Match Group (MTCH) Q3 Earnings Grow Y/Y, Revenues Top Estimates

Match Group MTCH reported third-quarter 2022 diluted earnings of 44 cents per share, up 2.3% from the year-ago quarter.

The Zacks Consensus Estimate for third-quarter 2022 earnings was pegged at 64 cents per share.

Revenues of $810 million increased 1% year over year, beating the Zacks Consensus Estimate by 2.14%.

Excluding forex, the top line increased 10% year over year to $883 million, driven by 9% growth in revenue per payer (RPP).

Quarter in Detail

In the third quarter, the number of total payers increased 2% to 16.5 million. The number of total payers from America and Europe decreased by 0.9% and 1.31%, respectively, whereas the Asia Pacific (APAC) saw an increase of 11% on a year-over-year basis.

Total RPP was flat over the prior year’s quarter at $16.02. Region-wise, RPP increased 6.07% in America and decreased 14.5% in APAC, while remaining unchanged in Europe year-over-year.

America’s RPP increased primarily due to increases in subscriptions and a la carte purchases at Tinder and Hinge. Europe’s RPP was unfavorably impacted by the strength of the U.S. dollar relative to the euro and British pound, while APAC and Other’s RPPs were unfavorably impacted by the strength of the U.S. dollar relative to the Japanese yen and Turkish lira.

Direct revenues from the Americas were up 4.9% to $413.8 million. Direct revenues from Europe and APAC decreased 1.35% to $214.7 million and 4.72 to $166.5 million, respectively.

Direct revenues from Tinder grew 6% from the prior-year quarter, driven by 7% Payers growth to 11.1 million, partially offset by an RPP decline of 1%.

Direct revenues from All Other Brands collectively declined 5% year over year, along with an 8% Payers decline, which was offset by 3% RRP growth. Within All Other Brands, Hinge Direct Revenue grew nearly 40% year-over-year in the third quarter 2022.

Match, Meetic, OkCupid and Plenty of Fish, saw both direct revenue and payers decline 15% year-over-year basis. APAC-based businesses, Pairs and Hyperconnect, saw direct revenue decline 15% year-over-year basis.

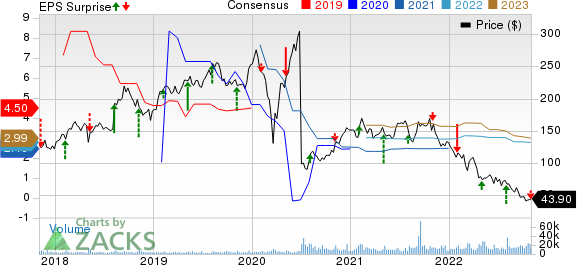

Match Group Inc. Price, Consensus and EPS Surprise

Match Group Inc. price-consensus-eps-surprise-chart | Match Group Inc. Quote

Operating Details

Total operating costs and expenses increased 3% year over year to $598.9 million in the third quarter.

Adjusted operating income was $284.1 million, declining 0.4% from the prior-year quarter, representing an adjusted operating income margin of 35%.

Balance Sheet

As of Sep 30, 2022, Match Group had a cash and cash equivalent balance of $398 million compared with $473 million as of Jun 30, 2022.

As of Sep 30, 2022, Match Group had long-term debt of $3.9 billion, the same as the previous quarter.

As of Sep 30, 2022, Match Group reported $1.2 billion of exchangeable senior notes and $750 million under its revolving credit facility. The amount was undrawn as of Sep 30.

Guidance

Match Group expects fourth-quarter 2022 revenues to be in the range of $780-$790 million, flat year over year.

Adjusted operating income for the fourth quarter is anticipated to be $270-$275 million.

Zacks Rank & Stocks to Consider

Currently, Match Group has a Zacks Rank #5 (Strong Sell).

Match Group’s shares have tumbled 66.9% compared with the Zacks Retail and Wholesale sector’s fall of 27.5% in the year-to-date period.

Potbelly PBPB, Vivint Smart Home VVNT and Tapestry TPR are some better-ranked stocks that investors can consider in the broader sector, each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Potbelly’s shares have declined 9% year-to-date. The company is expected to report second-quarter fiscal 2022 results on Nov 3.

Vivint Smart Home’s shares have lost 20.9% in the same time frame. The company is expected to report second-quarter fiscal 2022 results on Nov 8.

Tapestry’s shares have declined 20.8% in the year-to-date period.

It is scheduled to report fourth-quarter fiscal 2022 results on Nov 10.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Match Group Inc. (MTCH) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

Vivint Smart Home, Inc. (VVNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research