Matador (MTDR) Stock Rises 35.9% YTD: What's Driving It?

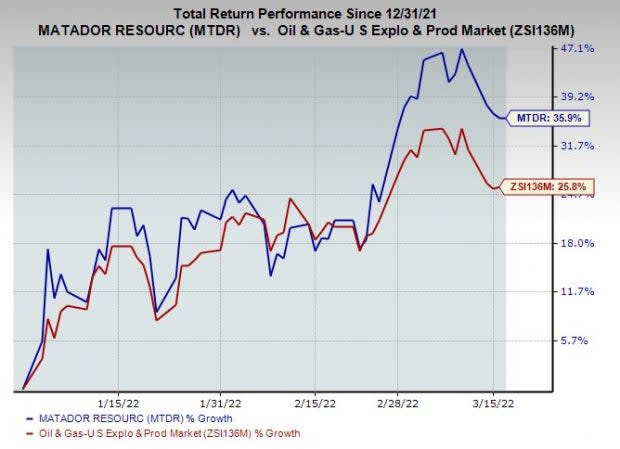

Matador Resources Company’s MTDR shares have gained 35.9% year to date compared with 25.8% growth of the composite stocks belonging to the industry.

The Zacks Rank #3 (Hold) stock, with a market cap of $5.9 billion, witnessed a rise in the Zacks Consensus Estimate for 2022 earnings per share in the past 60 days.

Image Source: Zacks Investment Research

Let’s delve into the factors behind the stock’s price appreciation.

What’s Favoring the Stock?

The West Texas Intermediate crude price is currently trading at around $100 per barrel, a substantial improvement from a slump into the negative territory in April 2020. The ongoing recovery in demand, owing to the easing of coronavirus restrictions, will continue to support the strong momentum in oil prices.

Rising oil prices are undoubtedly a boon for Matador’s upstream operations. This is because the upstream energy player has a strong presence in oil-rich core acres of the Wolfcamp and Bone Spring plays in the Delaware Basin. In 2021, Matador’s total proved oil and gas reserves grew 20% year over year to 323.4 million barrels of oil equivalent, marking an all-time high level.

For 2022, Matador projects its oil-equivalent production at 36.3-38.3 million barrels. The production estimates suggest an improvement from 31.5 million barrels of oil equivalent in 2021. Moreover, it expects total oil production of 21-22 million barrels. Also, it has hedging deals for 2022 oil and gas production in place, which will help it navigate any weak price environment.

Matador continues to improve its capital efficiency. In 2021, the company spent $513 million for the drilling, completing and equipping of wells, 7% lower than its projection. Despite a surge in oilfield service costs in the second half of 2021, Matador achieved annual cost savings.

The rapidly spreading new variants of coronavirus remain concerning as countries consider new lockdown measures. Hence, the short-term fuel demand looks cloudy. With the rolling out of the coronavirus vaccines worldwide, the long-term outlook continues to be rosy.

Risks

Matador’s 2022 capital spending guidance for drilling, completing and equipping wells is pegged at $640-$710 million. As a result of the rising commodity prices, the company started experiencing inflation in the costs of certain oilfield services, including diesel, steel, labor and trucking costs. Matador expects to face additional service cost inflation in the future, which might increase costs to drill, complete, equip and operate wells.

Key Picks

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

PDC Energy, Inc. PDCE is an independent upstream operator that engages in the exploration, development and production of natural gas, crude oil and natural gas liquids. In the fourth quarter of 2021, the company returned approximately $110 million through dividends and share repurchases.

PDC Energy’s earnings for 2022 are expected to grow 67.8% year over year. As of Dec 31, PDC Energy had $33.8 million in cash and cash equivalents, and $942.1 million in long-term debt, representing a debt-to-capitalization of 24.5%.

Centennial Resource Development, Inc. CDEV is an independent oil and gas exploration and production company. Centennial announced its proved reserves for 2021-end at 305 MMBoe, representing growth from 299 MMBoe at the end of the prior year.

Centennial is expected to see an earnings growth of 98.6% in 2022. CDEV recently announced the launch of its stock repurchase program of $350 million. The authorization of the plan is for two years.

Petrobras PBR is one of the largest publicly-traded Latin American oil companies, dominating Brazil’s oil and gas sector. At the end of 2021, Petrobras had cash and cash equivalents of $10,480 million.

Petrobras’ earnings for 2022 are expected to grow 55.5% year over year. PBR generated positive free cash flow for the 27th consecutive quarter, with the metric rising to $7,511 million from $5,684 million recorded in last year’s corresponding period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Centennial Resource Development (CDEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research