the company's debt-to-Ebitda ratio of 4.5 exceeds Joel Tillinghast's warning level of 4.

See also

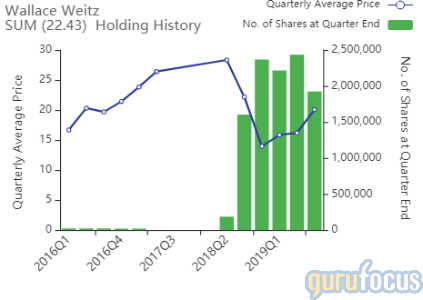

The top-three holdings of Hawkins' firm as of the September quarter are CenturyLink Inc. (NYSE:CTL), General Electric Co. (NYSE:GE) and CNX Resources Corp. (NYSE:CNX). Other gurus that sold shares of Summit during the third quarter include Wallace Weitz (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio).

Disclosure: No positions.

Read more here:

John Rogers' Firm Trims Alithya Stake

Wasatch International Growth's Top 5 Buys of the 3rd Quarter

Bill Ackman's Pershing Square Packs Into Agilent

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial her

This article first appeared on GuruFocus.