Matador (MTDR) Q1 Earnings Beat Estimates, Revenues Miss

Matador Resources Company MTDR reported adjusted earnings of $2.32 per share, beating the Zacks Consensus Estimate of $2.05 per share. The bottom line significantly improved from the year-ago quarter’s earnings of 71 cents.

Total quarterly revenues of $566 million missed the Zacks Consensus Estimate of $609 million. However, the top line increased from the year-ago level of $267 million.

The strong quarterly earnings can be attributed to increased oil-equivalent production volumes and higher commodity price realizations.

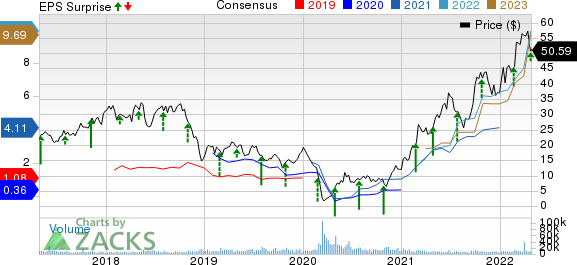

Matador Resources Company Price, Consensus and EPS Surprise

Matador Resources Company price-consensus-eps-surprise-chart | Matador Resources Company Quote

Production

For first-quarter 2022, total production volume averaged 8,457 thousand barrels of oil equivalent (MBoe) (comprising 57% oil), higher than 6,658 MBoe a year ago.

The average oil production volume was 53,561 barrels per day (Bbls/d), up from 41,537 Bbls/d reported in first-quarter 2021. Natural gas production was 242.4 million cubic feet per day (MMcf/d), up from 194.7 MMcf/d a year ago.

Price Realization

The average realized price for oil (excluding realized derivatives) was $95.45 per barrel, which significantly increased from $57.05 in the year-ago quarter. Also, the natural gas price of $7.63 per thousand cubic feet was higher than $5.88 in the prior-year quarter.

Operating Expenses

The company’s production taxes, transportation and processing costs increased to $7.07 per barrel of oil equivalent (Boe) from $5.13 in the year-ago quarter. Plant and other midstream services’ operating expenses increased to $2.30 per Boe from the year-earlier figure of $2.05. Also, lease operating costs increased from $3.90 per Boe in first-quarter 2021 to $4.01.

Total operating expenses per Boe were recorded at $28.23, higher than the prior-year figure of $25.65.

Balance Sheet

As of Mar 31, 2022, Matador had cash and restricted cash of $120.2 million. Long-term debt was recorded at $1,498 million, including $50 million of borrowings under its credit agreement. Debt to capitalization was 39.1%.

Capital Spending

The company spent $198.8 million for the drilling, completing and equipping of wells in the first quarter, 9% lower than its projection. Enhanced operational efficiencies in the Delaware Basin primarily aided its performance.

Outlook

For 2022, Matador reiterated its oil-equivalent production guidance at 36.3-38.3 million barrels. The metric suggests an improvement from 31.5 million oil-equivalent barrels reported in 2021. In the second-quarter, the company expects to produce 106,000-108,000 oil-equivalent barrels per day.

Matador’s 2022 capital spending guidance for drilling, completing and equipping wells is pegged at $640-$710 million. In midstream, it expects to spend $50-$60 million for the year.

Zacks Rank

The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

A Glimpse of Q1 Results of Other Energy Companies

Halliburton Company HAL is one of the largest oilfield service providers in the world. The company reported a first-quarter 2022 adjusted net income per share of 35 cents, in line with the Zacks Consensus Estimate.

Halliburton’s earnings for 2022 are expected to surge 76% year over year. The company expects its international business to prosper through the rest of 2022. HAL’s cash flow generation capabilities and balance sheet strength should also ensure increased shareholder returns.

Liberty Oilfield Services Inc. LBRT is a North American provider of hydraulic fracturing services to upstream energy operators. LBRT posted a loss per share of 3 cents, 81.3% narrower than the Zacks Consensus Estimate.

Liberty’s earnings for 2022 are expected to surge 151% year over year. In the second quarter, the company sees some 10% sequential revenue growth, along with higher margins on improved activity and pricing.

Schlumberger SLB is the largest oilfield services player, with a presence in every energy market across the globe. SLB reported first-quarter earnings of 34 cents per share (excluding charges and credits), beating the Zacks Consensus Estimate of 32 cents.

Schlumberger’s earnings for 2022 are expected to increase 42.2% year over year. SLB’s board of directors approved a quarterly cash dividend of 17.5 cents per share of outstanding common stock. This suggests a 40% increase from the prior quarterly cash dividend of 12.5 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research